It can seem almost too easy to forget about the rest of the world as an American during these times.

We have a presidential election that’s putting a strain on our ability to focus, a Supreme Court nomination dominating headlines, and a still-raging pandemic on our hands.

But the rest of the world does go on. Or, maybe I should say, isn’t quite ready to go on either.

France just instituted a new lockdown/curfew to combat a recent rise in COVID cases. Spain is creeping back up as one of the worst locations of the outbreak once again.

India surpassed the U.S. in a number of new cases over a seven-day rolling average.

But there’s another place that is currently suffering arguably worse than all of the above: the Czech Republic.

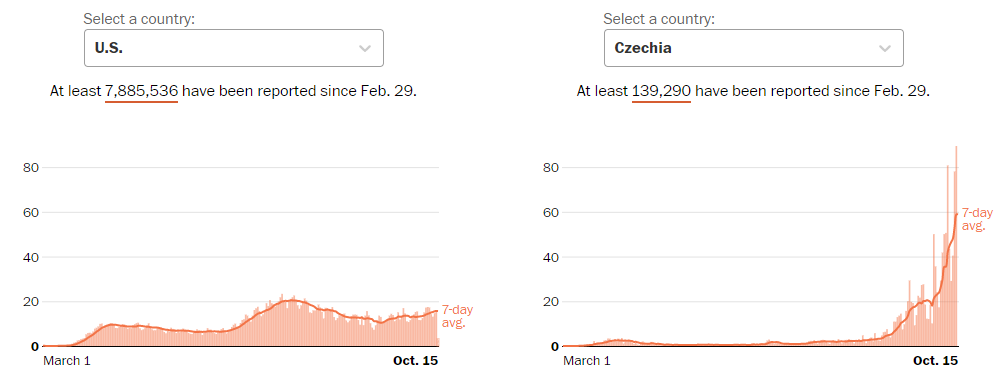

The beautiful eastern European country is being ravaged. Its grand totals might not sound like much. But on a per capita basis, the pandemic is completely out of hand.

Just yesterday, new Czech Republic cases per 100,000 people reached nearly 90. The U.S.’s new caseload was just 16 per 100k people.

On Monday, the country went into its second lockdown, banning sporting, social and religious events of more than 20 people.

Even then, they are only allowed outside. Universities are not allowed any in-person learning. And high schools are completely shut down.

So, with all of this information, the next thing I write might seem incredibly controversial and straight-up stupid. But I promise it makes sense.

That’s right. In the place where we might be seeing the worst outbreak of COVID-19 all year is also a market for smart real estate investors.

Now, let me back up and say outright that I wouldn’t go around picking up residential property in Prague or shopping centers in Brno.

However, there is one type of real estate that has done well elsewhere and absolutely crushed in Czechia: warehouses, and logistics.

As you can imagine, the lockdowns and the high number of those under quarantine has made eCommerce invaluable.

We saw the same thing here, in the U.S. But Europe is a different game entirely.

Take Amazon for instance. Here in the U.S., many of us take Prime for granted.

Sure, we pay a sizable chunk for the premium service. But we can count on two-day or even one- and same-day shipping.

Not every European can count on that. The Czech Republic is a perfect example.

Yes, they have Prime and two-day shipping. But that only works on products bought from the Czechia Amazon site (Amazon.cz), which has a far limited number of products.

Many in Prague, for instance, use Amazon Germany (Amazon.de) for their purchases, which don’t offer the same fast shipping.

In a year when just about everyone has been in dire need of necessities like toilet paper, further delays like this are devastating.

Fortunately, this year has also brought enough light to that subject that investors are waking up.

It leaked this morning that CTP BV, an industrial real estate company in eastern Europe is in talks to go public next year.

This is a huge opportunity.

CTP is the fifth largest logistics real estate company in all of Europe, with its largest assets in the Czech Republic.

The early reports are that it might go for listing in Amsterdam. But it will likely trade over the counter here in the States no matter where it finds a home.

The company does have a sizeable debt load. But the early valuation of around $7 billion means it should raise plenty during an IPO to take care of that problem.

It seems strange, but the Czech Republic might be the most fertile real estate in the world right now. And a play is coming along that should make it easy to get in on it.

I’ll keep you posted as this news moves from leak to official. And when you can act on it.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder