It looks like most restaurants are going to make it after all.

Well, all except one.

Over the last few months of quarantine, a large investor fear was that restaurants were largely unprepared to deal with the shutdown.

It turns out that most have been able to sail through.

McDonald’s Corp. (NYSE:MCD), Chipotle Mexican Grill Inc. (NYSE:CMG) and even Starbucks (NASDAQ:SBUX) have all bounced back hard after their March lows. Chipotle has even reached all-time highs over the last few days.

And that might make sense. These are huge names that have been increasing their presence on GrubHub, DoorDash and the like even before COVID-19.

Even large sit-down restaurants like those in the Darden Restaurants Inc. (NYSE:DRI) portfolio have largely survived. Olive Garden does deliver and offer takeout, after all.

But not all such places have fared so well.

Dave & Buster’s Entertainment Inc. (NASDAQ:PLAY) has obviously run into a bigger problem. And it’s apparent even in its name.

Down to Its Last Penny

The company is primarily an entertainment group. Its arcade games and flashy lights are what attracts customers. No one really goes to Dave & Buster’s for the food.

So, in the early days of the coronavirus, the company made the decision to completely shut down, rather than trying to do some delivery to keep going.

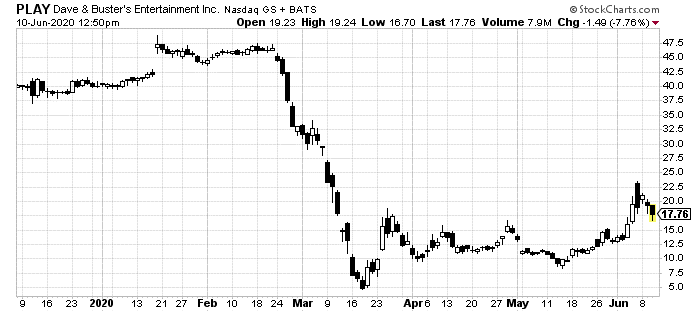

That hurt the company tremendously. Shares fell from a pre-crisis $48 to less than $10. At one point it even dropped below $5.

There were a few specific reasons investors fled. Not only was the company in the wrong industry at the wrong time. But it was also carrying a terrible balance sheet.

The company had very little in the way of cash on hand, about $25 million. But it had a ton of debt, about $633 million in long-term debt. That doesn’t even include its monstrous $1.2 billion in operating lease liabilities. Basically, rent it was certain to struggle with.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

However, as the case for many companies so obviously unprepared for the crisis, Dave & Buster’s survived… for now.

The company was able to strike a deal to sell a little over $100 million in new shares in May.

This was a short-term fix to provide liquidity until it was able to start opening up locations again.

With the overall market rally, the provided investors some relief.

Shares have quadrupled from their lows. They are still well below their pre-crisis highs. But the sentiment seems high.

Here’s the problem. Analysts don’t agree.

The average price target for Dave & Buster’s stock is just $14.65. Shares are trading at $17.68.

It could get worse still.

A Day to Dread

Tomorrow, the company reports its quarter that ended in April. That’s when investors and analysts alike finally get to see just how bad this crisis was for the entertainment company.

Remember, this is not a restaurant. This is a company that competes with the like of AMC and casinos. It is like to be hit just as hard as them.

Most analysts expect a loss for the quarter, as you might expect. But the downside is still large.

Expect a worse than expected quarter. The recent cash infusion certainly helps. But if the company misses on even a single estimate – revenue, earnings, comps, etc. – this stock is likely headed way back to where it came from.

Even with businesses opening back up, Dave & Buster’s appeal just isn’t what it used to be. Even prior to the crisis, the company was seeing its numbers slip. This quarter, while expected to be bad, is more likely to be terrible.

Here's The Opportunity

Only 21% of the shares available are short sales, which means hedge funds haven't gotten heavily short in this name yet.

The company is due to release earnings tomorrow after the market close.

Any pop higher should start to bing in the hedge funds with shorting stocks.

If shares trade back to the March low of $4.61 per share, that would be a 15% drop from current levels.

Watch out below and then cash in your tokens.