Stocks started the week out strong and allowed you to lock in another double-digit gain!

But there’s nothing like a good Trump tweet to shake stocks up.

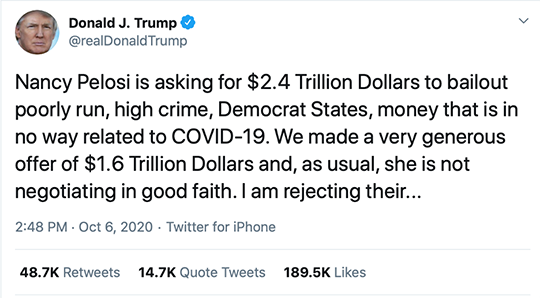

This tweet instantly sent stocks plunging right before yesterday’s close.

We’re seeing a snapback rally in today’s session as Mnuchin and Pelosi resumed discussions for stimulus.

This news, while unexpected, is not a complete surprise. Election headlines are going to dominate over the next several weeks.

And our Hot Money trading system is the perfect way to withstand kneejerk headline reactions.

Now, the fear gauge for the S&P 500, known as the CBOE Market Volatility Index (VIX) is holding at 28. That means volatility is 2x the normal and markets will see quick moves higher and lower.

Let’s talk about our newest position this week.

On Monday:

Right now, we’re holding:

Let’s keep focused and let the market come to us.

And I’ll be keeping you updated every step of the way.

The mailbag is full, so let’s get to your most pressing questions.

“Hi, Joshua,

Why do you recommend selling all our position at once instead of selling half? -Daniel D.

The short answer is winning and making money is fun!

The older traders on the floor used to say, “you can't go broke taking a profit.”

There's no better feeling than earning the right to take profits on your winning trades.

To create consistency in the financial market, you must have a consistent process.

Back when I was a professional, that is how we managed our positions.

There's nothing more frustrating than locking in your gains only to see the prices of those contracts go higher the next day.

But, if the prices drop the next day, you feel like a genius.

These types of targets seem to be a common practice with other services.

Every investors’ risk tolerance is different, and you must decide what’s best for you.

Often times, the options contracts we trade in the Hot Money trading system are short-dated.

That means we are looking for a big move and then to cash out.

If you're worried about missing out on more potential profits, you can sell half of your position.

That way, you can take profits and reduce risk.

But they could drop in value before hitting your next target.

Once the profit target hits, no matter what happens, you’ll make gains on at least half of the trade as we did with our MLCO calls.

I found success in keeping things simple and why we don't do anything too fancy.

Simple, but smart money management.

That’s it for me today, be on the lookout for our next profit alert!

If you want your questions answered next week, make sure you email it in today at [email protected]

Sincerely,

Joshua M. Belanger