Back in early April, small businesses were allowed to apply for Paycheck Protection Program loans.

These loans are backed by the Small Business Administration.

They are designed to be completely forgiven as long as those small businesses continued paying their employees.

Here’s the rub. Their forgiveness deadline kicks off next week.

Now, the lenders making these loans are protected against losses. The SBA and the funds from the CARES Act ultimately back these loans.

However, the processing and administration of these loans fall to the lenders. And that’s the real problem.

You see, these loans don’t make the lender much money at all, even when repaid. For megabanks like Bank of America and Citigroup, the size of these loans won’t make much of a difference. They like the program because it makes it easier for their customers to repay other loans where they do make money.

For the most part, banks used PPP loans to shore up their own customers.

Others, however, might have severely miscalculated.

63% Decline Only the Start

Under the rules of the CARES Act, the bill that put the PPP into place, non-bank lenders could accept applications for these loans. Few did. But one went all in.

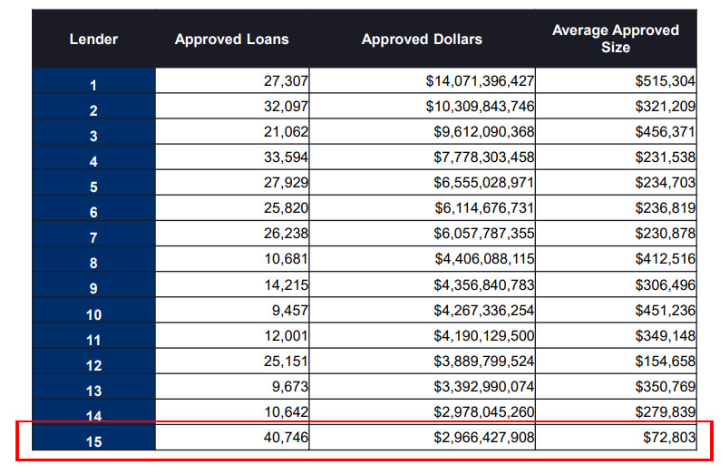

Ready Capital Corp. (NYSE:RC) told investors during its recent earnings call on May 11, that it approved 40,000 PPP applications worth $3 billion. And that was only for round one of PPP loans. It had another $2.1 billion ready to go for later loans.

To put that in perspective, its pre-COVID loan book was only $4.2 billion. This also marks RC as the non-bank lender with the largest stake in the PPP.

As noted, this on its surface doesn’t sound all that bad. These PPP loans might not pay much to the lenders. But they are fully backed by the federal government.

That’s true. However, RC doesn’t have the bandwidth to process that many loans without taking overhead losses.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Worse, with its team already scattered and working from home, costs could rise significantly. Imagine trying to hire several hundreds of qualified employees to handle this work in such a short amount of time. And then pay them from the minuscule interest from the loans themselves.

Valley National Bancorp, another PPP lender with a smaller loan portfolio, announced it had to allocate 500 out of its 3,200 employees just to this admin issue. RC will have to do more, with fewer than 500 full-time employees.

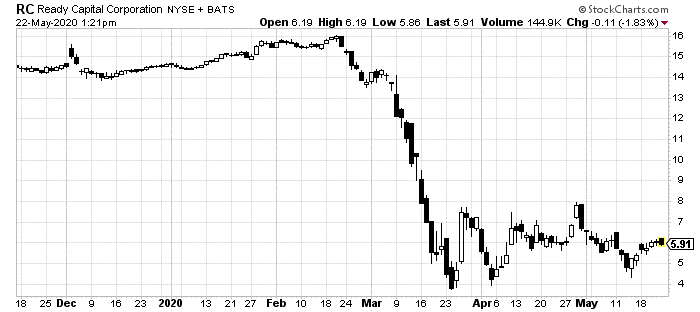

RC investors are already unhappy with the company. Because of its weak performance in Q1, shares have fallen 63% already during this crisis:

Just wait until they see a sudden spike in costs next week through the summer from processing all of these loans.

Again, it doesn’t necessarily matter if these loans are forgiven or not in terms of profits on the loans. But it might make a significant difference in terms of costs to process them.

Small Business Crunch

You see, a fully forgiven loan is going to be the easy part. But one that doesn’t quite qualify or might questionably be rejected will take manhours and RC representatives’ time.

For RC, this is a bigger problem not already factored into its share price. You see, along with being the largest non-bank PPP lender, it has also focused more on the smallest of businesses.

CEO Tom Capasse said this during the May 11 call:

"Ready Capital was in a neat position not only of having more PPP loan applications to fund than any other financial institution in round 1 but also the smallest average balance with 50% under $25,000 and over 20% comprising sole proprietors."

While that might have seemed "neat" at the time, that could be a real problem. Clearly, companies requiring less than $25,000 are in a more vulnerable spot. Cutting one employee’s pay just because it couldn’t pay on time could make a company ineligible for PPP forgiveness.

That will ultimately cost companies like RC time and wasted energy. That’s on top of the rest of its business struggling already. During the first quarter, before a single PPP loan went out, the company reported an EPS decline of 97%.

In short, Ready Capital went all-in on PPP loans. Now it has to pay the piper.

The current dividend is 26%, but that is definitely in jeopardy after shares down -62% from March levels.