The world’s largest merger in the world of financial management just closed this week.

Specifically, the incredibly exciting world of registered investment advisors, or RIA, (sarcasm intended).

RIAs are those with enormous portfolios go to do their investing. These fiduciaries, similar to hedge funds, collect “2 and 20.”

Either (or both) fees of 2% of all assets under management and/or 20% of all gains made lands in these RIAs’ pockets.

This is huge money. When the rich get richer, you know someone is taking their cut. And that’s what RIAs do, by definition.

The Charles Schwab Corp. (NYSE: SCHW) announced its plans to merge with TD Ameritrade Holdings late last year. Somehow, despite controlling more than half of the RIA market, regulators recently approved of this deal. Yesterday, it closed.

This has far-ranging impacts on the world of finance. Some seem obvious. Others remain in that mysterious cloud that is high-net-worth investing.

As you can imagine, hedge funds have done very well over the last decade, in terms of returns for their investors and the fees they collect on those.

But they have also had a problem due to the stock market’s 10-year climb; they haven’t been able to beat the indexes.

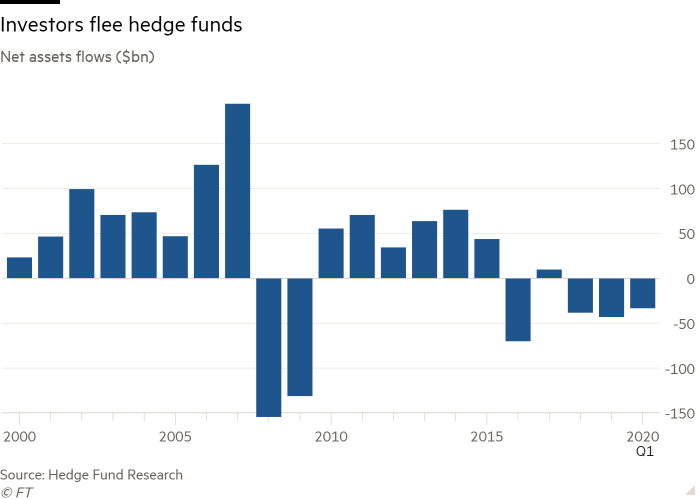

With stocks rallying for that long of a period, it hardly mattered where you put your money after the financial crisis. Hedge funds, which rely on more money coming in under management, saw those numbers drop of late.

2018 saw hedge fund outflows of $56 billion. 2019 saw up to $98 billion exit hedge funds. In just the first four months of this year’s pandemic, high-net-worth individuals pulled $72 billion out of these funds.

That’s reversing, but still going to leave another large deficit on the year.

That money doesn’t disappear. However, it has to go somewhere. And as it gets shifted from one place to another, RIAs are there to collect.

Now that SCHW basically owns 51% of that market, it can set the price tag for such moves.

In the end, that will make its move to bring in all of TD’s customers a major deal.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

On the surface, the legacy brokerage industry is in shambles.

With the introduction of commission-free trading services and apps like Robinhood, the veterans of the industry have been scrambling and failing to play catch up.

This is also, on the surface, the main reason why E*TRADE decided to join Morgan Stanley (NYSE: MS) and TD gave in to Schwab. But there’s a lot more to this story.

Yes, these three, Schwab especially, has been late to the game. They finally gave in to investors’ demands for commission-free trades. And that sounds bad for the companies that used to lock in all of that money.

But they got there in the end. And, as noted back in June, Schwab only counted those commissions for 8% of its total revenue.

I also wrote about the introduction of Schwab’s “Stock Slices” program. This is where the oldest discount broker started allowing the trade of fractional shares.

Instead of paying $521 for Netflix Inc. (NASDAQ: NFLX) shares, you can buy a small fraction of one for just $5.

Others, including Robinhood, now offer the same. But it keeps Schwab, and now its TD business, competitive.

The real advantage of this deal actually comes from the integration of all of these companies’ other services.

Schwab has built up a business that leans into tiered financial advisement and products. TD’s banking business has always been lucrative for the company.

Now, with control over both the RIA world and an enormous chunk of the investing public, the combined company is able to fight back.

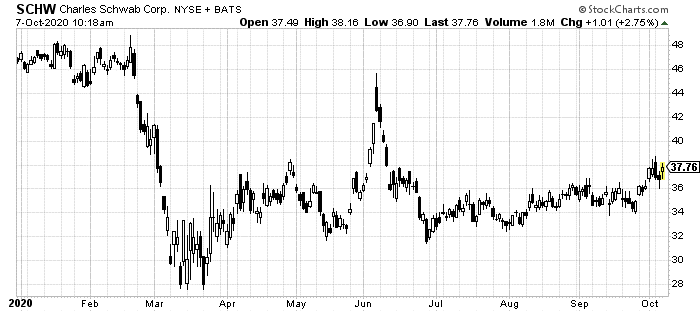

And if all of this isn’t enough, just take a look at how badly Wall Street is missing the mark on this right now.

Despite nothing but positive news and the potential for billions in cost reductions as the two groups merge, shares of Schwab have continued to underperform.

Analysts continue to underappreciate the effects of this combination.

Possibly, they don’t see the huge possibilities of one company basically controlling the high-net-worth market.

Maybe, they are hung up on the brokerage business and the allure of Robinhood (which I reserve the right to judge until it finally IPOs).

In any event, these analysts are primed to be the market movers here.

When Schwab is able to lay out more exact details and return figures from the combination of these businesses during its next shareholder meeting, these analysts will need to reassess their price targets, currently only showing a potential for a 3% gain.

One might have already started seeing the light. Morgan Stanley analyst Michael Cyprys just updated his target for the competing company to $51. That’s about a 35% gain from current prices.

More will come as we near and get to the next few earnings and shareholder events. Two of those events are coming up just this month.

Expect a short-term profit opportunity of between 35% and 50% as Wall Street reconsiders one of its own following this historic deal.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder