I still remember as a kid asking my dad how much he earned in a year.

That did not go over well and it was the first of many lessons I learned regarding what personal information (data) is ok to share with what personal information should be kept private.

Obviously, the memory has stuck with me. And I bring it up today because it directs me to our discussion and opportunity for June.

It all revolves around your data, and in the many ways, folks are trying to access it, corrupt it or, monetize it. The company I will reveal today will show us how we can protect personal data and most importantly make some cash off this growing industry.

Privacy is an Age-Old Issue

Data privacy has been around for ages in one form or another. As long as folks have been locking documents in desk drawers, trunks, and safety deposit boxes, data privacy was an industry.

Today the need for data privacy is greater than ever. Not only are there more pieces of data on us than ever before, but this data is also now digital, and a lot less protected than most realize.

And as more and more of our data gets digitized, and we share more and more information online, protecting this data will become a wildly important industry.

But as daunting as it sounds, it’s not all bad news. There are plenty of good reasons to allow instant access to our data.

Big Data is Changing the Face of Healthcare

Easy access to shared data is having a remarkably positive impact in healthcare. The ability to communicate health data is really the only way to maximize the potential of our healthcare systems.

Quick and easy access to a patient’s health information and related data is not as uncommon as we think.

The American Hospital Association notes in a detailed report:

We carry detailed personal records and information with us everywhere, embedded in smart chips in our cars, credit cards, and mobile phones… As national hospital associations, we are united in our conviction that it is time to finish the job and grant all patients the peace of mind that comes from knowing that their health care decisions are based on the best and most complete information possible.

However the report notes, there are significant needs to increase the security of this data as well:

While we have made much progress, at present, we have the incomplete outline of a national data-sharing system in place, one that lacks the agreed-upon rules of the road, conformance, technical standards, and standardized implementations to ensure that all HIE platforms can communicate correctly with each other. The movement toward true, national interoperability has been underway for some time.

More simply, If you happen to be on vacation abroad or even out of state and fall ill, you’ll be thankful the doctors taking care of you will be able to quickly access your medical records in order to safely administer treatment according to your specific health needs.

To develop these systems it takes huge amounts of capital investment, however.

In fact, Markets and Markets reports the global healthcare analytics market was estimated to be valued at $14.0 billion in 2019. Furthermore, this market is projected to grow at a rate of 28.3% annually reaching a value of $50.5 billion by 2024.

And that’s just the beginning of how valuable the data industry is becoming.

Big Data Is BIG BUSINESS (And Worth Billions)

Big data refers to the kind of data sets that are too large for traditional data processing applications.

According to the European Union's General Data Protection Regulation (GDPR), big data is defined as having one or some of the following characteristics: high volume, high velocity or high variety. This means things like the information garnered from mobile data traffic, cloud computing traffic, as well as technologies like artificial intelligence (AI) and the Internet of Things (IoT) all contribute to the increasing volume and complexity of big data.

More simply, your age, name, phone number, address, social security, GPS location, date of birth and a few other million pieces of information are circulating in cyberspace every day, 24 hours a day, and are all part of what we call big data.

And this data is very valuable.

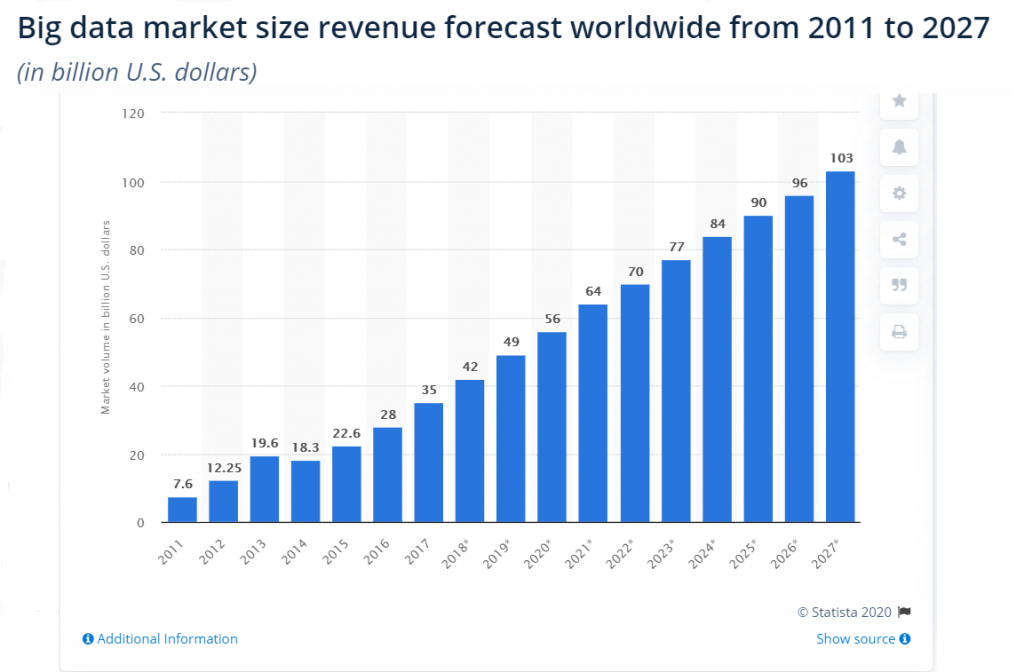

According to Statista, the global big data market is expected to grow to $103 billion dollars by 2027, more than double its expected market size in 2018. With a share of 45%, the software segment would essentially become the “big data” sector segment by 2027.

Most folks don’t realize how valuable their personal information is. But many big corporations do. As do, hackers, social media companies, and the government just to name a few.

And these entities are all vying to access your data constantly.

This reality underscores the importance of data privacy, and we can assure you that this goes well beyond the obvious vulnerabilities that come to mind.

And as companies create data solutions we have a lot of opportunities ahead of us now and for many years to come.

Start-Up Watch: DuckDuckGo

When you’re browsing a company’s website or using an online service that the company is storing hundreds, if not thousands of data points. This even includes your location at any given time and your private browsing data.

In fact, a single company like Facebook could have personal information on millions of customers And there is no guarantee that this data is being kept as safe and protected as possible.

Thankfully, not all companies want to sell your personal information to the highest bidder.

DuckDuckGo is a new search engine now widely available for download that sets a new standard of trust and transparency when browsing online. Its app and browser extension stop you from being tracked, so you can browse online with peace of mind. Additionally, the company has a tracker free search engine so Google and Microsoft won’t know everything about you in an instant.

And if all this is too overwhelming the company offers tips and tutorials to help you protect your data.

Currently, the company has seen over 1.8 billion unique web searches via its browser and has received nearly $2 million in privacy donations to facilitate its operations.

Now, this company is a private startup, but if one day it decides to IPO, or you have the means to participate in any series funding, this is one company that really piques our interest.

Now onto a privacy play that minimizes your investment risk and helps keeps data pirates at bay.

Cloudfare: A Great Way to Earn Easy Profits

For organizations, protecting privacy and personal data is an issue of trust. When this trust is lost, it can have a devastating impact on an organization. Some wrongly think that privacy gets in the way of an organization’s innovation, but protecting privacy solidifies its relationships with people and its image.

Firms that fail to protect their customer’s data face reputational harm, regulatory penalties, and other damages. As such many companies are now making data privacy an essential business operation.

This is creating a lot of growth opportunities for many of the top cyber software and data management companies.

The HACK ETF for example, is a data privacy and cybersecurity ETF that continues to find buyers in wake of the COVID downdraw and other headwinds. The ETF sits just off all-time highs as we write, and counter to what you’re thinking this stock still has a lot more room to grow. In fact, over the past 4 years, the ETF has averaged an annual gain of 15.6%.

Looking at the chart we can see HACK has shaken off its March weakness and is again breaking out towards new all-time highs in June.

As an investment HACK is a great way to capture profits and minimize your downside risk. But its upside potential is limited so we’re focusing on one of the ETF’s top holdings Cloudfare (NASDAQ: NET).

Founded in 2009 and headquartered in San Francisco, CloudFlare, Inc. owns and operates a cloud platform and offers a wide range of services to businesses across the globe. Its integrated cloud-based security solution can protect a number of platforms, including public and private clouds, on-site protection, software-as-a-service (SAAS) applications, and Internet of Things (IoT) devices.

Most recently the company surprised investors with better than expected earnings. Positives included:

Moreover, the stock has performed as strong as one could expect a stock to perform, marking new highs annually.

That is why today we’re adding Cloudfare to our holdings.

Action to Take: Buy Cloudfare, Inc. (NASDAQ: NET) at market.

Now onto our main recommendation…

Mikecast Keeps Your Data Safe and Offers Outsized Gain Potential

Every developer, platform owner, and web user needs to be aware of the alarming number of website and email attacks they face.

The statistics will blow you away. There is an attack administered on the web every 39 seconds.

A report by WebARX paints an even more telling picture.

The report notes in 2019 it’s estimated that hackers stole 75 data sets of personal or corporate information every second. Even worse these hackers openly admit most current cybersecurity software is ineffective.

In 2017, the U.S. cyber budget was $13.15 billion. In 2019 the Feds budgeted $14.98 billion to combat cyber threats, a 14% spending increase. The amount of money now being invested to combat these threats is staggering.

One of the biggest areas of focus is personal and corporate email protection.

Email and email related apps are especially vulnerable and this leads us to our opportunity today.

And that’s where today’s recommendation is making its mark.

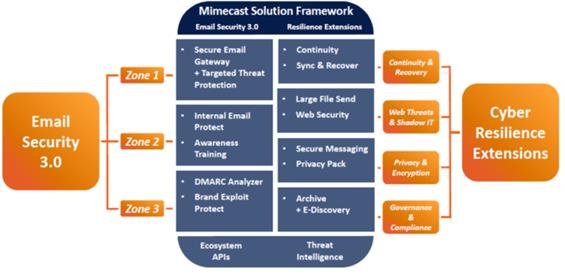

Mimecast Limited is an email and data security company that provides cloud security and risk management services for corporate information and email systems. The company’s flagship product is its Mimecast Email Security services which offer clients a range of enterprise-level security protections. Its suite of services includes a URL Protect which addresses the threats from emails containing malicious links, Attachment Protect which reduces threats from malware-laden attachments, Impersonation Protect which offers protection from social engineering attacks, and Internal Email Protect, which allows customers to monitor, detect and remediate security threats that originate from within their internal email systems.

Additionally, Mimecast offers Secure Messaging for sharing sensitive information with external contacts through email, Large File Send which allows employees to create security and compliance risks when they use third-party file-sharing services, and Data Leak Prevention, which prevents the inadvertent or malicious loss of sensitive corporate data.

The company’s second flagship product is its Mimecast Business Continuity, which protects email and data against which adds an extra layer of protection when initial protocols fail due to total system failure, natural disasters, planned maintenance, upgrades, or migrations tasks.

The company’s third cyber solution is Mimecast Enterprise Information Archiving which provides customers with cloud archive services with encryption for all internal and external communications.

Mimecast also offers bundled services and Mimecast Mobile and Desktop Apps for personal use. Additionally, the company has developed a proprietary operating system, Mime OS for native cloud services and comprises 20+ microservices that control the hardware, storage, indexing, processing, services, administrator, and user interface layers in a native cloud environment.

Source: Mimecast

Mimcast currently operates eight grids in fourteen locations around the world to deliver its services. This gives customers geographic and jurisdictional control over their data location, which enables them to more quickly address privacy concerns and breaches.

Each grid is exclusive to a region and comprises two identical data centers that function in active-active mode is different. This allows Mimecast to switch operations from one data center to another to maintain customers’ email and data services in the event of downtime or maintenance or other total system events.

The company sells its services through direct sales and channel partners. As of March 31, 2020, it has operations in the United Kingdom, the United States, South Africa, Australia, Germany, and Israel.

The company is strong financially, reporting over $426 million in revenue for the year ended March 31, 2020. Additionally, the company reported an adjusted EBITDA of $78 million and over $173 million in cash for the same time period.

One red flag is the company’s extremely high P/E ratio (over twice the sector average), however, given the macro trends at play, we think the market is more or less pricing in its long term growth, albeit pretty prematurely.

That issue aside, the stock is offering a nice entry point sitting nearly 25% off its 2020 high and could easily offer significant gain potential as it continues to scale into new markets.

Action to take: Buy Mimecast Limited (NASDAQ: MIME) at market.

Portfolio Review

RF Industries (NASDAQ: RFIL) - RFIL is tracking sideways looking to recover from recent losses.

Invitae Corp. (NYSE: NVTA) - Invitae found its support and is breaking out; now up over 51% since our 2019 entry date.

Twilio Inc. (NYSE: TWLO) - Has bounced back and is now trading near recent highs, up 120% since 2019’s entry date.

Pinterest, Inc. (NYSE: PINS) - Pinterest is weathering the coronavirus correction but has continued to regain losses and now sits just below our entry price. Keep holding.

Alteryx, Inc. (NYSE: AYX) - AYX has recovered recent losses and is breaking out, now up almost 140% from our 2019 entry date.

Fastly, Inc. (NYSE: FSLY) - Fastly has recovered recent losses and is breaking out, now up almost 120% from our November 2019 entry date.

Veeva Systems Inc. (NYSE: VEEV) - Veeva is on a tear now up over 133% since entry in January.

MongoDB Inc (NASDAQ: MDB) - MongoDB has rocketed almost 170% since our entry date in 2019.

Okta Inc. (NASDAQ: MDB) - MongoDB has rocketed over 190% since our entry date in 2019.

GOGO Inc. (NASDAQ: GOGO) - GOGO has felt the full impact of recent COVID related shutdowns.

Loral Space & Communications (NASDAQ: LORL) - Loral continues to bounce in a range, currently sitting just off our original entry price.

Advanced Micro Devices (NASDAQ: AMD) - Small gains could soon turn into much bigger ones as AMD continues to show strength.

Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) - Ericsson is up over 8% since our entry date in May 2020.