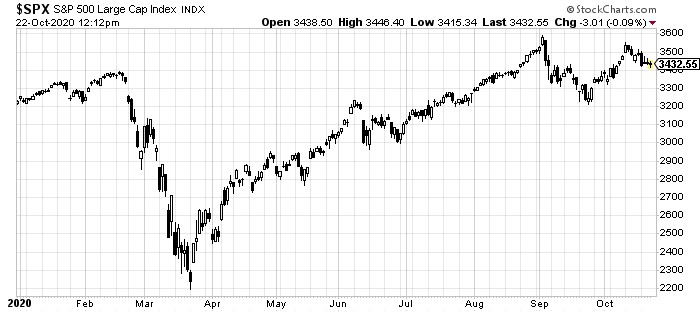

The stock market is often called a leading economic indicator. And it is.

When news of how bad COVID-19 could become raced around the world, stocks tumbled hard.

If you were paying attention back in March, there were several days when we saw the stock market “circuit breakers” trigger because stocks were falling so far so fast.

And then, to prove the point again, the market began to rally, indicating that post-COVID economic life might go on.

But sometimes, investors can get too far ahead of themselves.

We’ve seen that already this year with record numbers of highly successful IPOs. Surely, not every one of those will survive five or 10 years down the road.

But there’s another mistake taking place right now in stocks. Brick-and-mortar retail has been declared dead.

Completely dead.

Amazon.com Inc. (NASDAQ: AMZN) has been coronated as the king of all retail. And there can be no place for shopping of old.

Except, that’s not really the full picture.

In fact, you might not see it if you simply look at share prices and listen to CNBC pundits, but Amazon has lost ground in this “the year of eCommerce.”

The likes of Walmart Inc. (NYSE: WMT) and Target Corp. (NYSE: TGT) have taken serious bites out of the eCommerce landscape.

In just their most recent quarter, these two brick-and-mortar giants saw their digital sales grow 97% and 195% respectively.

Of course, there doesn’t have to be a single winner.

And perhaps because of the rapid shift to online sales during and post-lockdowns around the world, we’re seeing what brick-and-mortar stores can bring to the table that pure digital retail can’t.

Since the stock market is a forward-looking, leading economic indicator, you’d think it would pick up on where all of this is headed.

The future of retail will be a strange fusion between online and offline sales.

Personalized ads in stores.

Quicker and more efficient inventory management through digital product views and geolocational data mined from online shoppers.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Tracking which items are being looked up online by people in the stores themselves.

Further integration and widening margins for BOPIS and store-to-door delivery.

There are a hundred different ways for these industry-leading physical retailers to compete, and in places, beat eCommerce giants at their own game.

The integration of digital and in-person shopping experiences has only just begun.

COVID-19 has certainly pulled the future of this unholy marriage to our doorstep today.

But it has done something else.

While it has helped the likes of Walmart and Target gain footing into Amazon’s world, it has also absolutely wrecked their smaller, former competitors.

The number of physical retail stores without the giant Walmart sign or bullseye on them has shrunk exponentially.

We’ve seen this happening for years as the likes of Sears, J.C. Penney, and even Toys ‘R Us have flirted with and even succumbed to bankruptcy.

But here in 2020, that trend too accelerated.

That leaves further market share opportunities for Walmart and Target, along with other leading brick-and-mortar retailers.

You have market share-gobbling advantages from the digital landscape and oligopolistic market share opportunities from the changing physical landscape.

All of this benefits a select few at the top.

So, while the stock market may be a leading economic indicator, it isn’t perfect.

There’s a lot of room in the brick-and-mortar retail world. At least, there is for the right companies.

None of this is to say Amazon isn’t dominant in its own right. But the industry it has greatly disrupted isn’t dead just yet.

As we turn our calendars to 2021 in just 10 weeks from tonight and look back over the holiday shopping season, maybe then investors will see the real opportunity here.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder