A window is about to open for the industry-first crushed and first to recover from the pandemic. But to push through it, you’ll have to be ready to act fast.

When the coronavirus first struck, one of its earliest economic targets was the luxury goods industry.

The countries affected by the virus in the earliest days were all in Asia, where 45% of luxury goods company LVMH Moet Hennessy-Louis Vuitton (OTC: LVMUY)’s revenue is generated.

Along with the high fashion industry falling apart, jewelry was hit equally hard.

For LVMH, that was a double whammy. You see, just prior to the outbreak, the luxury handbag company had agreed to buy luxury jewelry maker Tiffany & Co. (NYSE: TIF) for $16 billion.

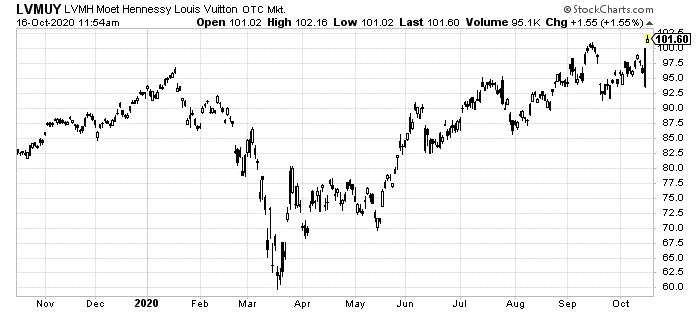

Since those early days, something a little strange happened. Luxury fashion items began recovering rapidly.

Apparently, since the well-to-dos weren’t spending on travel and vacations, they were happy to snap up even more luxury goods.

This, apparently, hasn’t translated into jewelry, however.

Tiffany is still in deep decline, while LVMH just showed a double-digit sales growth rate for its fashion and leather business during the most recent quarter.

This is where the story gets really interesting. And what happens over the next few months could create a monster opportunity.

As you can imagine, with Tiffany still in deep decline, its shareholders want more than anything for the original pre-COVID deal with LVMH to go through.

$16 billion is a lot of money, and likely far more than the company is now worth.

LVMH, as you can equally understand, does not want to have to pay that much anymore.

The European-based (which I’ll get to in a moment) fashion company decided to break off the deal this summer. Tiffany said, “Not so fast.”

The two are locked in a legal battle over a term in the agreement called Material Adverse Effect, or MAE.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Come January, when the two are set to get their day in court, we’ll find out if a pandemic is actually a materially adverse problem for the luxury goods industry.

Both sides do have solid arguments. LVMH’s is basically, of course, it is. Tiffany’s argument is that it wasn’t listed specifically in the agreement.

So, it can’t be.

We’ll see how that plays out then. I won’t get into betting on the outcome of a court case like this.

But of the three potential outcomes, two end up in LVMH’s favor:

1. The deal goes through as previously planned, forcing LVMH to cough up $16 billion.

2. The deal gets trashed, because who in the world could have seen this pandemic coming last November?

3. The deal is altered, lowering the buy price, giving LVMH what it wants but for less than expected.

In any outcome, shares of both companies should see volatility.

With LVMH’s core business back to high pre-COVID growth rates, that could come with buying opportunities.

But this potential deal and court battle isn’t the only thing creating this unique window of opportunity.

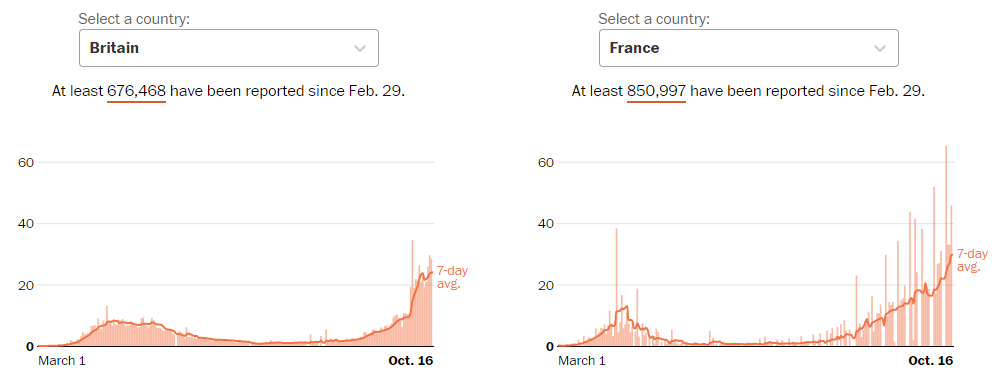

As discussed yesterday, Europe is seeing a real problematic and heartbreaking surge of new coronavirus cases right now.

For the luxury industry, that’s even more problematic than the Asian outbreak at the start of the year.

London and Paris are incredibly important fashion hotspots. And right now, they are disasters.

As you can guess, the longer this second surge lasts and the more restrictive the potential lockdowns in these fashion capitals become, the worse a company that sells Louis Vuitton and Christian Dior brands will do.

So, we could see the second fallout in share price as we did back in March for this luxury company and group.

But remember, it also rallied in a hurry once its numbers started coming back into the black.

In fact, buying at the bottom, some investors have had the chance to already lock up nearly 60% in profits.

We could see another opportunity in this niche market with these two major catalysts.

And remember, neither will affect LVMH’s 45% sales numbers out of China and other Asian markets, which are already seeing high fashion and jewelry come back in surges of their own.

The likelihood of a choppy fourth quarter for LVMH shareholders is high.

The court case to be settled at the start of the new year and the potential for a real second wave of coronavirus shutdowns makes it almost hard to watch what’s coming for the company.

But those with patience and timing can use this window to pick up a solid, double-digit growth rate for pennies on the dollar.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder