Cannabis companies have become whipping boys for many investors.

Those looking to get in on the next great industry have repeatedly lost money on this seemingly amazing opportunity.

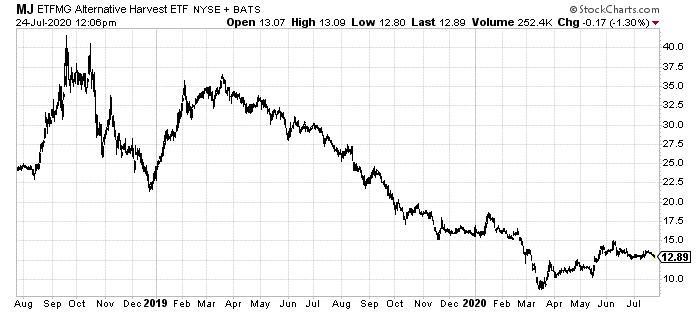

While many have recovered somewhat from their March lows, these stocks are almost universally 50-plus percent below their 2018 and 2019 highs.

There are a million reasons for this, including overhype when Canada legalized, the extended Schedule I drug classification in the U.S. and broken promises on profitability.

But there is one specific reason why the cannabis industry has failed investors’ expectations that beats all: no one knows how to sell pot.

The problems in retail cannabis sales are obvious.

First, it was undersupplied; then oversupply.

The taxes applied by Canadian provinces and U.S. states kept purchasers in the black market.

Banking access is still extremely limited in the U.S.

The list goes on.

Still, there is one important problem with this retail approach that makes all of that look like a series of minor problems one can overcome…

Retail is Dead

One story that has persisted prior to the current economic downturn and only accelerated recently: no one goes to brick-and-mortar stores anymore.

The only real success we saw in Canada when cannabis was first legalized two years ago came from online sales.

During the first week cannabis became legal in Canada, online stores reported thousands of transactions. Shopify reported that it was processing more than 100 new orders per minute from newly-legal Canadian online stores. And online sales weren’t even legal yet for many provinces.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Meanwhile, the retail industry only ran into problem after problem with supply and permitting.

This trend hasn’t faded in the nearly two years since that October 2018 law went into effect.

In the U.S., retail problems are even worse. Customers face idiotic problems in today’s society, like needing to use cash because the pot stores can’t use traditional banking.

One company, on the CBD side of this issue, has run into other problems. The FDA has restricted what can be sold and where.

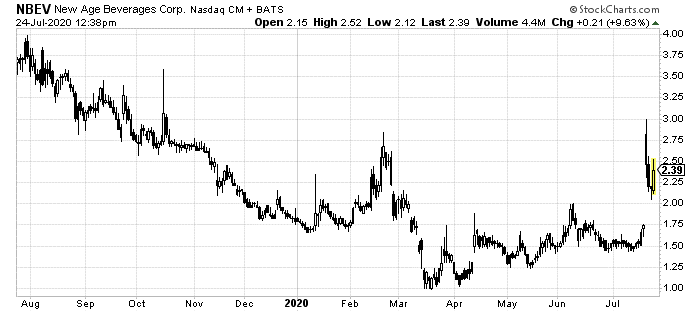

Despite massive deals with the likes of Walmart and 7-Eleven, New Age Beverages Corp. (NASDAQ: NBEV) hasn’t been able to really sell many of its much-hyped CBD-infused beverages.

Its partner retailers are obviously slow to stock up on these products as the laws remain uncertain. That doesn’t mean there are no avenues to sell these kinds of products.

Well, this week, NBEV figured that out.

The Smartest Deal in Cannabis Yet

On Monday, New Age announced a massive acquisition of five different companies, none of them in retail.

Instead, each of these companies plays a different role in direct selling, nutritional products, and research. The goal is to turn New Age into a direct marketing nutraceutical play for at least its CBD brands.

Prior to the current economic downturn, direct-selling nutritional supplement and nutraceutical companies were experiencing rapid growth. Experts were calling for extended 8-10% sales growth through 2026.

As fewer people head off to places like GNC, they head online for their vitamins and supplements.

But there’s an even bigger reason why this particular deal and repositioning is important.

While nutraceuticals and supplements were exploding in direct-selling channels, they were still making a killing on Amazon and in stores like Walmart and Target.

Yet none of those are really available to cannabis-related companies like New Age.

Despite a deal with Walmart, the company is dragging its feet on putting New Age products on its shelf.

Target won’t touch these kinds of products.

And Amazon has a policy stating: "Listings for products containing cannabidiol (CBD) are prohibited." Sure, you can find some. But not at this level.

Direct-to-consumer sales are the only real way to grow this market right now. New Age’s latest $500 million global partnership/merger with these companies is striking at exactly the right place at the right time… finally.

The new companies also extend the combined organization’s geographic reach to Europe and Asia, which it previously hadn’t really had great access to.

Shares jumped as high as 100% on this news before settling back down.

Still, they remain well below where they were trading even a year ago.

This is a chance to get into the one cannabis-related play that finally gets it. Retail isn’t the best place to be. But that doesn’t mean there isn’t demand.

New Age could easily test its 2020 highs as early as next week. That’d be a minimum of a 20% one-week gain.

By year's end, my money is on that shares trade above $3.50 per share again.

In other words a 50% gain in the next 160 days.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder