Can AT&T Inc. (NYSE: T) finally make a comeback on the 5G wars?

Everything that could go wrong for the once communications monopoly has gone wrong.

In 2015, AT&T purchased DirecTV for $48.5 billion. A year later, it announced its even larger $108.7 billion Time Warner deal. That ultimately took years of court battles and appeals to get through.

All of that left the company with an enormous $200 billion pile of debt just as COVID-19 began ripping through the country and the world.

Customers, meanwhile, have been actively cutting cable and satellite TV subscriptions in droves.

Less growth and income, but more debt than ever. That’s where 2020 has found old Ma Bell.

Investors, for their part, have noticed this intense problem:

While Verizon Communications Inc. (NYSE: VZ) has not been having the year it should have, AT&T’s performance was even more blown away by the likes of T-Mobile US Inc. (NASDAQ: TMUS).

Recently, I shared with you why these other two players in the 5G space are so much better equipped for the 5G war now ongoing.

But an interesting turn of events now being discussed could arrest AT&T’s fall. At least, that’s one possible outcome.

The question remains:

Can AT&T Play Catchup on the 5G Rally?

It is being reported this week that AT&T is again trying to offload its reckless purchase of DirecTV. This time, it looks serious.

The Wall Street Journal first reported Friday that the communications giant hired Goldman Sachs as an advisor to find a new home for half of its ownership of the satellite TV provider.

Already, groups like Apollo Global Management and Platinum Equity are interested buyers.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Now, there’s a few things worth mentioning here.

AT&T has tried this before.

Last year AT&T sought out a deal with its direct competitor Dish Network to take over DirecTV. That deal fell apart. And there’s no reason this one will turn out any different.

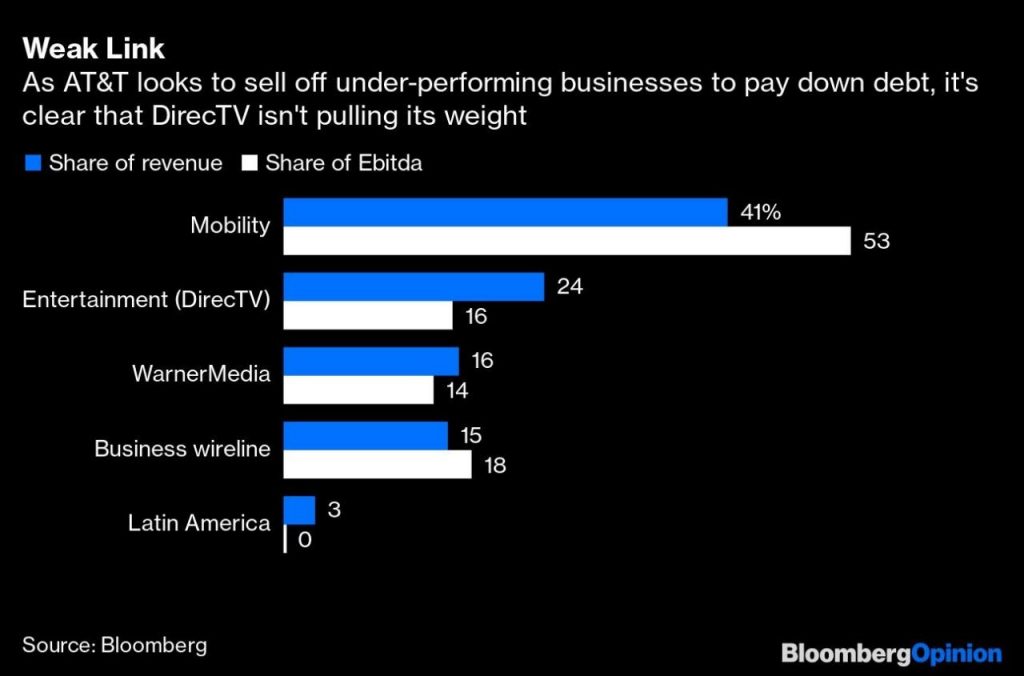

Second, despite falling numbers, DirecTV still makes up a huge chunk of both revenue and cash generation at AT&T. With its enormous debt load, having the cash handy to make payments is incredibly important.

Finally, the deal being proposed behind closed doors is only for 50% of the failing group. And it looks extremely unlikely that consumer subscription trends will reverse even after COVID-19 fades from headlines.

The switch to subscription services like Netflix is still very much ongoing.

Those are serious obstacles AT&T faces even if it can reach a deal. That deal, by the way, will likely only recoup a fraction of what the company originally paid for DirecTV.

All of this comes as the likes of T-Mobile surpassed AT&T’s mobile subscriber base dropping the former monopoly to third place. It also comes as the company remains lagging on the 5G transition.

But there might be some hope.

AT&T’s Only Hope

If it can sidestep or crawl over all of those above obstacles, there might still be light at the end of the tunnel.

Any deal to sell any portion of DirecTV will be a step in the right direction. It would be flush with a little cash to pay down its overwhelming debt, potentially even strike better deals in today’s zero-rate environment.

Second, it would free up some capital to actively try and catch up with the likes of Verizon and T-Mobile on the 5G front.

And as for losing out to streaming services? AT&T has been active on that front too. It owns HBO, which is making a huge push toward streaming. It also launched its own in-house streaming service AT&T TV.

Now, the company is still no great winner in the streaming wars. But cutting its stake in satellite service in favor of these new streaming efforts is welcome all the same.

It may no longer have a complete monopoly on the likes of Apple iPhones or the top spot as a mobile provider. But all of this does point to great improvement.

And that stock performance itself lends itself to some hope for investors.

The company’s shares have fallen so far, so fast with all of these terrible decisions and debt issues that now they might begin looking like they are at a real discount.

The company’s always-impressive dividend is even more sparkling at nearly 7% right now.

It trades at a slight discount based on its earnings and sales too, compared to the overall market and its competitors.

I wouldn’t say AT&T is a screaming buy just yet. But as we watch it attempt to overcome its current obstacles, it could become a real contender again. That’s especially true if it can put any of these funds back into the 5G wars.

For now, VZ is still the dominant choice on that front. T-Mobile, as outlined earlier this month, is a solid second. But AT&T is a 135-year-old behemoth. Don’t count it out just yet.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder