All good things come to an end. And Stitch Fix Inc. (NASDAQ: SFIX) investors have a front-row seat.

I’ve said this more than anything else this year: 2020 has changed a lot of things.

Beyond just the immediate consequences of COVID on markets, the pandemic has set new schedules, routines and habits for millions of people.

Working from home isn’t something that can be seen as completely isolated to 2020 anymore. Throughout this year, I’ve noted major indicators that prove this is the new norm for millions.

Things like consumer purchasing of higher-end office furniture, shortages of computers and printers among others indicate that people are settling into this new WFH life.

Another area I’ve frequently mentioned is the consumer spending change that came to retail. Ecommerce is king. Amazon has truly beaten even stubborn rivals like Walmart and Target. Though, those two have had their own success following Amazon’s lead.

Brick-and-mortar retail is dying. While not new in 2020, it certainly accelerated more than any other time.

So, naturally, a company like Stitch Fix, which brings the success we’ve seen in subscription-based companies to retail, had a stellar 2020.

The company’s customers sign up and provide style preferences and sizes. From there, the company sends out regular boxes of new clothes for the customer to pick through and purchase what they like.

In this new stay-at-home world, that’s an ideal growth opportunity. However, something else came with this particular stock you need to be aware of before you go all-in on the continuation of this trend.

Stitch Fix has been one of the highest shorted stocks in the market for more than a year. Since its fall from early investor interest back in 2018, shares have been very good for people betting against it.

That changed drastically in 2020.

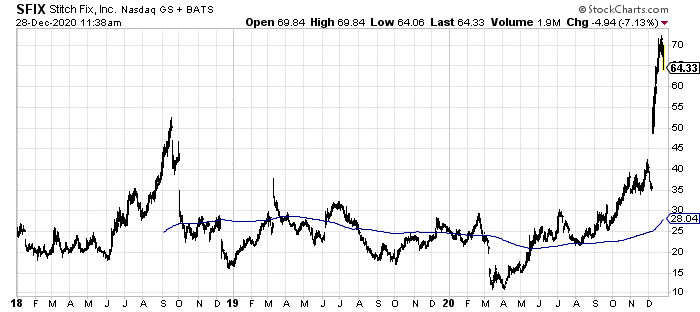

As you can see, after the initial COVID drop in the spring, shares have quintupled in price.

Interestingly, however, shorts didn’t cover much throughout this period. They were able to keep on their bearish bets right up until this month.

Short interest hit 39% earlier this month, meaning more than one in three were betting against it. If you aren’t a regular bear, that means that a huge number of people were borrowing shares against Stitch Fix’s performance.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

When something like an earnings announcement provides a bit too much good news, shares can spike as those short sellers are forced to unravel their positions.

That’s exactly what happened this month.

Stitch Fix announced solid 10% topline growth and even better guidance for next year. As more customers pile into subscriptions, particularly for athleisure wear in this work-from-home boom, shorts were forced to cover.

That’s the spike you see on the right side of the chart. It’s also why those shares are now, once again, reversing course so quickly.

Short squeezes like this follow a general pattern: very quick spike and complete reversal.

As those shorts are squeezed out, prices rise. Once enough have been wiped off the books, shares crash back to where they were before the squeeze.

You can see this in the famous 2008 squeeze in Volkswagen:

As you can see, SFIX has a long way left to fall right now. We just entered the post-squeeze freefall.

If shares can come back to where they were trading this summer, long-term bulls could have a real opportunity.

In a year marked by dramatic price movements in so many tech names, it can be easy to ignore another one such as this. But unlike those others, shorts were the real story here.

Once they are flushed over the next week, interest could build in this unique “new normal” play. Consider keeping a little powder dry for that potential opportunity.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder