If you are having flashbacks to 2000 right now, you aren’t alone.

But just because the presidential race is going to go down as one of the most contentious and contested in history doesn’t mean all contests will.

Specifically, as early as Tuesday night, this election had already produced one unanimous winner: cannabis.

A number of states, including unlikely ones such as Montana and South Dakota legalized recreational cannabis.

Mississippi voted for medical marijuana, bringing the total number of states without at least decriminalization of cannabis to just seven.

But that demarcation between recreationally legal, medically legal, and decimalization is important for the cannabis industry.

And one state, in a crucial area, just made an enormous splash on Tuesday.

With more votes than it gave to either Trump or Biden, New Jersey passed Ballot Measure 1: legal cannabis for adults 21 and over.

It joins a dozen or so other states to have done so. But its geographic location is even more important.

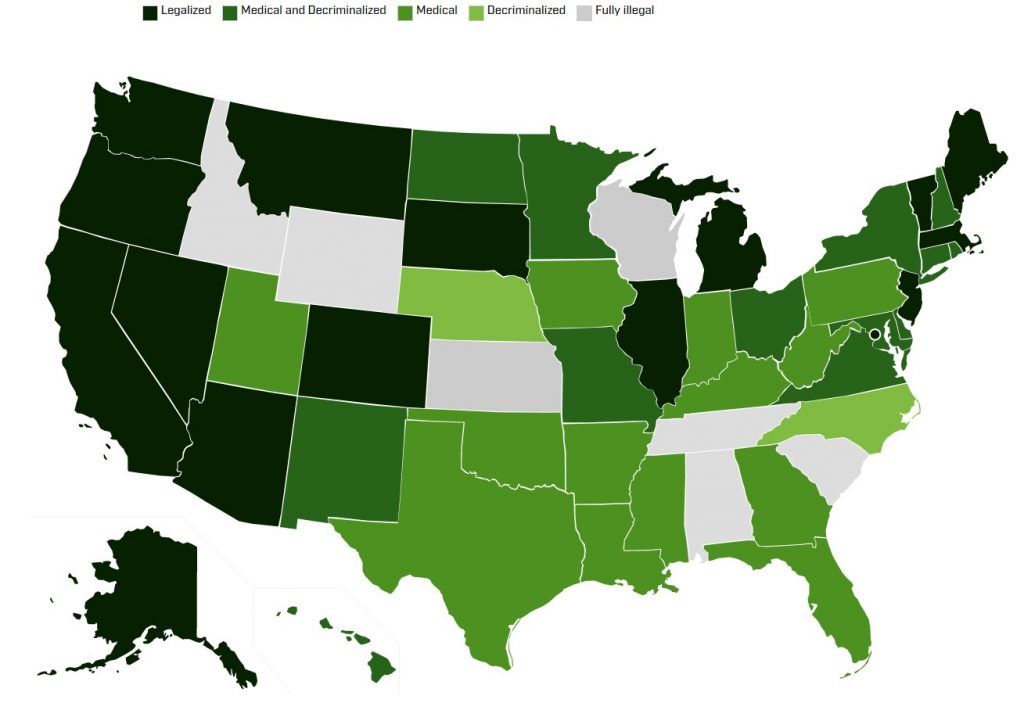

Just take a look at this map:

The states in dark green are the ones, counting those from this election, that have legalized recreational weed.

While you can go anywhere in the West to pick up an ounce for personal consumption, you really can’t along the Atlantic.

In fact, besides Washington D.C., you’d have to go as far north as New England to find recreational marijuana.

That’s important. And for one company, it is going to be a huge moneymaker.

The two largest tri-state areas in the United States — New York metropolitan and Delaware Valley/Philadelphia metropolitan — including New Jersey.

Some 30.8 million people live within short driving distance to a state with 8.9 million residents.

That’s crucial. New Jersey is now the only place those tens of millions of people can buy legal recreational marijuana.

And as I noted above, the delineation between recreational and medical is important.

In New Jersey, which has had medical marijuana for many years now, only 90,000 have cards allowing them to buy it.

With this expansion to include all adults, the number of customers is expected to jump to 1 million.

Now, throw in the tri-state residents, and you have a huge market for pot.

Of course, as we’ve seen in other places, simply voting on it and adopting it are different things.

What Ballot Measure 1 does is force the state’s legislature to craft the “whos,” “wheres,” and “hows” of legalization.

That could take a few months.

But that also presents an opportunity.

As every case study in Canada during its legalization period two years ago noted, the problem wasn’t necessarily the individual laws on distribution and sales of marijuana.

It ran into serious supply issues.

New Jersey, as in other states that have moved from medical to recreational pot, is going to soon face that exact problem.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

After all, just imagine the supply problems for any product when the customer base grows from 90,000 to 1 million or more overnight.

Fortunately, there’s an investment angle that has been just waiting for this opportunity.

Back in July, I highlighted a very strange pot-adjacent stock that was only starting to get real attention.

I called Innovative Industrial Properties Inc. (NYSE: IIPR) the “McDonald’s of Cannabis.”

And despite its enormous success, no single ballot initiative has made this play as irresistible as this New Jersey one.

In case you missed out then, IIPR is a real estate company.

Instead of growing, processing, or selling marijuana, it simply owns the land for those that do.

Specifically, it owns 63 properties located across the country that controls the supply of cannabis.

Yesterday, the company reported its latest quarter of earnings.

Those properties, which simply collect rent from actual pot companies, raked in $34.3 million.

That’s up 197% from the same quarter last year.

That’s an incredible fact. But it was a different line in its earnings report that stood out to me.

During the third quarter, the company bought its first three New Jersey properties.

With the number of customers instantly going from less than 100,000 to likely several million for New Jersey and the surrounding tri-state areas, those properties instantly become prime real estate.

Remember, the largest issue states and even countries like Canada faced following legalization wasn’t crime or sales.

It was supply. IIPR IS the supplier of all of this now-legal weed. Or at least, it can charge whatever rent it wants to those who are the direct suppliers.

Investors have noticed.

I won’t lie, shares of IIPR have jumped significantly since I first wrote about it in July, especially since Tuesday and yesterday’s earnings announcement.

But there’s still an unbelievable amount of room to grow.

If the company wanted to, which I doubt just yet, it could probably flip those New Jersey properties and make millions just on their price appreciation due to this new legalization.

Instead, the company has proven its incredible timing, ability to churning out unbelievable growth rates, and its market dominance.

And with millions of customers now demanding products only produced at its properties, there’s only green pastures in front of IIPR.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder