When did the phrase “mature company” become such a negative?

And how in the world can maturity in the sphere of cloud computing mean investor abandonment?

We like new, shiny things. I get it. New gadgets, the latest wearable smart tech, the next-gen gaming consoles, and graphics cards all garner headlines these days.

The same is true in the investing world. A few years ago, all you had to do was add the word “blockchain” to your business name and you could easily double its market cap. “AI” does the same today.

But companies that have been around for a while don’t have to lose their appeal. Take Apple, Microsoft, or even Amazon. These are decades-old monopolies in their respective fields.

Yet, if your company is no longer shiny, nor one of these market-dominant dinosaurs, you’re just a maturing business with limited upside.

Just ask Dropbox Inc. (NASDAQ: DBX).

Despite trading on the stock market for just over two years, the company is ancient and unloved.

Now, there are arguments on both sides why Dropbox is not the hottest stock anymore… and for where it goes from here. But I want to look at what makes it uniquely one of the most attractive buyout targets in the market.

First, let’s look at where it stands today.

Dropbox’s Disappointment as an Investment

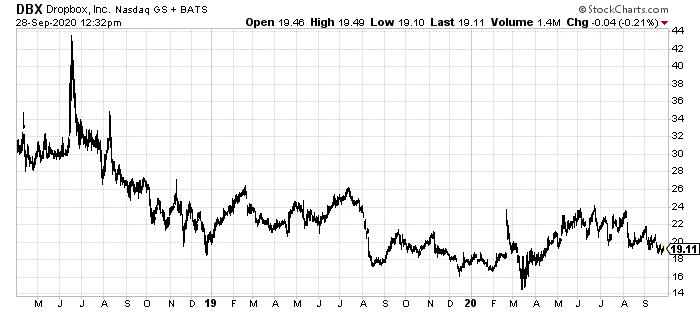

It only peeks at its two-and-a-half-year trading history to see how much of a disappointment Dropbox has been for its investors:

It is up year-to-date, but barely much at all compared to other companies in the cloud business. And the reason for this is primarily because there are other companies in the cloud business.

When “the cloud” idea first popped up in the mainstream, Dropbox was one of the first to capitalize on the idea. Originally using Amazon’s AWS, Dropbox was one of the first to allow regular individuals like you or I to store files on a cloud.

Novel and attractive for the company’s first decade of life, this has become commonplace and accessible almost everywhere you look.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

From Google Drive to Microsoft OneDrive, we have increasing options for this type of feature. In fact, Steve Jobs famously called Dropbox’s cloud storage idea a “feature, not a product.” Meaning, anyone could do it, and it doesn’t amount to a business model at all.

Still, Dropbox hasn’t gone anywhere. A look at its numbers show it is still successfully growing and finally producing profits.

During each of its last several years, its number of users, total revenue, and gross margins have grown rapidly. Still, there is something to be said about increased competition. But this is the part I believe is often missed about Dropbox’s story.

Once a story about consumers protecting their files, Dropbox is now a story about how small and medium-sized businesses can grow.

For most individuals, Dropbox’s free services are more than enough. For small businesses, its cheap paid memberships do the job just fine. And that’s the whole point.

Its competitors’ business or enterprise offerings often require large bundles of other services. For small businesses, you might not want to spend a fortune on a massive business bundle from Microsoft or Google.

Dropbox, much like Zoom Video Communications Inc. (NASDAQ: ZM), has the advantage here… for at least a very specific type of customer. These companies specialize in one aspect of enterprise needs.

Zoom can handle meetings in the modern world. It has huge competitors of its own. Microsoft’s own Skype once dominated that field. But since Zoom is pinpoint in how it is used and functions, it has been the darling of 2020.

Dropbox is kind of like that too. It has a very narrow economic moat, for sure. It has major competitors hundreds of times its size. But it doesn’t need to package its cloud data offerings with Office or jacked up data limits.

It can attract small businesses needing just a place to share files and projects.

To be fair, it has broken out into the “smart workspace” or workflow arena. But that remains a smaller portion of its overall appeal.

Yet, despite all of this, the company’s stock remains held down. It has growth, it has a clear niche in its industry, and it has an incredibly strong balance sheet and cash flow. But it still trades at just 4.4 times its sales, when the rest of the industry often goes for 30 or more times sales.

This means that it is trading at a ridiculous discount to its peers. But that doesn’t necessarily mean its share price will grow. Instead, that makes it an ideal buyout candidate.

If you look at a company like Microsoft, you’ll see that it has more than enough money and willingness to go out and make deals. Its history includes more than 225 acquisitions. Just this month, it announced it was buying video game maker ZeniMax for $7.5 billion.

Locking down Dropbox’s 15 million paid subscribers, which bring in an average of $126 per user, is a no brainer. Especially since Dropbox as a stock is dirt cheap.

Oh, and Dropbox’s famed CFO Ajay Vashee is stepping down next month, leaving room for a new CFO and new deals.

For regular investors like us, that makes this the perfect time to beat Microsoft and others to the punch.

Dropbox might not be the sexiest tech play right now. But it offers a goldmine of potential with or without a deal.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder