Ever since Democrats have taken control of the House, the Senate and the White House, one industry has been on fire.

It’s no surprise that with the possibility of cannabis decriminalization or even legalization on the table, cannabis companies have done very well in the stock market of late.

Companies like Aphria Inc. (NASDAQ: APHA), which recently agreed to combine businesses with Tilray Inc. (NASDAQ: TLRY), have shot up since November’s election.

But mainstream cannabis companies aren’t the only ones catching steam so far this year.

With even more recent efforts to bring legalization legislation to a vote in both Houses of Congress, companies only tangentially-related to cannabis are also doing very well.

Last week, I highlighted one area — hydroponic products and sales — set to continue having a very good run.

Today, I want to back up and discuss the run-up and future of three more hot cannabis-adjacent industries and where they go from here.

Growing and selling marijuana could certainly become a majorly-lucrative business to own. But consumers must do something with their buds before they get any benefit.

So, for those who prefer joints, rolling papers is an essential good.

It might not appear like much, as paper seems like an easy, low-moat type of product. But there is really only one major pure play in this field.

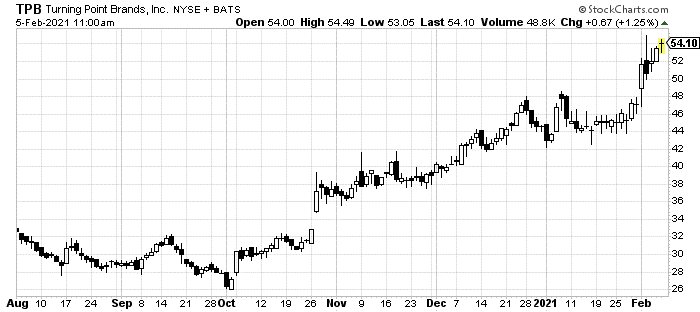

That company is Turning Point Brands Inc. (NYSE: TPB). Even if the name of the company doesn’t ring a bell, its main brand might: Zig-Zag.

Shares have done just as well, if not better than the companies that actually grow marijuana plants.

After a double in share price over the last four months, you might be thinking it is time for some profit-taking. But that might not be the case.

Just this week, the company announced preliminary fourth-quarter sales of between $103.5 and $105.5 million. That’s a 30% year-over-year growth.

It also successfully raised a quarter of a billion dollars in new capital by issuing senior notes without suffering any dip in share price.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

This remains an important player with high-growth prospects going forward.

A federal law that opens up the cannabis industry would have massive effects. But that doesn’t mean D.C. is quick-moving.

One of the most likely scenarios for any kind of cannabis law would be a simplified decriminalization or legalization.

The regulations themselves that actually begin allowing the production and sale of marijuana will take a lot longer.

That plays into the hands of companies that have already profitably navigated the state-by-state regulations. Specifically, the companies that own the facilities and production of cannabis at the state level.

One company, which I’ve shared before but remains a central player in this ancillary industry, is Innovative Industrial Properties Inc. (NYSE: IIPR).

IIPR is a real estate investment trust (REIT) with 67 properties in 17 states. It leases these facilities to growers for the production of cannabis.

This model will continue to benefit regardless of what Congress does.

The final area worth paying attention to is brand new. In fact, only last month did it even become a real industry at all.

Cannabix Technologies Inc. (OTC: BLOZF) received the first U.S. patent for a THC breathalyzer.

That’s right, just like alcohol, police need to be able to test if someone is under the influence of marijuana. That too applies to heavy equipment workers, schools, etc.

Cannabix, a tiny over-the-counter play from Canada, just got a patent for its rather bulky breathalyzer prototype.

That’s the keyword: prototype. The company isn’t even close to full production of this product. So, despite its massive post-patent rally, it remains a wildcard.

It is also not the only player in the game. Just the first publicly-traded company with a patent for its potential first-to-market breathalyzer.

It’s too early to recommend this one. But it could end up the biggest of the three. And it certainly deserves to be on any watch list.

One final note: all three of these pot-adjacent players have done well in the run-up to potential legislation. But none of them require it to continue their successes.

While Wall Street is simultaneously backing growers and sellers of marijuana, these three offer some protection if those legalization efforts are slow to come.

To your prosperity and health,

Joshua M. Belanger