Gold investing is like an onion. It comes with several layers.

Warren Buffett made a huge splash over the weekend. After years of next to no new purchases, his Berkshire Hathaway Inc. (NYSE:BRK-A), (NYSE:BRK-B) went all in on gold.

His company reported having bought 20.9 million shares of Barrick Gold Corp. (NYSE: GOLD) worth more than half of a billion dollars during the most recent quarter.

This came out of nowhere. For years, Buffett and his business partner Charlie Munger have absolutely hated the metal.

Buffett once told investors that "gold would be way down on my list as a store of value," calling it just "some piece of metal that people dig out of the ground."

Munger noted that Berkshire’s managers "have never had the slightest interest in owning gold."

Now, they own an enormous position in one of the precious metal’s largest mining company.

To see what this means for Berkshire to take this turn and for the industry as a whole, we need to understand what owning a mining company is really all about.

Leverage Layer 1: Production vs. Gold Itself

When gold is in demand, as it very much is right now, its price rises. That’s simple economics. But when that happens, something else is going on.

Each ounce of gold a miner pulls out of the ground becomes more valuable. If input costs like labor and energy remain the same, the company’s margins can explode at an even higher rate than the metal itself.

Take this example.

If a mining company produces gold at $1,100 per ounce and sells it at $1,300, it profits $200. If prices rise to $2,000 as they are today, that profit explodes to $900 for each ounce extracted.

Gold, in this example, jumped a sizable 54%. But mining profits grew by 350%.

That’s why Buffett just went long gold. He wants that leverage.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Leverage Layer 2: Buying Out Miners

Berkshire’s purchase offers a secondary layer here.

Now, shareholders of Barrick have been treated to both a steady rise in profits and the new interest from Buffett.

GOLD shares jumped 12% by mid-morning on this news.

Gold, the metal, too is having a good day. But it is only up 1.9%.

The news of Berkshire buying into gold, and specifically GOLD is offering a second layer of leverage for shareholders. They get the best of both: rising profits and higher demand for their shares.

Leverage Layer 3: What Comes Next

You might think that this story is over. That since we now know that the most-watched investor in the world just bought a huge chunk of one of the largest miners in the world, the market will find its equilibrium again. Prices will settle into a groove, and we can move on.

But if you go back to the first bit of leverage, what is essentially monstrous profits for mining companies, we find ourselves in a new environment.

Major mining companies are absolutely raking in the money from gold’s sizable rally this year. Margins have exploded. Debts are falling. And free cash flow is pouring in.

What happens when any company begins sitting on piles and piles of cash?

They reinvest it. Specifically, and especially in this case, they buy out competitors.

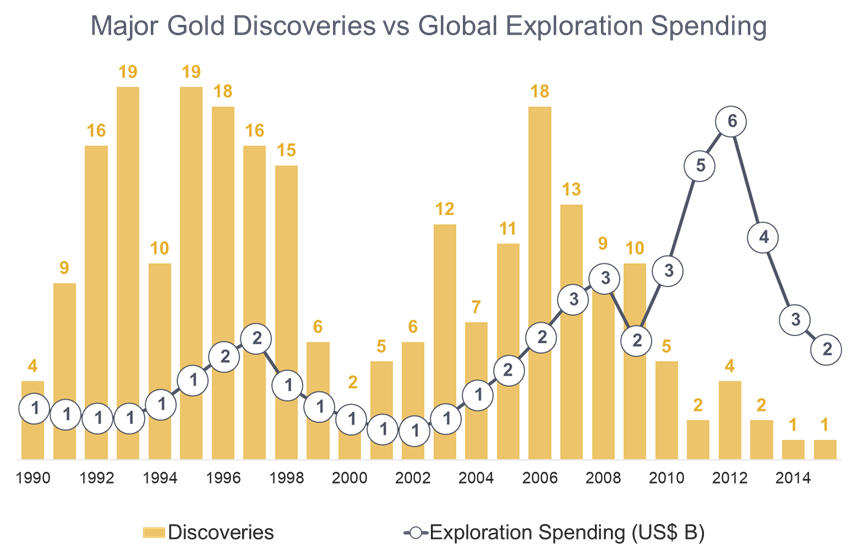

You see, I pointed out back in July that gold companies have had a poor track record of late when it comes to finding new areas to mine:

That leaves relatively few options for them when they are sitting on piles of money like today. They could, and most certainly will invest in new technologies pointed out then like artificial intelligence.

But the far easier way to grow rapidly and strike while the iron is hot is to simply buy out smaller competitors.

Think about the savings. Rather than spending a fortune exploring and developing new operations, simply buy ones that have already done the job for you.

That leads to the third leverage layer, and where the best opportunity from this news story comes in.

Junior gold miners are already leveraged to the teeth, in a good way. When their profits rise from increasing gold prices, they typically outperform even the industry leaders. After all, it’s easier to grow from $50 million than from $50 billion.

Just look at the last rally, what happened back in 2010. Juniors, represented by VanEck Junior Gold Miners ETF (NYSE: GDXJ) quadrupled major miners’ performance:

That’s what is now on the table here in 2020.

Take a lesson from history, from basic principles of leverage and Berkshire’s wild turnaround on gold.

The iron is hot.

Junior gold miners are the best place to find golden profits over the next several months and years.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder