By the time this year is up, 2020 will be known for a number of things. Not many of them good.

However, for certain investors, it might be fondly recalled in years to come.

Without a doubt, 2020 is the year of the unicorn. It is also the year of the SPAC.

A unicorn, as defined by its coiner Aileen Lee of CowboyVC, is a privately-held startup company with at least a $1 billion price tag.

2020 is the biggest year for unicorns since the tech boom in the 90s.

And one of the reasons why so many unicorn stocks have come to market is through special-purpose acquisition companies (SPACs).

I’ve even written about them before. As recently as earlier this month, the idea popped up.

A SPAC is simply a company without a business. It is basically a shell company that goes public without a product.

The money they raise in their IPO is then used to purchase one of these unicorns, which in turn takes the SPAC’s place on the market.

This reverse merger strategy allows for faster and easier public offerings for privately-held unicorns than a traditional IPO.

And this process has been a huge part of 2020.

The SPAC-Unicorn Story For 2020 So Far

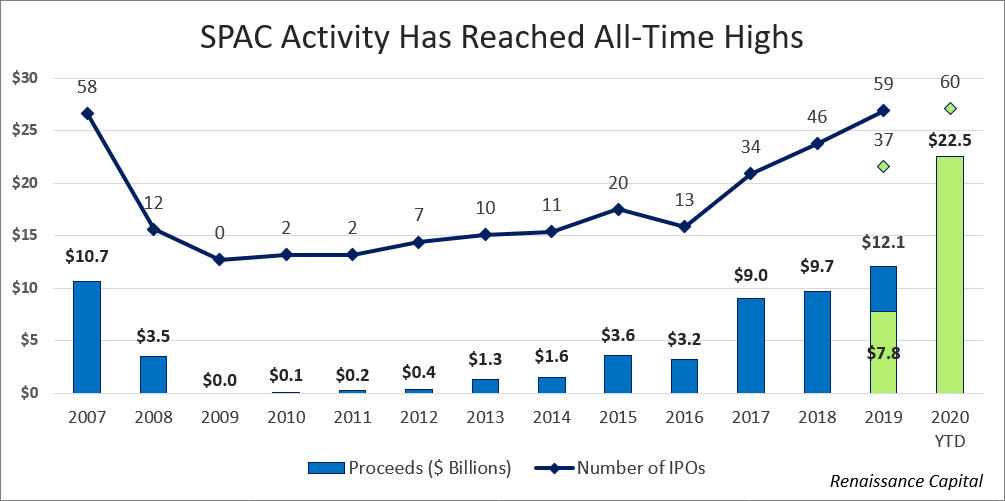

By the start of this month, more than 55 SPACs have gone public and raised money totaling more than $22.5 billion. That compares to just $3.2 billion raised for SPACs in 2016.

Yet, SPACs have been around for a while. Back in the 80s, they were a completely different animal, used mostly in penny stock scams.

In the 90s, they briefly came back to facilitate some of that tech boom hype.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Today, they are finally legitimized as a proper strategy to go public.

Legendary investor Bill Ackman even got into the game earlier this year with his own $4 billion SPAC Pershing Square Tontine Holdings, the largest in history.

But what all of these multi-billion funds do with their money is the more intriguing part of this story.

They are going nuts for unicorns.

Kicked off by last year’s Virgin Galactic deal worth $1.5 billion, the number of deals between SPACs and private unicorns is still rising.

Here are a few notables; DraftKings Inc. (NASDAQ: DKNG), Nikola Corp. (NASDAQ: NKLA) and Allied Esports Entertainment Inc. (NASDAQ: AESE).

There’s a really interesting phenomenon when it comes to these SPAC-unicorn deals. They can be very profitable for everyday folks like you and me.

How to Profit from SPACs

The easiest way to describe the opportunity here is to look at Nikola’s deal with VectoIQ Acquisition.

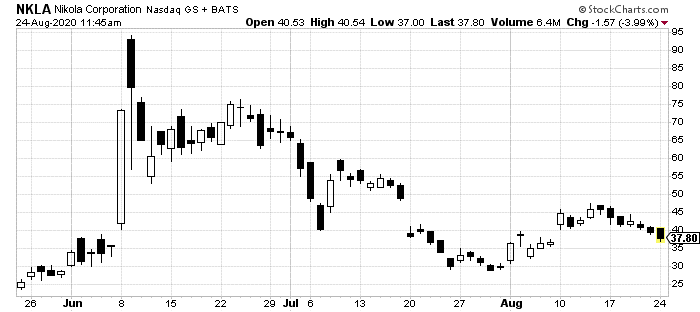

The deal came out to about a $3.3 billion price tag. This makes it one of the largest in SPAC history. But if you look at the company’s share price since officially changing over to ticker NKLA, it’s been a bit lackluster:

That first week in early June, it was exciting as the first trades came through. But here, nearly three months later, shares are actually way down from their early peak.

But here’s where the phenomenon comes in, and our opportunity.

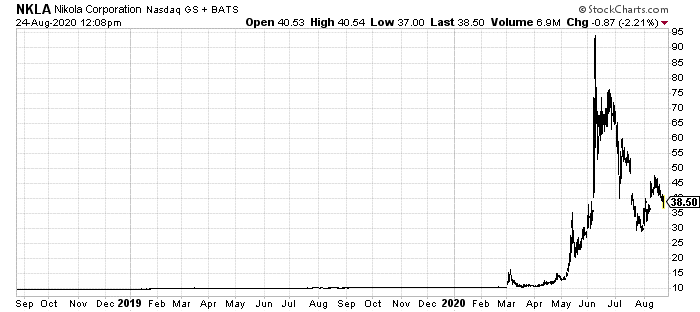

Take a look at the fuller trading picture of the SPAC that became Nikola:

VectoIQ went public back in 2018. Like most SPACs, it was under a time limit. It had to find a deal within a few years or liquidate.

Its deal with Nikola was obviously a big one. But for its own early investors, it was enormous.

Obviously, since SPACs aren’t really businesses, their shares don’t typically move before deals. That was the case here. Shares of VectoIQ traded at its $10 IPO price for two full years before it struck its deal.

So, you can see the real money is made holding the SPACs themselves as deals are announced, or just prior to them. NKLA shareholders who bought in after the deal was announced are down 50% or more. VectoIQ investors, however, are still up nearly 300%.

This phenomenon is only going to be more exploitable going forward. We are nowhere close to the end of this SPAC-unicorn trend.

In fact, while the third quarter is only halfway over, it is already the largest quarter in history in number and size of deals.

Peter Thiel-backed Luminar, an autonomous car tech company, just announced a $3.4 billion deal with a SPAC this week.

This isn’t the last time I’ll be writing about opportunities in SPACs. It is an emerging profit opportunity just getting started.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder