Saying it’s been a wild week would be an understatement…

Over the last 15 years, I’ve traded through a lot of wild market swings, flash crashes, short-selling bans, etc.

But what happened this week is a first.

Retail firms banned the basic foundation of the equity markets, buying shares of a company.

Now, there’s a lot of speculation and theories why this happened.

Every firm is different and who they clear transactions though is also different.

Some firms blocked transactions on the reddit focused stocks and a few had to stop for a few hours because regulators told them they had to.

We’re witnessing a revolt and the start of a revolution against the establishment and the elite class.

It’s incredible to see all these events unfold.

People have had to sit back for twelve months while seeing their livelihoods and communities destroyed, while a certain group of people get filthy rich.

In 2008, I walked away from Wall Street with a mission to help that little guy beat the market.

What I’ve seen this week has invigorated me with more purpose and joy.

The goal is to make money, but this goes deeper!

The little guy is tired of being told they can’t do something or they aren’t smart enough.

As you’ve seen this week, we must stick together if we want to beat them.

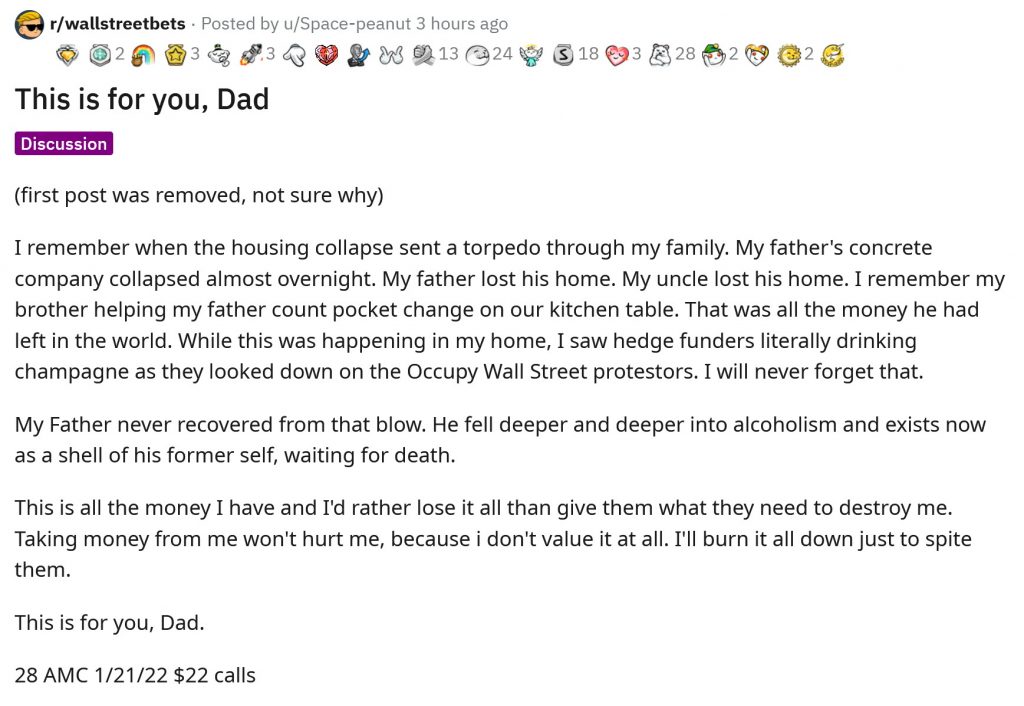

Trading is tough, but at the bottom of today’s update I attached a screenshot.

It’s a post from one of the reddit members in the WallStBets group.

They are out for blood and it’s only the start of something big.

Now, The CBOE Volatility Index (VIX), aka the “fear” index, is still above our key 15 levels, trading at 31 — this is 10 points higher than last week!

Markets are very volatile and the market structure is on shaky ground with some of these hedge funds blowing out.

Typically, we have a domino effect with good stocks being liquidated to cover the losses of other positions from this aftermath.

That is why we’re seeing the market weakness, because the heavily focused names like Apple, Facebook and Amazon are being sold, pushing down the indices.

This market has been built of a house of cards the last decade and I don’t know if this is the final blow.

This is why I love being in options, because we can manage our max loss before entry.

And when big drops in the market happen, we’re not playing on our heels and making poor decisions.

It allows us to focus on the signals and ignore the noise.

January has been a tough month for us, but I know things will turn around and we’ll go on a nice hot winning streak.

Now let’s talk shop.

On Monday:

Buy-To-Open the GOGO Inc. (NASDAQ: GOGO) March 19, 2021 , $20 call (GOGO210319C00020000) up to $0.95 per contract or better, for the day.

On Wednesday:

Buy-To-Open the Amer Axle & Manufacturing (NYSE: AXL) April 16, 2021, $13 call (AXL210416C00013000) up to $0.45 per contract or better, for the day.

Sell-To-Close the Altria Group, Inc. (NYSE: MO) Jan. 29, 2021, $43 call (MO210129C00043000) at the market.

Right now, we’re holding:

This is our debriefing of every trade closed or expired to analyze what happened, why it happened and how it can be done better — like what the military uses after missions.

Altria Group, Inc. (NYSE: MO) Jan. 29, 2021, $43 call (MO210129C00043000)

Date: January 6, 2020

Reason: Our system triggered a bullish signal triggered after a new $21 million New Money bet, which is a 712% surge in new call options purchased

Outcome: Exit for a 34% loss.

Notes: We traded this the right way. We didn’t gamble and play earnings, we took our shot and it didn’t hit our profit target. Unfortunately, that’s how it goes sometimes.

Let’s keep focused, not panic and let the market come to us.

And I’ll be keeping you updated every step of the way.

Have a great weekend, and I’ll have a new trade for you on Monday.

To your wealth, freedom, and options!

Joshua M. Belanger

P.S. Here’s the screenshot from the WallStreetBets group on reddit.