Riots in the streets…

US COVID-19 death toll surpassing 100,000…

Jobless claims passing 40 million…

The current climate is terrible on Main Street. And it shows.

But all of these terrible facts do lead to one reality: life has to go on in any way it can.

Discount retailers Dollar General Corp. (NYSE:DG), Dollar Tree Inc. (NASDAQ:DLTR) and Ollie’s Bargain Outlet Holdings Inc. (NASDAQ:OLLI) all blew analysts away with their most recent quarterly earnings numbers.

DG, the industry leader was expected to report earnings per share of $1.70. It actually brought in $2.56 during its first quarter.

This doesn’t surprise me with 40 million Americans out of work.

Personal savings rate reportedly grew to 33% in April up from just 12.7% in March. Obviously, budgets are tighter. And people are holding onto every dime they have. Yet they still need to buy toothpaste and toilet paper.

These discount retailers are now reporting that they all expect to crush their previous guidance for 2020. So much so that they can’t even put a new figure on it.

Yet investors don’t seem to be catching the full story here.

Lukewarm Response to Discount Retailer’s Golden Era

Now, I can’t deny that these retailers haven’t been a favorite so far this year. Dollar General and Ollie’s both have been well rewarded by investor interest.

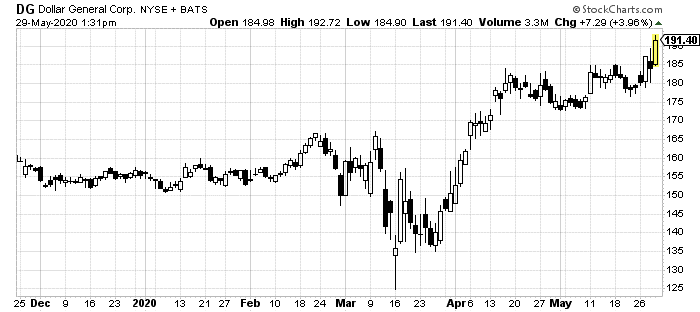

DG is up 23% year to date:

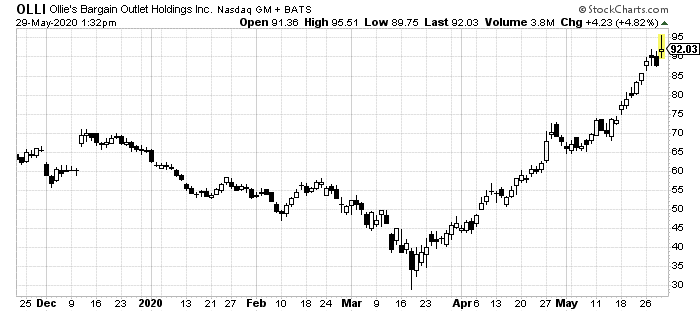

OLLI is up 42%:

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

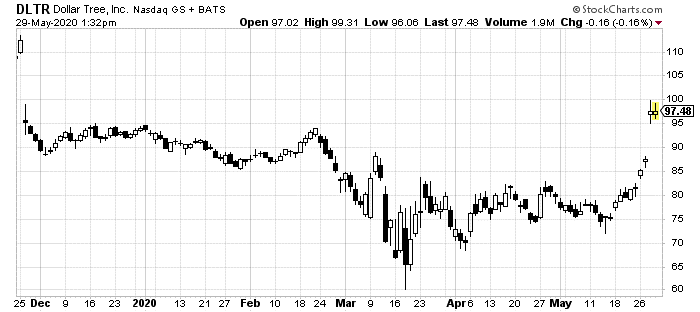

DLTR, while less impressive, is still up on the year:

But the response is still a quiet one.

With all three of these discount retailers clearly blowing away even excited analysts’ expectations, they haven’t really jumped like you might expect.

As I write, DG and Ollie’s are only up 4% and 5.7% on the news. DLTR reported a day prior and jumped a healthier 11.6%. But this still comes across as lackluster for just how overwhelmingly these companies are performing.

What Opportunities Await

Dwelling on a single quarter of numbers isn’t always the best practice for serious long-term investors. But in this particular case, they do tell quite the story.

Dollar General beat earnings estimates by 51%. Ollie’s beat their estimates by 44%.

In fact, Wall Street all agreed that Ollie’s was likely to see earnings fall 26% during its first quarter. The company actually grew instead.

I won’t be the first to tell you that the stock market is being a bit irrational as if late.

But right now, they are missing the bigger picture.

Even after the US opens back up… even after the number of new COVID cases drop significantly… consumer spending will remain in the toilet.

Many assume that it’s just a case of no place to spend money right now. But even so, daily necessities and consumer staple products sold at these discount stores will be priority number one.

Even as companies come back online and hire back workers, 40 million unemployed people are too large of a number to go away overnight.

Discount retail plays like these three are going to see extended success. Wall Street continues to discount them right now.

That leaves a medium-term opportunity for even larger gains. At the bare minimum, there’s a short-term opening to get in on the price realignment following this earnings season.

All three are tremendous buying opportunities.

What are your thoughts?