Markets are buzzing and the capital markets are back.

Last week played host to 2020s most successful IPO.

Lemonade Inc. (NYSE: LMND) is a breakthrough technology-led insurance company.

It boasts its two- or three-minute signup process through its mobile app. And it wows investors with its artificial intelligence-led claims initiative.

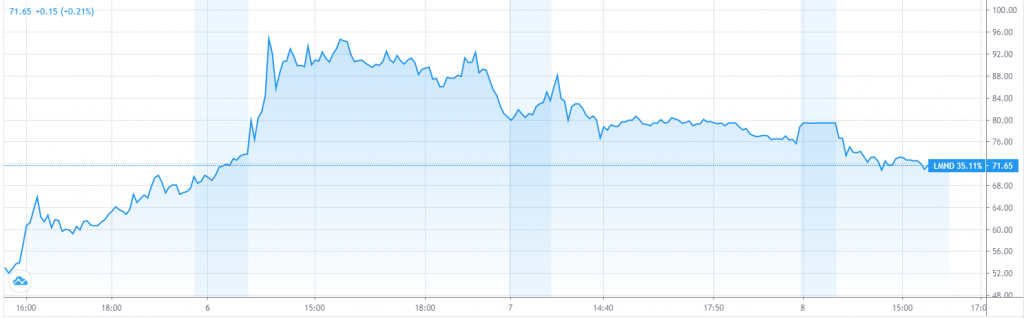

After it's IPO at $29 last Wednesday, shares jumped as high as $96 by the end of the week. Currently, they have eased and found a temporary home just above $70, as I write.

Source: Trading View

With so much hype and enthusiasm over this new issue, its more important than ever to step back and look at what it offers.

Excellent Business

Lemonade’s services include renter and homeowner insurance in about half of U.S. states, Germany, and The Netherlands. It is expanding rapidly to the rest of the States and Europe.

The company’s gimmick, which is quite attractive, is its ease of use and speed of service. I’ve signed up for renter’s insurance personally in less than five minutes. So, its boast is true on that front.

The thing that has really impressed investors in its first week of trading is its AI platform to settle claims without wasting time or money on adjusters and agents.

This is one of the industry’s largest costs. By having a $0 overhead on a majority of claims (it will have some adjusters on the payroll for a portion of them), it can compete on price with the giants in the industry.

Obviously, this is a win-win for the company and its customers. And it is also what makes it, to some, a pseudo technology play… almost a SaaS company.

The third enticing part of this story is its sales approach.

It is a direct-to-customer company. It doesn’t employ a sales force in the thousands to find new customers. Its app handles sales by itself.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Obviously, this isn’t a zero-cost benefit just yet. Rather than paying thousands of salesmen, it is spending that money on marketing and getting its relatively new name out there.

But you could see how after time, that cost could come down, whereas a sales team’s payroll wouldn’t.

In short, this is a great, exciting new company.

So, why even bother with retelling what traders have been gushing over for the last week?

Because the common stock is not the same as a business. At least not in this case.

Misplaced Identity

The primary problem with its stock so far is that no one sees it the same. This is a huge case of misplaced identity.

Traders viewing this as a SaaS tech play or an AI company are just plain wrong. It uses elements of both. But it is an insurance company.

The way it makes money is by selling property insurance. Sure, its innovative tech ideas help it compete with industry leaders right now. But it doesn’t own a monopoly on them.

It might have found a way to somehow make the insurance industry exciting, for a time. But it hasn’t left that industry.

It is an insurer.

It isn’t a broker or tech leader.

It is an insurance provider.

That’s a very low margin business. And while it can still expand margins as its name starts gaining wider-spread recognition without as much marketing, there is a cap to those margins.

While the company’s business model, technological innovation brought to a complacent, backward industry and serious early success in a highly-competitive market are impressive, they don’t quite justify LMND’s price tag.

Though, in the very short term, trader enthusiasm should continue to send shares higher yet.

As the post-IPO moratorium on underwriters’ initial analyst reports passes, it could receive another fresh round of buying. It is likely to open with across-the-board “buy” ratings.

So, a move up to $100 in the very short term, say within the next month, is likely. That could create a sizable short-term opportunity.

In the medium- to long-term, however, a post-IPO correction is just as likely.

Now, this is, as I noted, a great company. So, if shares fall back to where they started in the mid-$20s, that’d be a great second opportunity to buy.

For now, look for a short-term rally with a medium-term price realignment.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder