Big data means big money for companies.

We’re in a time when the more data that a company can collect and then analyze, the more chance the company must still be around in the future.

It is expected that the digital universe will reach 175 zettabytes by 2025. That’s 175 trillion gigabytes…and continuing to grow exponentially.

Companies are collecting everything that they can in an effort to discover something new about their network or about consumer habits. In order to store and process it all, companies turn to cloud computing.

Cloud computing comes in four different flavors. If the servers are owned by and dedicated to only one user, then that is a private cloud.

Public clouds are owned and operated by a service provider and resources are shared by multiple businesses. Since this allows for the sharing of resources, they tend to be lower cost and more attractive than exclusively using private clouds.

Most of the time, an organization has so much going on with its data, it’s going to need more than one cloud.

Hybrid cloud refers to the strategy of using public and private clouds in a single organization. The data and processes usually intersect clouds.

Multi-cloud is when an organization uses different clouds from different providers for separate tasks. This gives peace of mind of not being dependent on one provider. This is becoming the preferred IT foundation because it allows for more agility to quickly change direction when needed. Plus, it provides more protection against digital disruption.

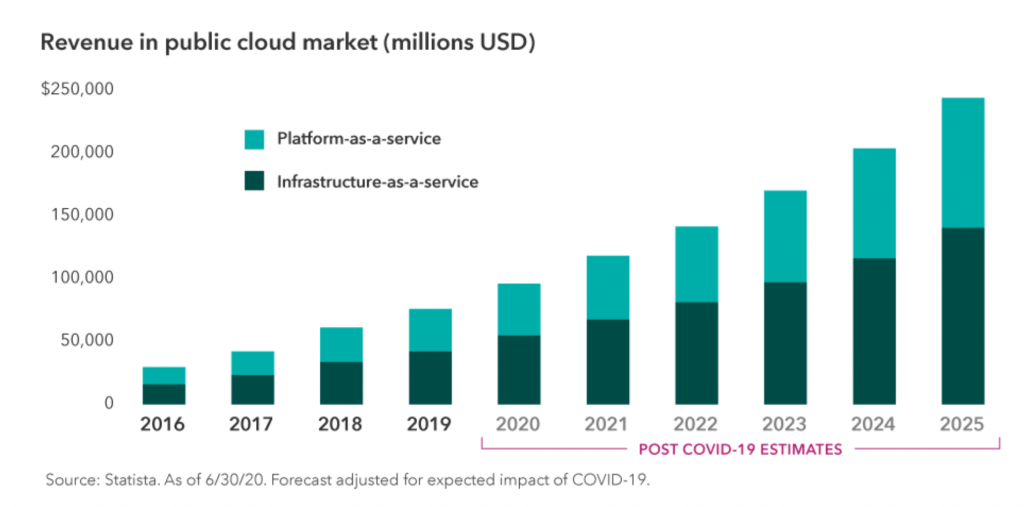

Three out of the four cloud strategies have at least some data on a public cloud. Which makes it obvious as to why revenues keep going up.

The Big Four of Public Cloud Computing

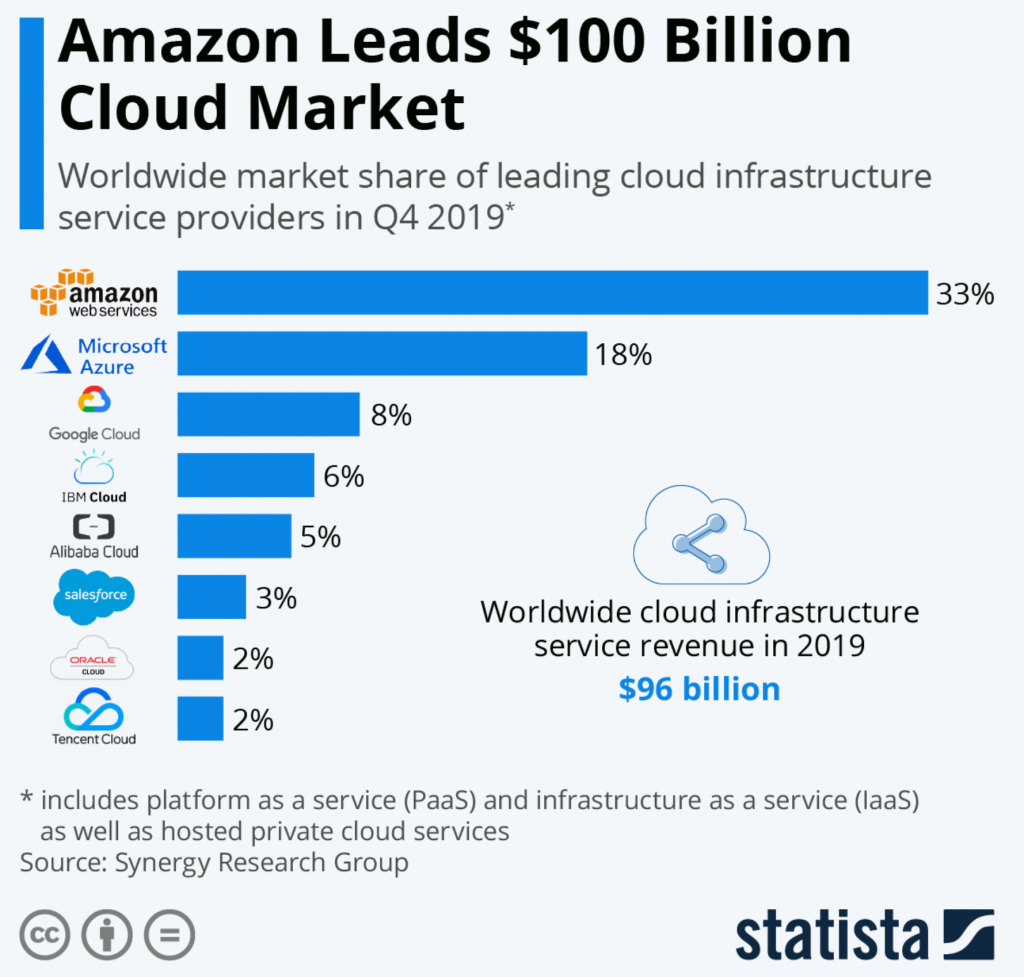

I’m talking about Microsoft’s Azure, Google Cloud, Amazon’s AWS and IBM cloud. These four account for 66% market share of the $100 billion cloud market.

Now that these four have established dominance, we expect to see them start to take over smaller competitors in the field. A prime example of this is Rackspace (NASDAQ: RXT).

Back in 2015, the company made it clear that it was no longer looking to compete directly with the cloud giants. So, it struck an alliance with Microsoft. Then three months later with AWS. And eventually added Google Cloud as well.

Instead, Rackspace is a cloud solutions company. It focuses on cloud optimization, cloud security, cloud-native enablement and data modernization. Essentially, it will guide organizations through the whole process of setting up and managing its clouds.

As I said above, multi-cloud setups are becoming the norm. Organizations have to have someone in house coordinating with all the public cloud companies in use…or Rackspace can do it for you.

Here’s the really interesting thing about Rackspace. Right after it established those partnerships, it was taken private by Apollo Global Management for a purchase price of $4.3 billion. Since then the management has taken the time to find strategic acquisitions and restructure the company.

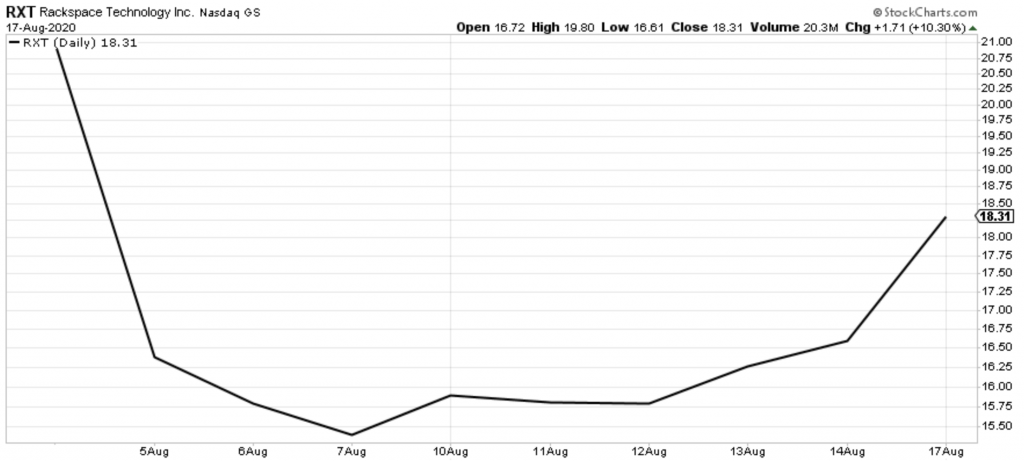

On August 5th, just 13 days ago, the company had an IPO to become public again. And the pricing came in around $4.2 billion…almost the same as what the company was worth 5 years ago.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

We are sitting on the precipice of 5G right now. And once implemented, cloud computing will start to change drastically as speed increases and latency essentially disappears. More automation and artificial intelligence will be attached to an organization's network, and clouds will become even more important. That will be the true catalyst for cloud solutions companies.

Amazon looks like it has come regrets of not taking a Rackspace acquisition seriously back in 2016.

Shares of Rackspace jumped yesterday on the news that Amazon was looking to acquire a minority stake in the company.

This deal will surely take a few months to hash out. But, deal or not, Rackspace looks to be well-positioned to succeed in the rapidly changing landscape of cloud computing.

With Amazon building a position, it's only a matter of time they make an offer.

That's why investors will see more upside buying shares today.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder