Americans have been extremely lucky over the course of our history. Not only have we but one currency. We have the currency.

Alexander Hamilton’s success at creating the national bank and his role in pushing through the Coinage Act of 1792, has brought about somewhat consistency to the U.S. dollar over its 228-year history.

There have been problems, of course. Falling into and out of gold standards, facing the breakup of the nation during the Civil War, and periods of high inflation have come and gone.

But for the currency itself, it has lasted far longer than its counterparts in much of the world.

Currencies and payment systems change. The Romans had to evolve its currency to fit with available resources. The British only switched to a decimalized currency in 1971, when it shed its shilling.

And of course, the great switch to the euro swept across Europe over the following decades.

As recently as 2016, India, the second most populated country in the world, abruptly wiped out 86% of its currency in an attempt to cut down on its shadow economy.

But here in the U.S., the dollar still dominates.

But 2020 continues to force change on everything it touches. And that may well include the U.S. dollar itself.

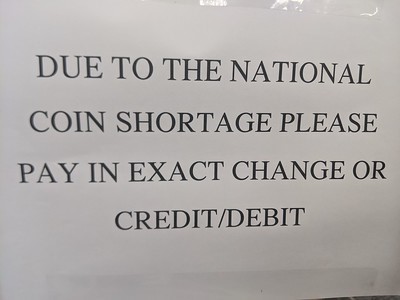

When shops and physical trade came to a crawl in the first half of this year, a rather strange thing happened: coins disappeared.

Eighty percent of coins in circulation, according to the Federal Reserve, comes from deposits at the Fed itself, which then sends them back out to the banking system.

With cash hoarding, limited banking hours, and next-to-no coin-intensive businesses in operation, that system started breaking down. Coins became hard to come by.

Likewise, with the rapid increase in eCommerce and digital transactions between people through services like PayPal and Venmo, cash too has been increasingly underutilized over the course of 2020, even though the average American kept more on his person this year than most years in the past.

Of course, those in the government noticed this. And while they aren’t exactly the quickest to act, they have been contemplating what all of this means for the future of the dollar.

Immediately on the heels of the Great Recession and the currency fears that swept Europe in 2008-09, the first cryptocurrency sprung from the ashes.

A decentralized, non-sovereign currency from which individual users themselves validated its worth sounded like a great thing. And depending on which peak or valley you might have gotten into or out of the likes of Bitcoin, you might agree or disagree.

In any event, cryptos and other digital tokens are big business today. Valued at around $267 billion in May of this year, the sheer size of this market continues to grow at a rapid pace. Governments around the world have noticed and worried.

Several, including the U.S. itself, have started pilot programs or research into what a sovereign version might look like as the world progresses into a cashless society.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Sweden has completed one and announced a second pilot program for its “e-krona.” Earlier this year, France announced testing on a “digital euro.” And China, which has pretty much banned all other cryptocurrencies within its borders, has a huge ongoing project called the “digital yuan,” which remains a bit secretive to this day.

So, maybe it shouldn’t be a shock that those with the power here in the U.S. are contemplating similar ideas.

President of the Cleveland Fed, Loretta Mester, gave a speech just this week about the government’s progress of its own “digital dollar.”

She announced that her own branch of the Fed is working with software developers on the project. The Boston Fed is “engaged in a multiyear effort, working with the Massachusetts Institute of Technology.”

This isn’t some pie in the sky idea either. The digital dollar was almost included in the first round of stimulus during this year’s pandemic, only to be pulled at the last minute.

In that initial language, each American citizen would have had a banking account automatically opened through the Federal Reserve itself. And instead of checks or direct deposits of regular dollars sent out through stimulus, digital dollars would be added to those new accounts.

Of course, that plan was abandoned, which was probably for the good because even using systems that have been around since Hamilton still had problems during that period.

But the likelihood of a central bank digital currency, or CBDC, here in the U.S. has certainly grown in 2020. And it is an important one to follow.

Immediate implications of such news include the first somewhat legitimization of other cryptocurrencies by governments including the U.S.

It also means the possibility of more instant transfers of money, with digital versions of the dollar able to automatically enter ledgers without bank employees overseeing each deposit.

A reduction in the black market and illicit trade, is, of course, another great hope for those looking into CBDCs.

But the real takeaway is that what we’ve seen from the private market – including both cryptocurrencies’ rapid growth as well as new payment technologies and platforms like PayPal – are here to stay.

And that will continue to have large implications for businesses, consumers, and investors for years to come.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder