There’s a new player in the cryptocurrency world. And it is a game changer… for now.

PayPal Holdings Inc. (NASDAQ: PYPL) announce last month that it was jumping into the crypto market for the first time.

It launched digital currency trading allowing users to instantly buy Bitcoin, Ethereum, Bitcoin Cash and Litecoin right from their PayPal accounts.

Now, if you’re an old pro at crypto, you may shake your head at this news. After all, one of the reasons some buy virtual currencies is because of its decentralized nature.

By going through PayPal, and Square Inc. (NYSE: SQ) which has had a similar setup for longer, you’re giving up that control. The currencies themselves are held in third-party wallets.

But for millions of others, this is likely their first foray into the crypto market.

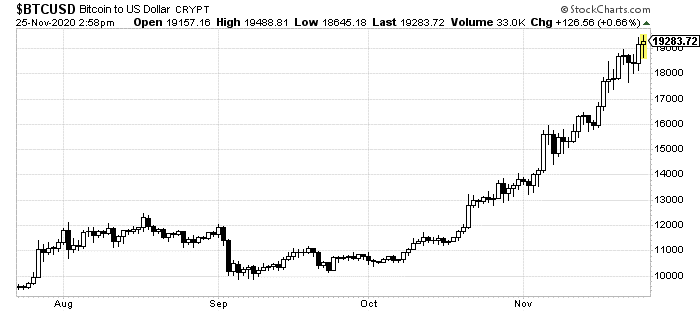

And, you can already see it having an effect:

Obviously, that rapid $9,000 rally over the last few months wasn’t only because PayPal started offering easy access to Bitcoin. But it certainly didn’t hurt the surging digital currency.

What’s odd about this is how this move differs from cryptocurrencies’ counterpart market: stocks.

For decades, brokerage companies like TD Ameritrade and Charles Schwab ran the stock trading industry. Almost every individual playing the stock market had to go through them to buy stocks. And that came with fees.

Robinhood and other newcomers completely broke that industry. I’ve written about its fall and transformation here before.

But the point is that great disruption came to stock trading making it cheaper to gain access to the market.

PayPal, however, is disrupting in another way. Rather than offering free crypto trades, it charges transaction fees.

Now, this isn’t unusual in the digital currency marketplace. Crypto exchanges, which have been the dominators since the industry started booming, charge fees as well.

But PayPal’s crypto “platform” is built around convenience. With millions of jobs and incomes disrupted this year, the company itself saw its number of users surge.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Now, all that money and all of those new accounts have basically two-click access to the crypto market for the first time.

I tested it out and it takes less than a minute to buy Ethereum, and likely the other three options, through PayPal.

Interestingly enough, Robinhood beat PayPal to the punch here too. It has offered one of the only places to trade cryptos transaction-fee free for some time now.

But there’s a difference. PayPal doesn’t necessarily need to entice millions to its platform. It already has those users.

And because cryptocurrencies have been on fire this year, there’s more interest than ever to get into the market. But the prospect of setting up an account on a crypto exchange or on Robinhood just to get a taste of this market is daunting for many.

PayPal, which already has millions of users with linked bank accounts and cash already in the system, offers instant access. No setup required.

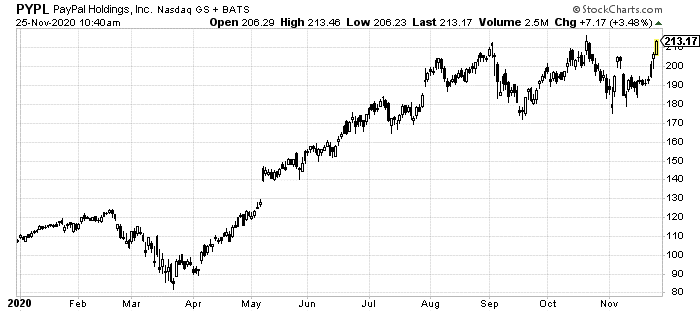

Now, I’m not arguing for or against trading cryptos themselves right now. No doubt, there are a hundred different emerging profit plays there if you know where to look. But this particular emerging profit idea is PayPal itself.

Until speculators lose interest in the surging crypto market, the timing couldn’t be better for PayPal. And I’ll throw Square in here too, although those users only have access to Bitcoin.

I know. These companies have already surged themselves this year, as the number of online transactions has skyrocketed.

But until tides shift, these companies are going to make a ton through their transaction fees… just like TD, Schwab and E*TRADE used to.

In the end, Robinhood’s model will likely win out. But for a slim period of time, say between now and their next earnings announcement in late January, there’s serious money to be made.

You have a window here to get in on the crypto craze without risking the enormous ups and downs that usually comes with it.

PayPal just struck gold. You can take advantage if you act now.