The countdown begins.

A searing hot blaze of cryogenic liquid oxygen and rocket-grade kerosene propellants roar out of two-stage boosters. A massive rocket hovers briefly just meters above the launch pad. Then in a flash it shoots itself upwards into the night sky leaving a trail of smoke and fire behind it.

As the unmanned rocket enters zero-gravity, thrusters navigate this marvel of science and technology to its destination in order to complete its mission and deliver its payload.

An hour later, as the rocket approaches its orbital destination, a robotic arm gently unfolds and moves a brand-new low-Earth orbit satellite constellation into release position.

Using artificial intelligence processing millions of equations per second, the rocket’s secondary thrusters move the it and the satellite array into perfect geosynchronous orbit. The arm releases as thrusters roar, simultaneously pushing the rocket away as the satellite constellation maintains its geocentricity and races by at hundreds of miles per hour.

At the launch site, a ground crew tracks the mission’s progress through high-powered 5G communication networks from a blast-proof control room. Standing behind the row of frenzied scientists are stoic NASA and Airforce officials.

Behind them stands a dressed-down, but clean-cut man staring intently at the rocket’s progression through space…

He has all the looks of an eccentric billionaire because he is one… And as the financial backer of one of the few semi-private space industry conglomerates around he’s reshaping our future as we speak.

Fiction or Reality? How About Both...

If this story sounds like fiction there's good reason… Personally, it reminds me of the back story for some James Bond villain.

But I kid you not, it’s also the very TRUE narrative of our reality today.

The race to commercialize space is off and running. Three big-name billionaires are leading the way; Elon Musk, Richard Branson and Jeff Bezos. And you can be sure other big-money investors and institutions are quickly shifting funds into this high-growth venture too.

The new space race is real but right now there are only a few ways to score profits in this high-growth industry.

Today we’ll look at one of the few public companies where you can tap into this action.

But first we have to know where we came from to know where we are going in the new space race.

From Operation Paperclip to Planet Elon

The first age of the space race began as World War II was coming to an end. In an effort to stem further confrontations and sway the post-war balance of power, the U.S., through a series of covert CIA missions, began shepparding German-Nazi scientists and technologies back to the U.S.

Operation Paperclip was the brainchild of then 33rd Vice President and former Secretary of Commerce, Henry Wallace.(1) While much of these cloak-and-dagger missions are still shrouded in mystery and speculation, we do know the U.S. Space Program and NASA owe their existence to the operation.

[[Now, it should be noted this operation was met with considerable opposition. After all, many of these scientists and engineers were complicit in horrific war crimes. Arguments for or against the need for personal preservation while living under an oppressive regime aside… there certainly were questions of morality to address…]]

Nonetheless, roughly 120 German scientists, engineers and technicians were brought to the U.S. Their ideas were used to develop many practical-use technologies including synthetic rubber, electromagnetic tape, miniaturized electrical components and much more.(1)

However, the most infamous person and technology comendered during Operation Paperclip was Wernher von Braun and his V-2 rocket propulsion system.(1)

The V-2 rocket was the world’s first long-range ballistic missile. Its propulsion technology was years ahead of any other rocket technology and was the basis for the systems used in our first rockets sent to space.

The V-2 unofficially launched us into the 1st age of the space race and monumental progress was made in the decades to follow.

We landed the first people on the moon in 1969 and more importantly we developed new advanced technologies that have greatly benefited our everyday lives here on Earth.

But despite our incredible progress, by the mid-90s many began to wonder if the exorbitant cost of space exploration and research was a government boondoggle. A giant money-pit not worth financing.

Flash forward to today and that sentiment has changed entirely. Folks are once again looking to space as the answer to many of our current problems. Instead of thinking about shuttering NASA we’re entertaining the idea of pleasure trips to Planet Elon.

I know that’s bold. Maybe the owner of Virgin Galactic, Richard Branson, wins the rights to rename Mars first. Or maybe Mars becomes Planet Amazon. That does have a nice ring to it.

The point is commercialized space travel is here and will soon be cheaper than we ever thought possible.

This industry is going to be massive. The U.S. Chamber of Commerce estimates the new space economy could be worth $1.5 trillion by 2040.(2)

The real exciting part is that there are ways folks like you and I can get invested right now.

Virgin Galactic Sets the Tone on Wall Street

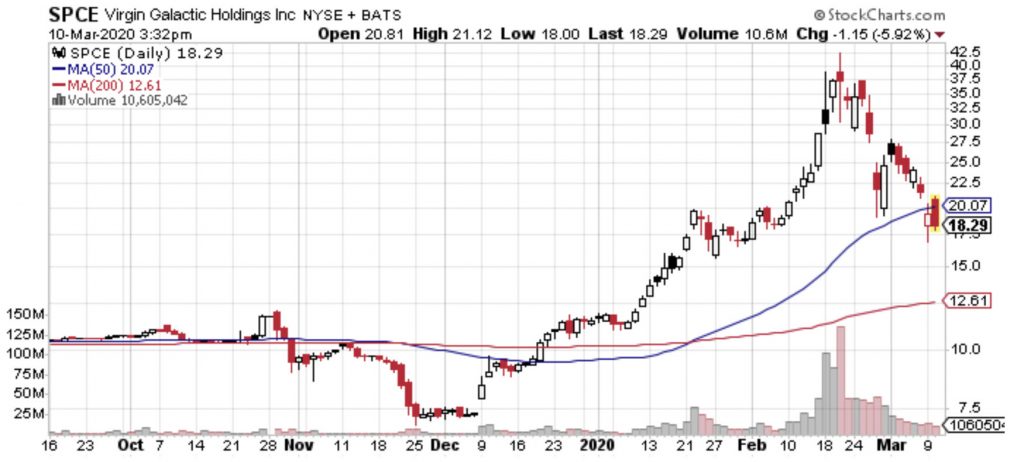

On October 28, 2019 Richard Branson’s Virgin Galactic (NYSE: SPCE) made history.

The company became the first commercial spaceflight company to list on a major exchange and the stock’s strong run through February has set an impressive tone for space offerings on Wall Street.

Founded in 2004, Virgin Galactic has positioned itself as the new leader in space tourism with the hopes its first-in-class status will offset the incredible costs of running a spaceflight business.

Projections look positive with 603 reservations confirmed by Virgin Galactic.(3) And just the other week Virgin Galactic announced its One Small Step program which allows folks to place a fully-refundable $1,000 deposit towards their own trip to space, once ticket sales reopen.(4)

Quartz reports, 3,700 people have placed deposits using the One Small Step program and with $80 million on deposit already, SPCE is quickly carving out a nice share of the space tourism market.(5)

Believe it or not with tickets costing $250,000 a pop for a 90-minute flight SPCE could be profitable by next year according to their recent industry whitepaper.(3)

But all those exciting developments considered, SPCE isn’t the company we’re going to buy today.

For one thing, the idea of space tourism isn’t as unique as it sounds. Moreover, the realities of Virgin’s short trip into micro-gravity (not actual zero-gravity mind you) may not be as life-changing as a stay at NASA’s Hotel International Space Station.

For $35,000 per night, plus $60 million for the cost of transportation, NASA will happily allow you to spend a few days in true zero-gravity. And for the super-rich SpaceX’s lunar flights promise to let billionaires travel around the moon for an undisclosed price.(6)

No word on whether NDA’s will be required to keep the Moon’s dark side secrets underwraps however.

The problem highlighted here is space tourism is not unique enough to keep competitors at bay. Especially when we’re talking about targeting the rich and super-rich as your only market.

Plus, shares of SPCE have ripped too far, too fast. After gaining more than 300% before settling around 200% in gains (all purely on speculation) it makes sense a correction is due.

And with travel stocks (even space-related ones) suffering from the coronavirus-fueled drawdown we want to wait and see if prices fall further before jumping into this particular name.

That all said, there’s another space-related play primed for entry right now and unlike the niche market of space tourism, this company has a much grander vision.

It Starts With the 5G Takeover

The promise 5G offers is very real.

5G networks will be hundreds of times faster than our current 4G networks. You’ll be able to download a high-definition movie in seconds and your kids will be able to stream their favorite video games without “lag” sending them into a tantrum.

But 5G isn’t just about faster downloads and smoother streaming.

5G allows for the creation of so many other new technologies. These technologies will revolutionize the world. Disruption in existing industries like cable and broadband internet is only the beginning.

5G will allow other tech trends like the internet of things (IoT) and autonomous vehicles to finally scale. Artificial intelligence will also get a major boost from the availability of 5G. This will accelerate research and studies allowing for amazing new breakthroughs in the sciences.

The amount of money projected to be invested in 5G has reached staggering levels.

In 2018, the 5G market was estimated to be worth about $43 billion. New estimates now suggest the 5G rollout will take trillions in investments.

TechRepublic reports, recent analysis of 5G spending estimates the total bill for the roll out throughout the global supply chain could top $2.7 trillion by the end of 2020.(7)

We all know there’s been a lot of hype surrounding 5G, but with little practical payoff so far.

That all changes this year. Simply put, if 2019 was the year of 5G network upgrades then 2020 will be the year of full implementation.

We know this because the FCC just greenlit a new, mid-band spectrum (C-band) auction. Insiders know it takes high-band and mid-band spectrum to make 5G possible. Until this auction was approved, 5G was stuck in a holding pattern.

The release of new spectrum allows for 5G to finally happen and you can be sure the rollout will be fast.

This means right now is the perfect time for investors who want to carve out their fair share of the 5G windfall to strike.

Here’s how we’ll do it.

Global Connectivity Unlike Anything We've Ever Seen Before

As we transition to a world powered by the internet of things (IoT) and other wireless technologies we’ll need extensive upgrades to the networks servicing this technology. This means tons of investment here on Earth, but also fleets of new satellite technology in the sky above.

Revamping our satellite infrastructure from the old hunks of junk orbiting Earth thousands of miles above into a fleet of small, easy-to-manage low-Earth orbit satellites is no easy task.

Nor cheap...

But some of the biggest names in tech are already answering the call. And low-Earth orbit satellites will create major disruption in the telecommunications world.

SpaceX Becomes World's Largest Satellite Provider

Elon Musk wants in on 5G like everyone else and I don’t blame him.

Last year SpaceX received FCC approval to place one million new, low-Earth orbit communications satellites into orbit as part of its Starlink internet service.(8)

SpaceX has made it its mission to dominate the new satellite industry. Earlier this year they launched 60 new Starlink satellites into orbit.(9) The launch made SpaceX the largest telecom-satellite operator on the planet and with another 20 or so planned Starlink launches expected to take flight this year SpaceX is a major disruptor on multiple levels.(9)

To date, SpaceX Falcon 9 missions have successfully placed 300 satellites into orbit for its Starlink internet service.(9)

But if SpaceX is a private company, how do everyday investors take advantage of this fast-paced space race?

Tapping the 5G Space Race for Profits

The unique way we’ll gain early access to the new-age space race is a much lesser-known company, Loral Space & Communications Inc. (NASDAQ: LORL).

Founded in 1996 and headquartered in New York City, Loral offers satellite-based communications services to broadcast, telecom, corporate and government customers worldwide.(10)

It owns and operates a fleet of geostationary satellites providing various telecommunication services and according to its most recent earnings call expects to put 300 low-Earth orbit (LEO) satellites into orbit by 2023.(11)

LORL is one of the few public companies working to advance global communications through low-Earth orbit satellite constellations and could be well-positioned to profit from the demand for LEOs that 5G will create.

Additionally, LORL also owns the controlling stake in Telesat Canada and a 56% stake in Xtar. Xtar is a Spanish telecommunications company bringing low-Earth orbit constellations to Europe.

The global reach LORL has, as well as the breadth of experience the company’s executives have with regards to negotiating with governing bodies like the FCC, make it an enticing play in the soon-to-be-booming space industry.

This experience, as well as the vertical integration of its supply chain as both satellite maker (as LORL) and as telecom operator (with Telesat and Xtar), gives it an early advantage against some competitors.

If LORL can bring its plan to launch 300 satellites into orbit to fruition over the next two years they could be the biggest challenge to SpaceX’s Starlink dominating the future of global communication.

LORL’s Breakout Is About to Happen

In 2018 LORL looked like it may be a dog. Its satellite ventures lacked funding and operations were stagnant. It was in the middle of restructuring assets including Xtar and even trying to off load Telesat in its entirety.

But all that changed once the company began to pivot towards low-Earth orbit constellations. Over the past year LORL has established a new network of partnerships with Airbus and Blue Origin to build out their new LEO satellite constellations.(11)

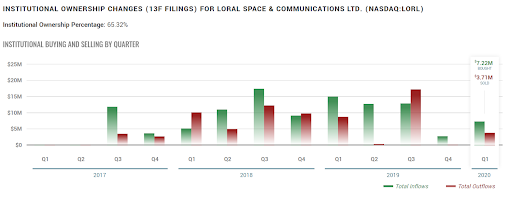

Q4 of 2019 was rough for LORL shares, but the stock appears ready to breakout of its recent trading range.

Some big-name institutions are making their move this quarter too. Institutional cash inflows have more than doubled the outflow in Q4 of 2019 and into Q1 this year.

Three of the biggest moves made by institutions recently include Stonehill Capital purchasing over 225,000 shares, Allianz Global Investors purchasing over 122,000 shares and Hudson Bay Capital Management buying over 87,000 shares.(13)

LORL’s most recent earning’s call highlighted mixed results.

Full-year numbers offered positives. After two straight years of revenue decline, CEO Daniel Goldberg announced that full-year revenue had stabilized. Additionally, full-year operating expenses were down 12% and full-year EBITDA rose by 0.5%.

Fourth quarter numbers were less impressive, with revenue down 5% year over year. Adjusted EBITDA was also down 8% from Q4 2018. Goldberg specifically noting one of the largest reasons was the non-renewal by Shaw Communications.

That disappointment aside, new updates to its low-Earth ventures were intriguing and there’s real belief these operations can get off the ground quickly after almost a year of delays.

Additionally, there are other bullish factors that suggest LORL is finally ready to breakout.

Yahoo Finance reports:

On July 24, 2019, Telesat announced that it had entered into a Memorandum of Understanding with the Government of Canada (“GoC”) regarding a partnership that would ensure access to affordable high-speed internet connectivity across rural and remote areas of Canada through the development of the Telesat LEO Satellite Constellation. The partnership is expected to generate $1.2 billion in revenue for us (Telesat) over 10 years, which includes a contribution of up to $600 million from the GoC.

Additionally, Telesat announced that it had entered into an agreement with the GoC pursuant to which the GoC will contribute $85 million to support the development of the Telesat LEO Constellation through the GoC’s Strategic Innovation Fund.

LORL’s future profits hinge on 5G and its ability to implement its LEO gameplan. But with the infusion of cash it should receive from the Canadian government to expand their high-speed internet connectivity across the nation there's good reason to believe LORL can get the job done.

That should be a boon for LORL shareholders.

Action: Buy shares of Loral Space & Communications (NASDAQ: LORL) up to $35

Portfolio Review

Roku, Inc. (NASDAQ: ROKU) - Roku is weathering the coronavirus drawdown.

RF Industries (NASDAQ: RFIL) - RFIL continues to trade sideways in its current range.

Invitae Corp. (NYSE: NVTA) - Invitae may have found support and is looking to break off its downtrend.

Twilio Inc. (NYSE: TWLO) - TWLO is also weathering the coronavirus storm.

The Trade Desk, Inc. (NASDAQ: TTD) - TTD is pushing back towards 2020 highs.

Pinterest, Inc. (NYSE: PINS) - Pinterest is also weathering the coronavirus correction.

Alteryx, Inc. (NYSE: AYX) - Shares are down along with the greater market, but AYX should bounce back strongly.

Fastly, Inc. (NYSE: FSLY) - Fastly is weathering the coronavirus storm.

Veeva Systems Inc. (NYSE: VEEV) Veeva falls further than the greater market. More on this soon.

Illumina Inc. (NASDAQ: ILMN) - We exited our position in ILMN. You can see that sell alert here.

MongoDB, Inc. (NASDAQ: MDB) - MDB is weathering coronavirus concerns.

Okta Inc. (OKTA) - Okta continues to weather the coronavirus drawdown.

Nike Inc. (NKE) - Nike is also feeling the greater effects of the coronavirus drawdown.

Zoom Video Comm (NASDAQ: ZM) Zoom is bucking the losing trend caused by the coronavirus

GOGO Inc. (NASDAQ: GOGO) - GOGO is suffering along with other travel-related stocks in wake of the coronavirus.

Sources: