It’s no secret by now that cannabis has fallen out of favor with investors.

With so much turmoil and confusion in the market, pot stocks aren’t as appealing as they were a couple of years ago.

Since the start of the year, the market as a whole fell sharply about 30% and has since recovered completely.

Pot stocks, however, fell around 45% and remain more than 20% below Jan. 1 prices.

But not all pot stocks are the same, as we’ve noted previously here and here.

And some pot stocks aren’t really even pot stocks at all… more like pot-adjacent.

McDonald’s of Cannabis

When you go and pick up a Big Mac and fries at McDonald’s, you aren’t really buying them from the McDonald’s. You are buying your burger from a franchisee.

McDonald’s, as in the publicly-traded corporation worth $137 billion just owns the brands and real estate. It leases them to the franchisee. At least that’s the case for about 90% of its US operations and 80% of its global ones.

Why can’t pot be the same way?

Well, that was the question the founders of Innovative Industrial Properties Inc. (NYSE: IIPR) asked themselves a few years ago.

IIPR, while not the most exciting of names for a market leader in a wild industry, does just that. It buys properties where cannabis companies operate. Mostly, its facilities include where cannabis is grown and processed. So, it has less risk of distribution and retail issues.

This strategy has worked well for the company. Profits are already well established each quarter and growing rapidly.

IIPR has also expanded at breakneck speed. It owned just 10 properties at the end of 2018. It owns at least 55 now, nine of which were bought in just the first quarter of this year.

Like McDonald’s, IIPR’s strategy with these properties is to lease them back to growers and hands-in-the-dirt pot companies. From there, just like at the golden arches, IIPR profits from the rents and passes that onto shareholders.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

How to Profit from Cannabis Land

Innovative Industrial Properties is a real estate investment trust or REIT. So, by its very structure, it must pass on profits to its shareholders each quarter. IIPR is doing that to their great benefit.

Last month, the company announced a 77% dividend hike over last year’s second-quarter payment. At $1.06 per share each quarter, that represents a forward dividend yield of 4.7%.

Just think about what this means. While most cannabis companies have been struggling to turn any kind of profit, IIPR is raking in cash and paying out dividends larger than most mature companies.

Now, it hasn’t been easy or cheap. The company’s performance masks the cost shareholders have had to pay to get to this point.

You see, to buy up huge acreage around the country, it takes a lot of money.

So, IIPR has diluted its shares to pull this off. Just last month, the company sold more than 3 million shares for $259 million in a secondary offering.

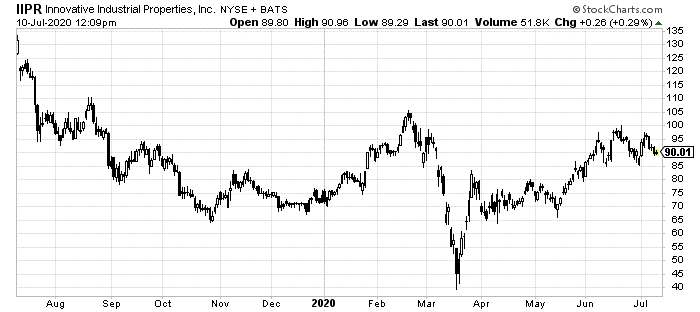

This was just one of many share dilutions in its brief history. As you can see, shares haven’t performed like you might expect with such a performance over the last year.

But this latest cash injection could be the turning point.

It was definitely one of the largest in IIPR history. The company’s $259 million windfall from selling shares brings its total cash position to $367 million.

That’s more than half what it already owns in real estate. Meaning that despite its huge success already in profiting from its pot landlord business, it stands to grow its portfolio by up to 50% yet again.

And, as you might expect, cannabis property is currently a buyer’s market. With so much cash on hand just when prices are at a low point, it should do even better with this round of acquisitions.

Furthermore, with profits on these properties coming almost the minute the ink is dry, the company will once again show at least solid double-digit growth next year.

Doubling in price from here as the search for yield and interest in pot stocks return isn’t so farfetched.

IIPR might be the single most boring company in the cannabis industry. It doesn’t grow, cultivate, process, transport, or sell a single ounce of the stuff.

And its name isn’t all that catchy either.

But for the biggest bang for your buck, IIPR is my pick for pot profits right now.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder