Pot’s pseudo-legal little sister is consolidating at a rapid rate.

CBD, which is made from hemp rather than higher THC strains of cannabis, has long fallen into a gray area.

It is officially a legal substance in the U.S. following December 2018’s Farm Bill. However, the FDA retained control over which products it can be used in.

So far, the FDA hasn’t made clear what it thinks. Last year, the agency held a hearing on the substance and invited scientists and market experts. Still, no real news has come from it.

The largest issue is whether CBD can be used in beverages and food. Though, many states still keep their own counsel over that.

But as a substance of its own, it has remained legal. And many products have been coming out despite the FDA’s lack of ruling.

But there’s something you really need to know about the CBD industry. It doesn’t work like the marijuana industry at all.

Niche Market Leads to Clear Leader

In 2017 and 2018, everyone was crazed about the cannabis market. Leading up to Canada’s legalization, very few expected anything but years of straight growth for early players.

That led to a very flooded marketplace. Huge money has been thrown around by the likes of Constellation Brands, maker of Corona beer, started piling into the top players.

What resulted from all of that money and build-up was a fractured market. Canopy Growth Corp. (NYSE: CGC) and Aurora Cannabis Inc. (NYSE: ACB) became the largest two in terms of market capitalization. But neither held more than 22% of the Canadian market share post-legalization. In fact, besides these two, no company holds more than 10%.

In the U.S., Canopy and others have already been planning what they will do if and when pot gains federal legality. But without that, the U.S. industry is even more fractious.

Some companies dominate certain states. But for the most part, smaller companies are still competing with one another.

CBD, considered less exciting and a far smaller market, has been left relatively alone.

And now, with COVID-19 forcing stay-at-home orders and penny pinching, even fewer have been paying attention. That doesn’t mean this industry has been quiet.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Undisputed Leader Only Gains More Market Share

Charlotte’s Web Holdings Inc. (OTC: CWBHF) was one of the earliest CBD-only companies to pop up over the last decade. Even before the Farm Bill sort-of legalized CBD, Charlotte had already amassed brand recognition and marketing plans.

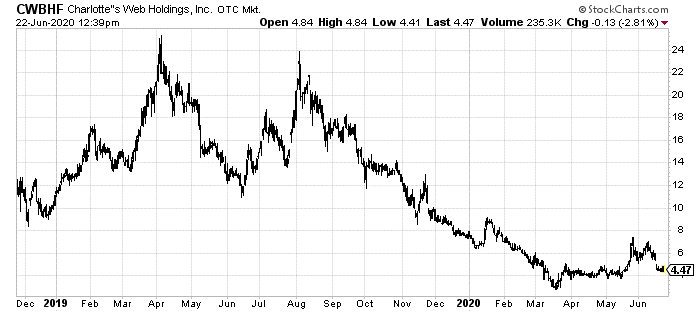

By the end of 2018, it had already been able to control about one-quarter of that new industry’s market share. That’s when everything started to go wrong.

You see, despite the huge growth potential for CBD, the FDA’s slow-moving inaction sent investor enthusiasm into a tailspin.

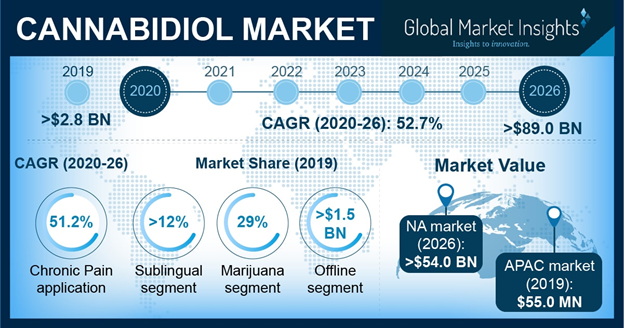

CBD does have a bright future, though:

That hasn’t stopped investors from dropping Charlotte’s Web anyways:

With the company’s stock trading at well below its 2018 peaks of near $24, this little Colorado company fell off everyone’s radar.

But it wasn’t taking this beating lying down.

Over the last few months, as the economy and new normal way of life was changing across the country, Charlotte’s Web got busy.

In March, at the height of market fears, Charlotte’s Web announced it was going to purchase Abacus Health Products.

That deal just closed this month.

Now, while no one was looking, this single deal brought Charlotte’s Web’s market share in the CBD industry up to 35%. That’s more than one out of every three dollars in this enormous market going to one company.

That alone should be worth a look. It doesn’t matter what the FDA decides to do about CBD in beverages and food. CBD is already a legal product sold in all kinds of other forms: oils, patches, topicals (which is why Charlotte picked up Abacus in the first place) and more.

With or without a CBD sports drink, this industry is going to grow. It might not ever be as large as marijuana. But it doesn’t need to be to make a solid profit.

But, that isn’t the only splash Charlotte’s Web is making.

Charlotte’s Web Ready to Attack

The company also just closed on a public offering, which raised C$77.6 million. CEO Deanie Elsner has plans for that.

Rather than be satisfied with 35% of the CBD market, she wants more.

In a recent interview, Elsner told Benzinga:

“We will continue to follow a deliberate growth strategy, while continuing to hold and grow our position in high-growth hemp-derived CBD categories. We will do this by continuing to evaluate strategic partnerships or acquisitions that fill gaps in product portfolio, market segments or geographical expansion. Acquiring Abacus is a clear example of our growth model in action.”

Charlotte’s Web is the clear market leader, despite investors abruptly abandoning it.

It controls an industry expected to grow from just $2.8 billion last year to as much as $89 billion in the next six years. That’s despite having a market cap of just $570 million itself.

And it just loaded up its arsenal to buy out the rest of that market before it gets too big.

This is a clear buying opportunity. With or without the FDA, investors won’t be able to ignore Charlotte’s Web forever.

To your prosperity,

Joshua M. Belanger

Founder & Publisher