Air travel has been one of the hardest hit industries in 2020.

Yet, for one tangential company, there’s never been a better time to buy than right now.

SP Plus Corp. (NASDAQ: SP) is a parking management company. Specifically, it is one of the largest airport parking management companies in the country.

I know. But hear me out.

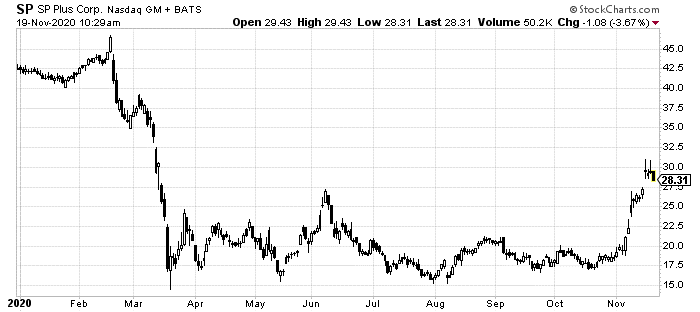

The company, as you might expect, has suffered in 2020. At least its stock has.

Clearly, being even tangentially related to air travel has not made SP popular in the least.

But look at what’s happened so far in November. That’s a 52% rally in just over two weeks. That’s after barely budging for seven months following the March meltdown.

Why is this small cap airport parking company taking off now, especially with new lockdowns going into effect all across the country?

Well, because it became too cheap to ignore.

Plenty of SP Plus’s largest contracts and operations center around airports. But it isn’t only in the air travel business.

It also owns many parking lots and garages around many cities, both in residential and office areas.

Now, I know you are probably thinking that’s a drain too. But with the complete abandonment of public transportation and the recent surge in vehicle ownership, this is been a boon for SP.

I’ve mentioned this before. But people are buying their first cars in droves right now. They may not be driving them very far or often. But they need to park them somewhere. So, this trend works perfectly for SP.

No doubt, the pandemic had seriously cut the company in the beginning. But as these other trends and factors came into play, SP Plus has turned things around in a huge way from at least a financial point of view.

When things looked bleakest this spring, the company made some hard choices. It cut costs across the board. It even had to cut pay for some employees.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

But those savings and early action helped the company return to positive free cash flows and full pay for employees earlier than most. Certainly, it has been able to do so quicker than just about every other company related to travel.

And while SP might not be a dominant triple-digit grower year over year, it is still a growth opportunity.

Because of the severe hit to others in its industry in the early days of the pandemic, SP Plus has been able to pick up a ton of market share through contracts from rivals and expanded services from residential and office parking.

Of course, the real opportunity is in just how overlooked this small cap is right now.

The major reason why shares are up 50% or so in November is because of its most recent earnings report.

As a small company, with a market share of less than $1 billion, its stock doesn’t attract many analysts to cover it. Often in cases like this, the few analysts that do cover small companies are spread too thin. And they miss their estimates in shockingly large fashion.

That’s exactly what happened during SP Plus’s third quarter. The average analyst estimate was for the company to carry a third quarter loss of 34 cents per share. Instead, SP ended up going 62 cents into the black. That’s almost a full dollar off in just one quarter.

That’s right. A company that manages parking at airports turned a substantial profit during a pandemic that has shut down air travel. And it did so to the utter surprise of those on Wall Street supposed to be watching it.

There’s plenty more to run here.

Even after investors realized their mistake this month, shares are still trading at just over 20 times estimated 2021 and 2022 earnings.

If, for whatever reason, air travel comes back on the menu, those earnings could double overnight. If they don’t, that’s fine too. The company already proved it can generate greatly-unexpected gains from its other businesses.

And remember, all of those new cars floating around have to park somewhere. If SP doesn’t get a large of income from airports, that just means it makes its money from parking garages under apartment buildings.

With the recent runup in price, the opportunity is closing, however. Now is the time to take advantage before this small cap gains any more traction.