Despite today's pullback, the tech continues to dominate the market.

The Dow Jones Industrial Average was created in 1896 as a way to track the performance of the largest industrial companies.

It originally consisted of 12 companies and included companies in cotton oil, sugar, tobacco, coal, leather….you get the picture.

That bigger picture of society at the time was the first industrial revolution had allowed these industries to expand through the use of steam-powered equipment. That brought these into the factory instead of small shops.

In 1913, Henry Ford installed the first moving assembly line. This is considered part of the second industrial revolution. Combined with the electricity, society would move into urbanization as factories took their place as the center of the economy. In 1928, the DJIA would switch to a basket of 30 stocks.

One of those 30 stocks was Standard Oil of New Jersey…who would eventually become ExxonMobil (NYSE: XOM). And up until last week, it was still in that benchmark.

It stayed there through all the innovations of the 50s and 60s. Through the switch from analog to digital. Through the widespread adaption of the internet and dot com bubble. But when markets opened on Monday it was gone…replaced by tech company Salesforce (NYSE: CRM).

And that wasn’t the only change…

Pharmaceutical giant Pfizer (NYSE: PFE) was given the boot for biotech company Amgen (NASDAQ: AMGN) and Honeywell Internation (NYSE: HON) bumped out defense contractor Raytheon (NYSE: RTN).

It’s not your grandpa’s DJIA anymore. Old stodgy companies are out and tech companies are in.

We are in the midst of the fourth industrial revolution and the Dow is adjusting accordingly. This revolution is about the combination of human and tech into cyber-physical systems.

Out with the old and in with the new.

One of the triggers for this switch up was the announcement that Dow holding Apple (NASDAQ: AAPL) would split 4 to 1 and investor-loved TSLA (NASDAQ: TSLA) would split 5 to 1.

Since the DJIA is weighted by price and not by market cap, Apple would now represent a piece of the portfolio…and that just couldn’t be the case.

The really interesting part of all this is how the market reacted on Monday.

When the market opened, TSLA and AAPL were both adjusted for their new split prices. And somehow that flashed a big “buy” sign to investors. It seems like everyone forgot how stock splits work. Yes, you’re paying a fraction of the price…but you’re getting a fraction of the former share.

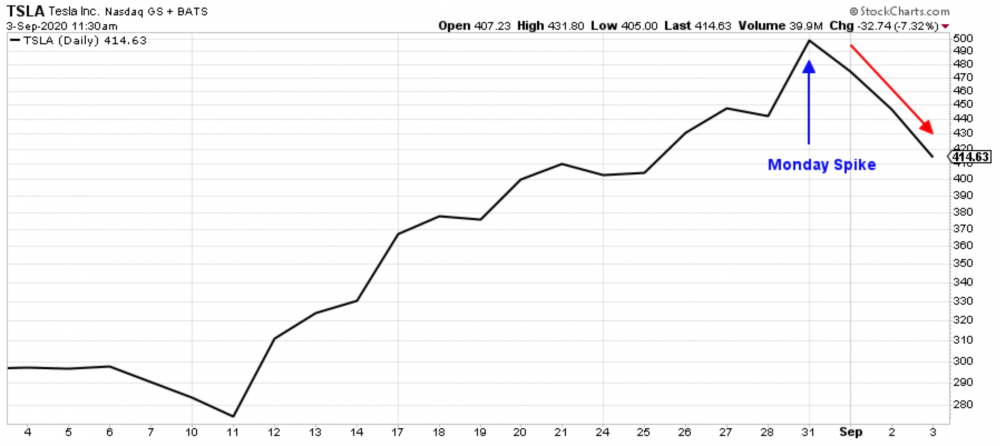

Shares of Tesla spiked 12% on Monday.

But then you can see the buyer’s remorse form as people realized they weren’t, in fact, getting the bargain basement price they thought they were.

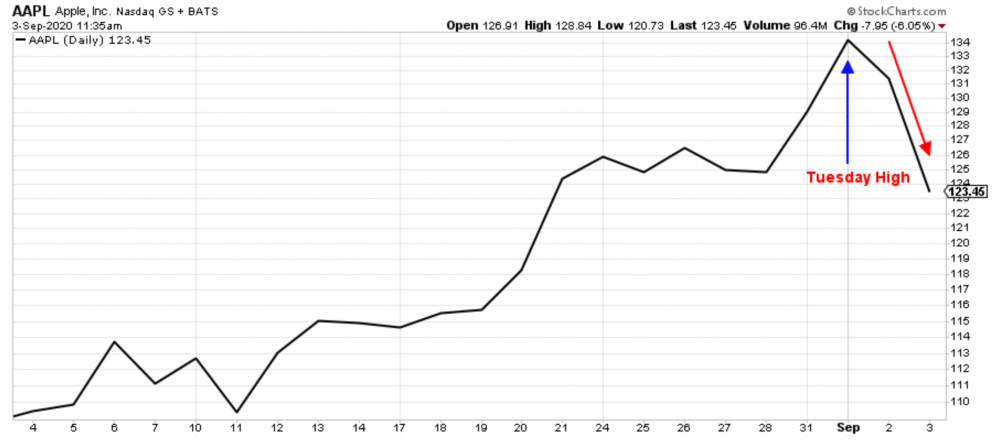

Apple saw similar movement, but gains extended into Tuesday as well, for a gain of 7% in just two days.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Both Tesla and Apple have impressive gains for the full-year, 434% and 78% respectively, but their high prices may have been out of reach to some. This lowering of the “price tag” became a “buying opportunity.”

If you’re going to put one of these in your portfolio, my bet is on Apple.

Will everyone be lining up to switch to a Tesla? I’m not so sure about that. Apple on the other hand will be a player to watch as 5G comes online. Apple users make up almost 50% of the smartphone market…and those customers tend to be brand loyal.

The real takeaway here is that investors are tech starved. They are looking for any excuse load up on big name companies.

Readers of my Wealthy Tech Investor newsletter know that it’s not always the big names that prove to be the most lucrative. We have seven companies in our open portfolio sitting at triple-digit gains. And unless you’re in the IT or biotech space you probably haven’t heard of any of them.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder