The ideal post-recession play is primed and ready to go.

With stocks nearly unpredictable and bonds yielding next to nothing, many investors are flocking to precious metals.

This is nothing new. During almost every economic downturn, people look toward safety. Gold and silver offer just that.

During the Great Depression, among President Roosevelt’s first decisions was to seize private ownership of gold.

Gold hoarding had gotten so out of control that the U.S. government couldn’t obtain enough to back the US dollar, which was still on the gold standard.

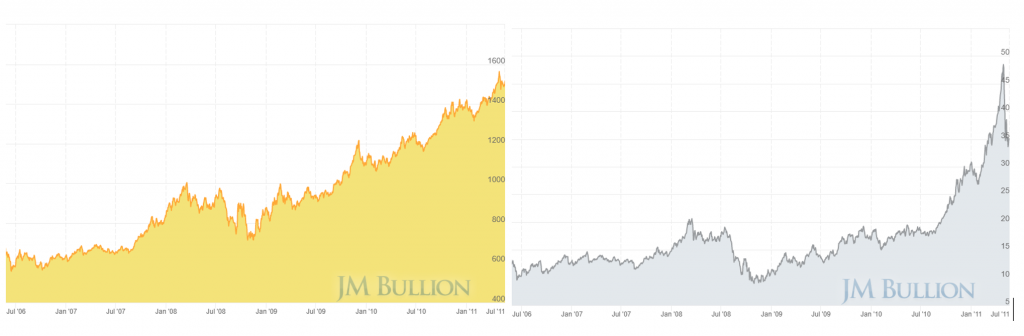

More recently, the hoarding part remained as true as ever. During the Great Recession, gold and silver both climbed higher than anyone predicted:

So, it shouldn’t come as a surprise that both investor interest and precious metals prices are up once again right now.

There is a stark difference, however.

Gold is sitting near its 2011 peak at around $1,750 per ounce. But Silver is actually trailing well below its 2019 peak. And it’s far below its 2011 one.

The main reason is because of what happened last time. As you can see, gold’s rally during the 2006-2011 period outpaced silver’s until the end.

The reason is how each of these precious metals are used.

Gold’s primary use is for investing and jewelry. Sixty percent of silver is used in electronics and industrial purposes.

When the economy slows, the argument goes, silver’s industrial properties hold it back.

But look what happens when gold is late into its rally. Investors do eventually flock into silver.

Of course, not every silver investment is the same.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Best Way to Play Silver

Silver, and gold for that matter, are fine to invest directly in. But rarely are you going to see the same kinds of gains with physical as you would with miners.

You see, in mining leverage is key. The companies the mine for gold and silver certainly see revenue rise when metal prices do. But they can also see earnings rise even faster if their costs also fall.

Right now, with cheap oil and precious metals set to spike, this is a miner’s market.

Since silver is even likelier to see a massive spike than gold, there are two main things to look for: production and cost per ounce.

First, on the production side…

You might think a company like Pan American Silver Corp. (NASDAQ:PAAS) or First Majestic Silver Corp. (NYSE:AG) might be the place to find great silver production.

In truth, the largest primary silver miner in the world is Fresnillo PLC (OTC:FNLPF) (LSE:FRES.L). While others have operations spread across many countries and continents, Fresnillo operates primarily in Mexico.

Secondly, we need to look at costs.

Here, Fresnillo is also something of a marvel.

The most important figure to watch here is “all-in sustaining cost.” This figure just measures the estimated cost it will take to mine each ounce of metal over the lifetime of the mine.

This allows investors to compare apples to apples amongst the miners.

Fresnillo has amongst the lowest AISC’s in the business, especially at its major mines.

Here, we come to the meat of the argument. Fresnillo combines these two better than the rest of the industry.

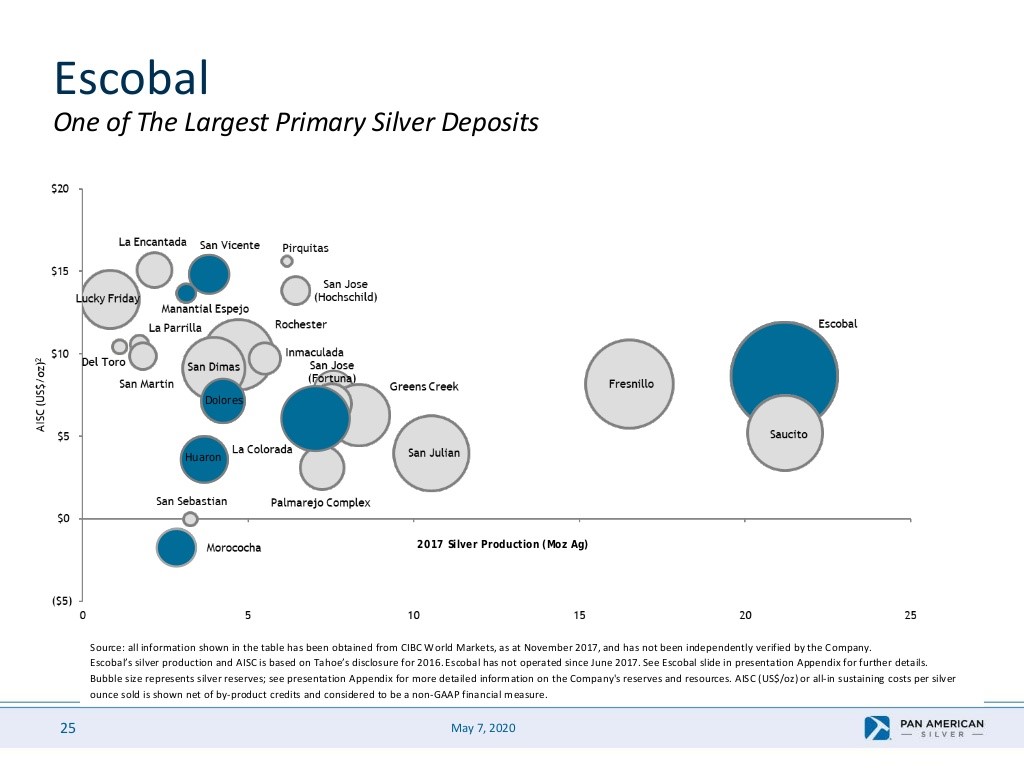

Take a look at this slide from its own competitor’s (Pan American’s) investor presentation:

Notice those three massive circles on the right. The giant blue one is Pan American’s, as you can see. The other two – Fresnillo and Saucito – are Fresnillo’s.

That’s what’s key right now. Low AISC, as you can see on the left axis, and high production, noted on the bottom axis.

The sizes of the circles represent reserves. So, those two mines are also clearly well stocked with future production.

When looking for an alternative precious metal play as this rally continues to gain its feet, look toward companies like Fresnillo. Low costs and high production count far more than a name.