There’s a deeper, possibly even more sinister problem coming than COVID, a double-dip recession or even climate change: water shortages.

You likely already know where this is going. The topic comes up every few months, when there’s a new wildfire or lull in the news cycle. But clean water around the world has been on the decline for decades.

The WWF estimates that “by 2025, two-thirds of the world’s population may face water shortages.”

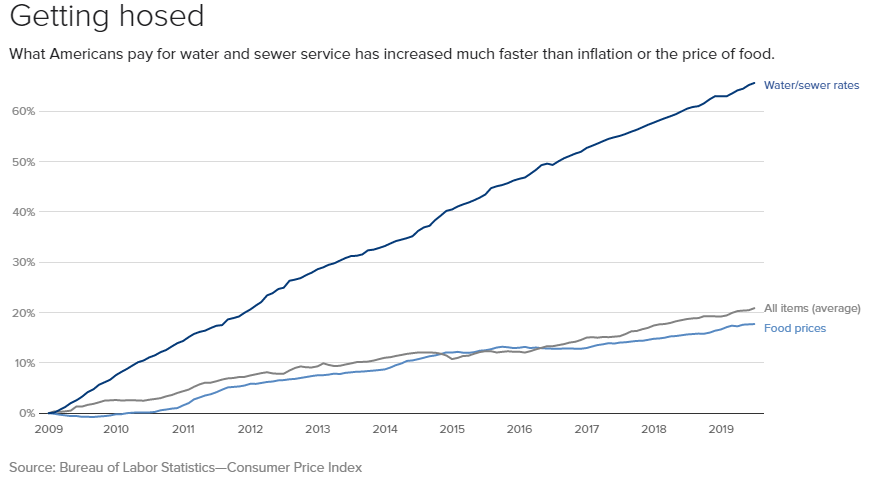

You can already see its direct impact here in the states. Water and wastewater utility prices have been among the fastest-growing spots of inflation over the last ten years.

In the U.S., shortages in the West have already taken a toll when it comes to available drinking water, water for industrial use and even wildfires.

Obviously, this affects large populations in areas like California, Arizona and Nevada. But it has knock on effects all the way to the East Coast.

Farms in California and Arizona, for instance, produce over 98% of all leaf lettuce in the U.S. each year.

You might not think much about paying $2.50 for a head of iceberg lettuce these days. But what happens when it costs you $10 or more every single trip to the grocery store?

What happens when prices at the rest of the produce aisle starts resembling those in the electronics department?

This is no new subject. People, including investors, have been asking these questions for decades now. With the population explosion over the last century, it has been a conversation worth considering for generations.

But, until now, most ideas and efforts to deal with this have only made it as far as the prototype or small-scale trial stage.

Sometime in the next month, the first company will bring it to the main stage.

This Niche Subsector Set to Blow Up Your IPO Feed

Water isn’t the only problem we face in such a large and diverse country, when it comes to food in our refrigerators. As many of us experienced this year, we have a somewhat outdated supply chain for many products.

Not being able to find toilet paper in March is still a recent memory. But grocers across the U.S., and indeed world, have had problems sourcing everything from produce to nonperishables. With the current surge in COVID cases, they are bracing for a second round of shortages.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

One specific type of farming can solve both problems, at least in part. And one company is going to test public markets soon to see if investors have the appetite for such a radical change to one of the country’s oldest industries.

AppHarvest is a high-tech, indoor ag company. It owns three indoor facilities in Central Appalachia that already produce tomatoes, leafy greens and other fruits and vegetables for an area that is within a one-day drive to 75% of the U.S. population.

Indoor farming is nothing new. But this scale and efficiency hasn’t been tested until now.

On the water front, the company claims its process reduces water usage by 90% compared to traditional, open-field farming. Rather than competing for limited water in the West, it has its facilities in rain-heavy locations and can take advantage of recycled water.

On the supply chain front, simply having the ability to really set up shop closer to where the bulk of the population lives is already an advantage. But with more efficient yields, it can continue to provide produce previously only found in California and Arizona. In fact, AppHarvest’s Berea, Kentucky facility is designed to do just that.

It signed a deal to merge with a SPAC named Novus Capital Corp. (NASDAQ: NOVS) by the end of 2020 worth an estimated $475 million, giving the combined company an equity value of $1 billion.

Depending on how this goes, another, likely larger deal will be in the wings for Plenty Unlimited. Plenty is also currently private, but has the same model as AppHarvest.

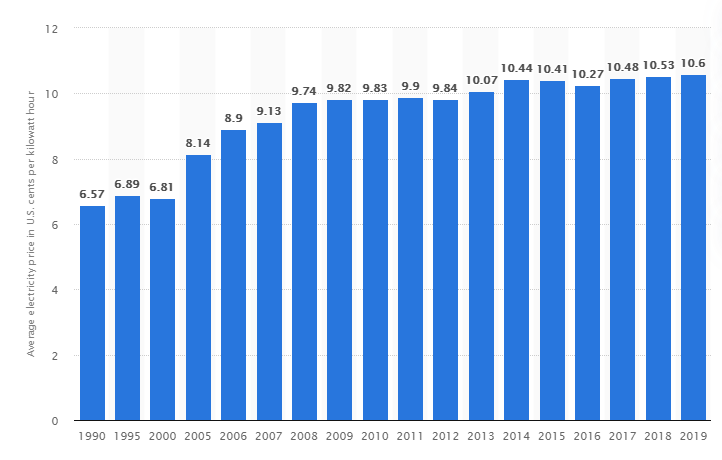

There is one downside to this story that investors might initially be wary of. It takes far more electricity to power these indoor facilities than traditional agriculture.

But compared to that water price chart up top, this flatter electricity price one makes this a no brainer.

Still, with the likely evolution in how we produce our electricity in the U.S. over the next decade, it could get choppier.

Nonetheless, there should be some strong investor interest behind this upcoming IPO, and the likely follow up from Plenty.

For longer-term investors, there might not be a better backdoor play on the water crisis. This is one emerging profit idea you can’t stand to ignore going forward. I certainly won’t.