On Wednesday, we discussed what could be the biggest deal of the 21st century.

But that day also hosted an announcement for what could be the most important IPO in at least the next several decades.

MP Materials Corp. announced it is finally going to get its public listing on the NYSE by the end of this year.

MP is more than just a miner of unusual and hard-to-pronounce metals. It owns the single most important mine on the planet, at least geopolitically.

MP’s Mountain Pass mine in California is the largest rare earth producer in the Western Hemisphere. The importance of this fact cannot be overstated.

Rare earth metals often come with funny-sounding names: Lanthanum, Neodymium, Praseodymium, etc. But they are crucial to almost every 21st- century technology you can think of.

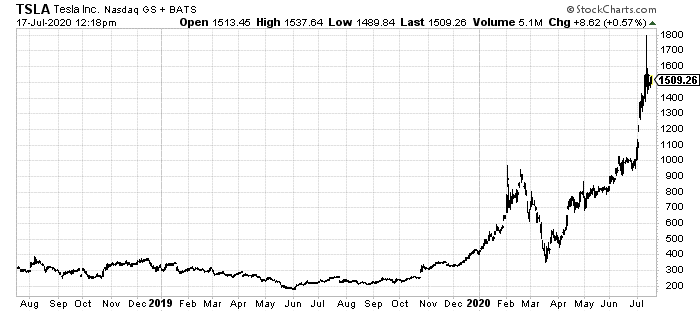

Tesla Inc. (NASDAQ: TSLA) is probably the most-discussed stock in the world right now. Its historic run from $200 to $1,500 per share over the last year has made more headlines than anything in the market.

But none of that would have been possible without rare earth metals, including those coming from Mountain Pass.

Electric motors, advanced electronic components, coolant systems and more use rare earths. But it’s not just the EV boom that depends on these materials. Everything from wind power to smartphones relies on the properties only found in these metals. In fact, many defense technologies like guidance systems use them.

Clearly, if all of these next-gen applications rely on this stuff, it is an important set of raw materials to power the 21st century.

But its very name gives away the game on just how important these metals are. They are rare to the extreme.

In fact, very few places even mine these materials. And that’s why this IPO could be enormous for the future of technology and early shareholders alike.

So, let’s look at just why this mine is so important geopolitically.

International Ramifications of This IPO Money

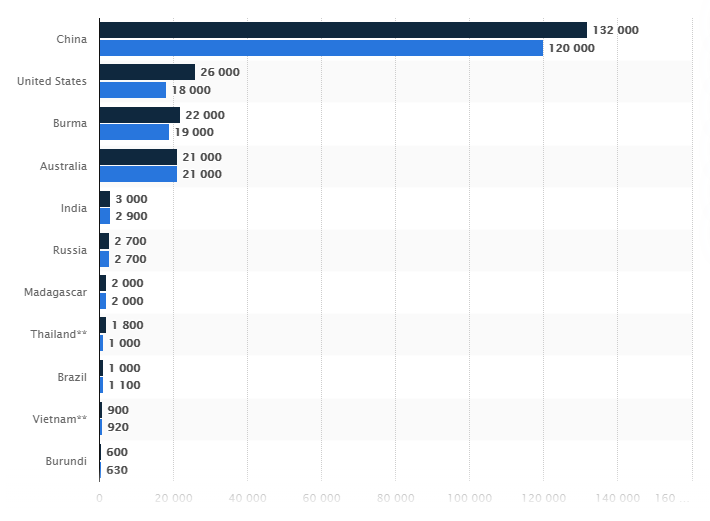

China leads the world in rare earth production by a large margin. And when you look at the figures, it isn’t even close:

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

This is an incredibly crucial fact.

Consider this.

No matter how intertwined China and the rest of the world’s economies are, this single fact dominates the technology industry. U.S. tech companies simply couldn’t function without the raw materials only really found in China.

Apple couldn’t really exist without China’s rare earth mining. Wind and solar power would be terribly inefficient and dead-in-the-water ideas. And Tesla would just be a word found in history books, not a global automotive giant.

The U.S. does have its own rare earth reserves. But getting them out of the ground and processed hasn’t been easy.

Mountain Pass is the largest of these rare earth sites in the U.S. With an estimated 800k tons of recoverable rare earth oxides, this is the most important site for the tech industry outside of China. It’s high 8% ore grade also makes every ounce mined more valuable than another other non-China site.

But it wasn’t just discovered recently. These metals have been mined at Mountain Pass since 1952.

The site’s former owner, Molybdenum Corp, and then Molycorp, went bankrupt trying to compete with China. MP Materials bought it and many other Molycorp assets in bankruptcy.

There are other factors that led to that downfall. And they are also what make this IPO even more intriguing and lucrative.

You see, just mining these metals is only the first step. They need to be processed. And that is an expensive thing to do. Currently, MP Materials ships more than 50,000 tons of concentrated rare earths to China each year.

You can see the problem here. First, shipping that much is expensive. It also puts these rare earths back into the geopolitical mess.

This could change, at least to an important degree. The money MP expects to take home after shares begin trading later this year is going to go into domestic processing equipment.

That changes this important, but low-margin operation into a lucrative money maker business of national importance.

Though, investing in this clearly huge opportunity isn’t as straightforward as waiting for its IPO and buying shares. It isn’t a traditional IPO.

How to Invest

MP Material’s current owners, two hedge funds, are folding their stakes into a special purpose acquisition company (SPAC) named Fortress Value Acquisition Corp. (NYSE: FVAC).

If you haven’t heard of a SPAC yet, you will. This is a subject we’ll definitely be covered going forward. But the important thing to know now is that SPACs are also called blank-check companies.

They go public, raise money from their IPO, and then invest it in new brilliant ideas and often tech companies. That’s what Fortress is doing here with MP Materials.

Later this year, Fortress will become MP Materials, changing its ticker from FVAC to MP.

One way to get in early is to get in on the SPAC itself. It only began trading recently, and there’s likely a huge run higher leading up to the actual transition to MP.

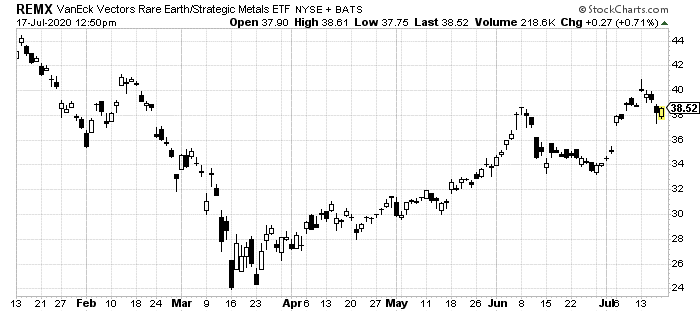

The other is through VanEck Vectors Rare Earth/Strategic Metals ETF (NYSE: REMX).

This is an ETF that owns basically all of MP’s competitors, and one has to assume will eventually be an early investor in MP itself.

This secondary way lets you benefit from the investor interest that will inevitably follow this industry throughout the rest of 2020. It also gives you some direct access to the companies already profiting from this large, generational-sized shift.

Both REMX and FVAC represent emerging profit opportunities right now. REMX is for the overall industry opportunity. FVAC is for the higher-risk, higher-reward-minded investor.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder