It seems strange to say with the market falling hard today and the pandemic reaching new heights that there is one industry absolutely booming right now.

Insurance companies have been the apple of investors’ eyes this year, with large IPOs and even older companies getting in on the action.

Lemonade Inc. (NYSE: LMND) IPOed this summer in one of the hottest new issues of the year. Priced at $29, the stock almost immediately jumped as high as $85.

I’ll get to why that’s so important in a moment.

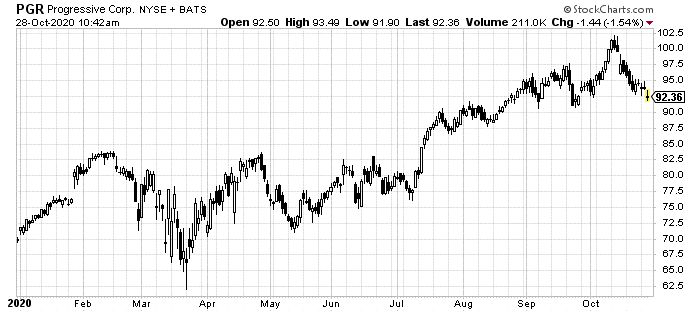

But even older companies in the industry have had success. Progressive Corp. (NYSE: PGR), for instance, has seen its share price jump 32% year to date:

Not all have done so well.

Allstate Corp. (NYSE: ALL) is down on the year. But for the industry as a whole, 2020 has been a good year.

All of this sets up one of the most oversubscribed IPOs of the year.

Root Inc. (NASDAQ: ROOT) starts trading today after being priced well above its estimated $22-$25 range last night.

The company is what Lemonade wants to be.

But because auto insurance is different from home and renter insurance, Root could actually be the real insurance disruptor tech play of 2020.

Everyone thinks they are a good driver. But let’s face it.

There are some real bad ones out there. Root’s entire philosophy is to separate the wheat from the chaff here.

The way it works is to force customers to download Root’s mobile app and allow the company to track various data about their driving.

If you think about it, this is very much like what actuaries do in the life insurance industry.

They crunch numbers related to health, age, and lifestyle to predict the expected lifespan.

Root’s artificial intelligence monitoring of driving habits is just a more sophisticated, if a bit invasive, analysis for the auto insurance industry.

So far, the company, as a private entity, has already caught on for many customers… especially first-time and returning car owners.

Sales in the first half of 2020 have already grown 136% compared to the prior-year period.

This is important because it coincides with the boom in car sales I outlined on Monday.

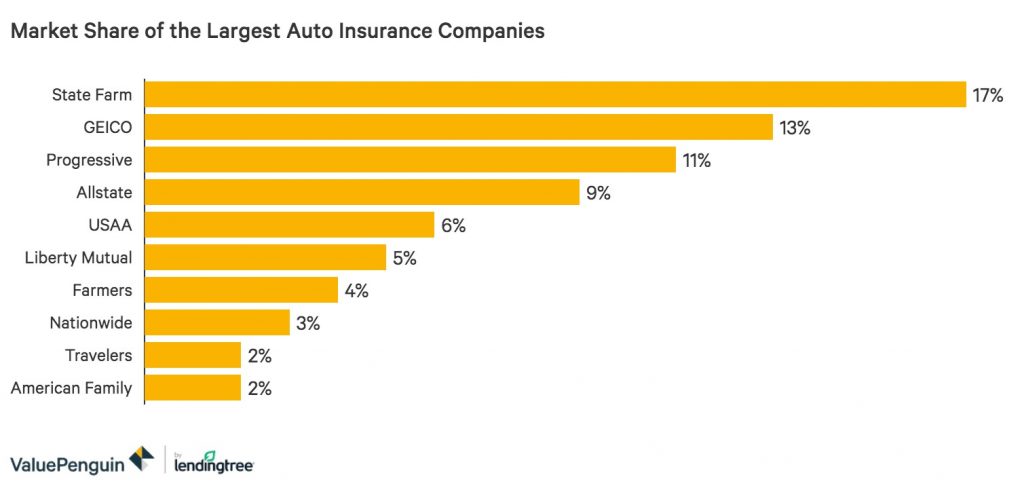

It’s also important to note that Root’s technological advantage plays well into the fractured auto insurance marketplace.

No insurance company controls more than 17% of the total dollars in the industry.

That leaves space for new competition in a way most other industries don’t.

This is all good news for early investors of this huge $724 million IPO.

But what does it mean for shareholders coming on board post IPO?

We can look to the other major IPO of the year for the insurance industry to get a hint of what comes next.

Lemonade technically started trading in early July at $29. But most people weren’t able to get in until shares were liquid enough at around $80.

I wrote at that time that despite Lemonade offering true disruption and a solid platform for growth, that price was way out of whack.

Sure enough, shares have nearly halved in price.

My original recommendation of waiting until they fall back into the $20-$30 range remains.

As for Root, a similar surge out of the gates is likely.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Already, IPO advisor IPO Boutique has reported that the deal is “multiple-times oversubscribed.”

There are more buyers than there are shares available.

That doesn’t mean it will remain that way. IPOs often fly in the face of expectations.

Just ask Rackspace Technology Inc. (NASDAQ: RXT), which fell instantly upon trading, or Uber Technologies Inc. (NYSE: UBER), which after more than 17 months still trades below its IPO price.

However, if a repeat of Lemonade’s triple-digit performance is to happen, an equally disappointing correction should follow.

My take on Root is the same as it was on Lemonade this summer.

Wait for the fickle market to forget about this potential high flier.

Like Lemonade, Root has the platform and technological disruption to transform its industry and steal the show from older insurers.

When prices come down off their early frenzy, no matter which direction they head, then you should be ready to get in.

Combining industry-changing technologies with the safety of insurance as well as enormous growth; that’s a formula for extended success.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder