COVID-19 has affected every aspect of life. It has also sent major companies spiraling down in both revenue and stock performance.

But one industry has been hit especially hard: cannabis.

These companies products are more often considered essential. But with much of the country set to open back up, investors remain weary of the newer industry.

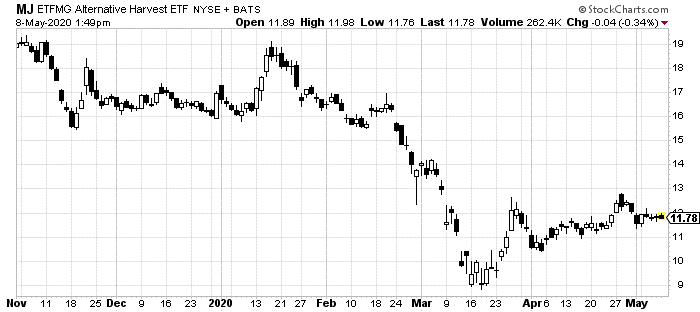

Shares across the industry remain roughly 50% below where they were at the start of the year. That’s despite the rest of the market recovering about half of their earlier losses.

The reason for this trend is obvious. Investors are seeking safety and government backing.

Cannabis might have a solid future. But with federal restrictions in the U.S., it is neither safe nor bailout eligible.

Latest Blow to Pot

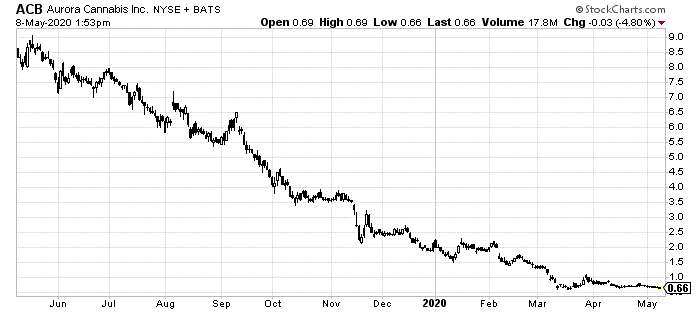

The former second-largest company in the industry, Aurora Cannabis Inc. (NYSE:ACB), is getting destroyed. Shares have fallen from $9 this time last year to just 66 cents as of today.

On Monday, that will change. But not for any good reason.

The company will be undergoing a reverse stock split. Every 12 shares will become just one share on Monday. This is to keep in line with New York Stock Exchange rules of maintaining a share price above $1.

That’s not a good thing.

According to a study from NYU and Emory University, stocks that undergo a reverse split underperform the market by 15.6% in the first 12 months, 36% in the year after that and 54% in the third year.

It’s pretty obvious why. Companies that need to reverse split to maintain a $1 price tag are often already in trouble.

ACB might not be a terrible company. But this split doesn’t bode well.

The company has mismanaged its operations in the past. It ferociously bought up expensive real estate leading up to the 2018 legalization in Canada. It has repeatedly missed its production targets and struggled with branding.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

But is this the canary in the coal mine?

Cannabis’ Path to Profits

It’s difficult to speculate on the immediate future for the major cannabis companies like Aurora.

Canopy Growth Corp. (NYSE:CGC), the still undisputed industry leader, has actually seen a significant bounce from its March lows. Still far below last year’s prices, it has matched the market with a solid uptick of late.

Instead, there is another way to play the still-inevitable rise in the cannabis market. Essential or not, picking up pot at a dispensary isn’t the only way to get it.

Laws in many of the 33 states where marijuana was legalized allow for private growing. The same applies to Canada. Individuals there are allowed to own up to four plants for personal consumption.

If anything, the recent stay-at-home quarantine around the world has made this new legal luxury even more appealing.

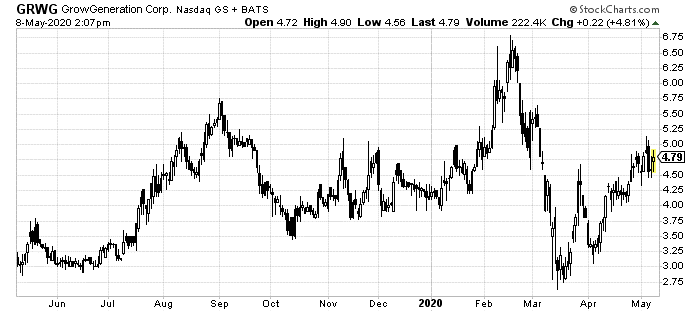

Mega international cannabis companies like Canopy and Aurora don’t really play a factor in this side of the industry. Instead, companies like GrowGeneration Corp. (NASDAQ:GRWG) might take this prize.

The company is small, only jumping onto a major exchange in December. But it has serious operations.

GrowGen owns 25 retail locations. It sells hydroponics and specialized gardening equipment. It also competes with Scotts Miracle-Gro Co. (NYSE:SMG) for the lucrative nutrients business for this growing industry.

Just take a look at what the market thinks about this side of the pot business compared to the above charts:

All the players in the space have a lot of hurdles, which is why they trade at these basement levels.

These are volatility plays, which means we can see them jump 20% in a day.

Those are great quick trading opportunities for quick gains, but these aren't investments

Finding alternatives might be worth the effort if you're a believer in cannabis's future, but the opportunity is to trade these names and not get stuck holding them long-term.