The economic shutdown exposed a major vulnerability in the U.S.

Unlike almost every other aspect of the public employee sector, education from K-12 up to state universities, are free for all.

The federal government does set certain standards for testing and attendance. But for the most part, it’s up to each state and district to monitor curriculum and teaching standards.

With today’s world of social distancing and stay-at-home orders, the chaos of such a system has been laid bare.

Each state has taken its own path on how to do this. It varies from district to district how online learning is being adopted.

What most agree on is that a hybrid system needs to be quickly agreed to by the fall. One part of online learning, one part in-person learning and a double shot of unorthodox trial and error.

Teachers are not enthused about what this means. It will completely turn the education system on its head.

It already has for many.

Through trial and error, schools are deciding between Zoom, Google Video and other platforms.

They are pushing for more laptops in and out of the classroom.

And districts, already largely underfunded in many places in the U.S., is asking even more out of teachers.

As one teacher in Sacramento noted, it is now more likely that teachers will have to go from classroom to classroom to teach. Not the students. They will stay put in groups of 10 or so, spaced apart in one room all day.

They will also have to take shifts coming to school. He argues that the total an average student might spend in a classroom during the school week will be roughly two days. The rest will be online from home.

Of course, there’s no standard. As noted, it’s the districts and states that are forced to come up with guidelines on what the fall will look like.

And that presents a unique opportunity.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

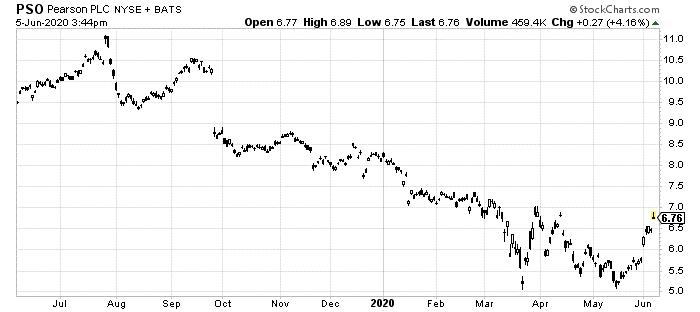

Beaten Down Education Company’s Final Chance

Pearson Plc (NYSE:PSO), (LSE:PSON) is one of the largest education companies in the world. It has also evolved more in the last decade than most companies do in a century.

At one point not too long ago, it owned the Economist and Penguin Random House Publishing. But its main group has always been – at least for a few decades – education.

Parents of schoolchildren probably already know the name. It is one of the world’s largest textbook and coursework publishers.

It does big business in college textbooks as well. Those outrageously expensive college texts are frequently published through Pearson.

That’s also the company’s problem.

As alternative sources for texts became more popular just as prices started skyrocketing at three times the inflation rate, the secondary market has swiftly taken over.

Amazon is a huge problem for Pearson, as you can get just about any textbook for a college class on there for a fraction of the price.

That business makes up 28% of Pearson’s revenue. So, you can see the problem.

However, because of what’s happening right now and the debate around a return to schooling in the fall, Pearson has a huge opportunity.

What Comes Next

You see, the business isn’t just an old-fashioned print company. It is already a hybrid play between traditional and digital learning platforms.

It has developed coursework programs for every level of education. And it has spent the vast majority of its money on digital platforms. Now, it is transitioning to bring all of those under the same umbrella.

As it spun-off and sold its other subsidiaries, it has used that money to take a leadership position in online learning.

And because it didn’t need to raise debt to do this, it has kept a solid balance sheet with EBITDA covering its total debt position.

Investors have been hesitant to endorse Pearson. But it’s strong position to sell products to the rapidly evolving education world offers a real buying opportunity.

If there’s one company situated just right in education, it’s Pearson.

So if Pearson plays catchup getting back levels before the market selloff in March, that's a 20% gain from today's price.