You might not think that banks could ever have a worse time then in 2008 when the financial industry completely broke.

But they are about to.

The root of their problem then was the irresponsible bundling and reselling of risky mortgage-backed securities. Risks increased. And it became a game of hot potato until investors figured out those securities were worthless.

In essence, the threat came from inside.

Today, the threat comes from outside.

The sharp economic decline at the outbreak of the coronavirus earlier this year, combined with swift Fed action to cut interest rates to near zero once again, left banks with next to no business nor margins on the little they had.

That hasn’t changed, despite some economic activity returning.

Investors have noticed.

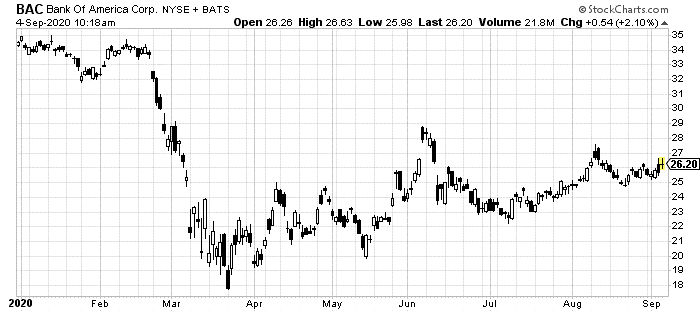

Despite the rest of the stock market testing all-time highs, banks like Bank of America Corp (NYSE: BAC) have remained far below pre-crisis levels.

But having a bad year in a tough economic situation isn’t the real problem.

This week, the very first financial tech company has successfully bought an FDIC-insured bank.

While the details and size of the deal haven’t been reported yet, a small fintech named Jiko got the go ahead to complete its purchase of Mid-Central National Bank.

Jiko is four years old. Mid Central is 63.

That’s the state of banking in 2020.

Jiko is basically a mobile app that allows users to open online bank accounts through Mid-Central with deposits going directly into Treasuries.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

This relatively niche app company is the new boss of a bank that’s served Minnesota for more than half a century.

This isn’t the only of its kind.

LendingClub announced a deal to buy Radius Bank earlier this year. But that one doesn’t close until 2021.

Others are no doubt set to pop up. Until now, the only viable option for fintechs to take control or gain access to the banking industry was through partnerships.

Chime, another mobile app company offering bank accounts, decided to partner with Bancorp Bank, now Stride Bank.

Current did the same with Choice Bank.

This shift from legacy banking to fintech shouldn’t really be that surprising. The road from 2008 to 2020 lead us on a crash course for this move.

2008’s MBS catastrophe proved that there’s no longer any connection between your local neighborhood bank and your money.

If you have had a mortgage over the last dozen years, you have likely seen it change ownership several times. Banks continue to buy and sell mortgages.

The money you deposit, through our fractional banking system, is used to trade on Wall Street.

And especially now, when many banks still don’t keep pre-crisis hours, nearly everyone banks online primarily. In-bank visits are rare for most these days.

So, what is the point of having a brick-and-mortar bank?

Instead, banking through mobile apps, including unique ones like Jiko, just makes more sense.

This is similar to how PayPal and Square have become household names. Cutting checks, mailing them, then waiting for the recipient to make a run to the bank to deposit them is an outdated concept.

Now, so far, Jiko is the first. LendingClub, an entirely different animal, is likely the second. And they’ve only struck deals to buy small regional banks.

But it’s not hard to see where this goes from here.

Fintechs are lions. Banks are zebras. And the lions are only going to get hungrier.

If you’re a long-term shareholder of major banks like BoA and JP Morgan Chase, you might want to pay attention. You’re at risk of accidentally becoming a start-up tech investor.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder