One of the biggest ecommerce deals in a decade is about to finalize.

And no one is paying attention.

Five weeks ago, a Chinese medical wearable device company announced a deal to buy the Newegg, a hardware technology ecommerce platform.

That alone makes this a strange deal. And it gets stranger.

But possibly the craziest part of this whole situation is that no one is talking about it.

Newegg rakes in around $3 billion per year in revenue, claims to have been profitable each year since its 2001 founding and is a beloved one-stop shop to many tech enthusiasts.

With the boom in ecommerce, especially on the tech side with millions stuck in their homes and building out their home offices, you’d think a deal of this magnitude would splash frontpages across the financial media.

It hasn’t. And, while there are a few reasons why that makes some sense, I believe it could be creating a massive emerging profit opportunity as soon as the deal closes.

Founding an online tech retailer in 2001 wasn’t exactly popular. If you’ll recall, the market for “dot-coms” back then was about as weak as it was ever going to get.

Newegg was very much a dot-com.

But it never went public. The company kept close control over its growth, allowing it to maintain slow and steady top- and bottom-line growth over its 19-year history.

It did flirt with going public, filing its intent with the SEC in 2009 to do just that. But after considering for two years, it backed out.

In 2016, Liaison Interactive, a Chinese tech company bought a majority stake in the California-based ecommerce business.

This infusion of capital allowed Newegg to finally branch off and start to really market itself with fast-growing trends like Esports and virtual reality (VR).

This pattern has held the last few years. Newegg has continued to grow, inch by inch. And its profits were going to its parent company Liaison, which is listed on the Shenzhen Stock Exchange.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

But then 2020 struck. And dot-coms are back on the table. Newegg and its Liaison owners are looking to get their cut. After all, they’ve done everything right for the two decades since this market was this hot.

Here’s where the story and deal get a little strange, which might just be a good thing for anyone paying close attention.

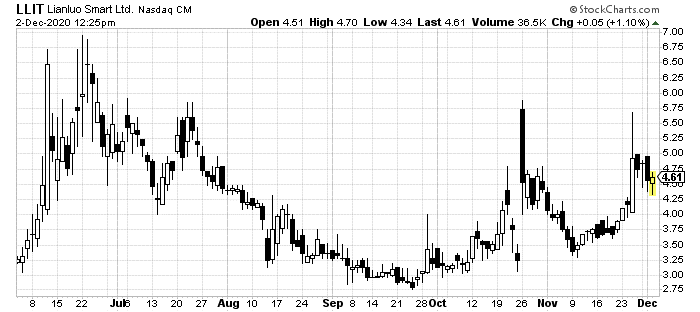

Both Liaison and Lianluo Smart Limited (NASDAQ: LLIT), the company merging with Newegg, are Chinese tech companies. And if you’ve checked out headlines this week, you’ll know that isn’t exactly a popular way to play the market right now.

Lawmakers in the U.S. aren’t agreeing on a whole lot these days. But both parties have recently pushed in a bipartisan effort to crack down on Chinese-owned businesses listed on U.S. stock exchanges.

In fact, bills in both Houses are moving forward as early as this week. The SEC is launching its own question period about auditing Chinese-owned, U.S.-listed stocks this month.

Both President Trump and Joe Biden seem to be onboard with making sure Chinese companies become more transparent to the very same U.S. investors they are soliciting for investment capital.

Now, that doesn’t mean every Chinese company will get delisted here. The legislation under consideration calls for a three-year window for these firms to accept more transparent auditing before they get delisted.

And I’m not saying either Liaison, which doesn’t actually trade in the U.S. or Lianluo, which does, would even be at risk here.

Of course, all of that might be moot. The terms of the deal between Lianluo and Newegg basically forces Lianluo to completely selloff (actually closer to give away) its medical device business, creating a shell company.

Newegg, if approved by shareholders, which is more than likely, will step in and become that company. It just gets a listing on the NASDAQ without all of the IPO or SPAC hassles.

Like I said, this story is strange.

But it’s precisely because there are so many knives in the air, there might be a real opportunity here.

Newegg, as part of the deal, will get another round of capital injected into its balance sheet. It has certainly taken advantage of the boom in technology ecommerce sales driving markets. And since its whole situation is so complex, no one is discussing it.

You could go out and just buy Lianluo today. But I’d wait.

Once the deal is approved, and the company officially becomes Newegg Commerce Inc. with its own ticker, it could rally.

The regulatory and legislative issues surrounding its Chinese owners won’t change its appeal in the short term. Investors are still clearly hungry for the next best thing in tech.

And while Newegg is neither new nor an egg anymore, it still has plenty of shine.

I’m going to follow this story through the shareholder votes and SEC approval process. And I’ll let you know when to strike.