While stocks continue to take a beating following the long weekend, oil is getting absolutely destroyed.

The S&P 500 is off about 4.8% from its mid-week highs last week. But crude is down more than 11%.

Worries over demand continue to cloud that particular industry. And rightfully so. But that doesn’t mean we’ll see another negative price tag as we did early on in the pandemic.

So, should you take advantage of this dip and pick up some oil-related plays? Maybe. But there might be an even better way to take advantage of oil’s new world.

Alongside oil’s near-term second dip, there’s news out of the oilfields servicing industry. Specifically, Baker Hughes Company’s (NYSE: BKR) top guy Lorenzo Simonelli is reported to have just bought $1 billion worth of his own company’s shares during the fire sale.

Now, insider buying has long been an indicator of markets going too far. When the people with the most knowledge about what a company should be worth go all in like this, they are often right.

But why? Why such a huge, astronomical bet when the market seems to be shifting so hard against oil yet again?

He apparently sees the untold story of where oil is headed.

Oil production has always been one of the most dangerous industries in history. With the discovery and rapid spike of production in North Dakota, also came the highest labor-related death rate in the country… four times higher than the nation’s average.

It is also expensive and often wasteful to have personnel standing around the oilfields dotting the countryside.

Well, as you can imagine, as oil prices fell off the cliff earlier this year, the companies still producing needed to cut out even more of those expenses.

Last month, the Wall Street Journal highlighted one way they were doing this. Prior to the pandemic, oil companies didn’t want to mess with anything. If they could find a profit in their operations, they kept them exactly the same.

But once those costs rose and their profits disappeared, they started looking at alternatives. One major one was automation.

Remote drilling cuts down on accidents, onsite waste and even some human error. Companies like Baker Hughes along with its brethren in the industry Schlumberger Limited (NYSE: SLB) and Halliburton Co. (NYSE: HAL) have been working on this technology for years.

But, as you can tell from their 10-year chart, it hasn’t been a savior for these oilfield service giants:

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

That could change. But I posit there’s an even better way to get in on this trend.

While it’s true that these big three have been on the forefront of remote drilling and servicing technology, they weren’t the only ones.

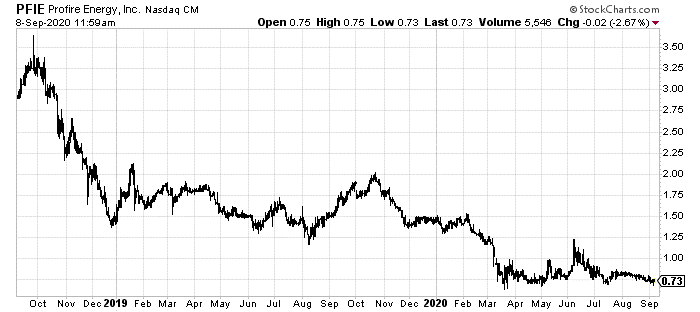

Take Profire Energy Inc. (NASDAQ: PFIE), for instance.

A quick look at its own stock chart tells an even uglier story than that of its bigger brothers’:

But there’s a reason why this could be a more exciting angle for investors right now.

Instead of large contracts with major drillers like the oilfield servicers, Profire and others on this tier do business with the oilfield operators themselves. And that’s not always the owners of those sites like Exxon and Chevron.

Profire develops, manufactures, sells and services chemical management equipment and burners. If you’re not familiar, oil companies still need to perform controlled burns of the excess gas during production.

As you might imagine, environmental regulations have made this more of a scientific balance between safety and excess emissions. So, 21st century technology needs to be applied.

Profire’s is automated and remotely worked. Meaning, the precision adjustments needed for this kind of equipment can now finally be done 100% offsite. That’s the kind of upgrade the producers themselves will need to compete as this industry shifts.

The company itself has been as disappointing as its stock chart suggests. Earnings turned red this year as oil prices forced immediate production halts.

But as the industry recovers and goes back to work, it will do so more remotely. And small companies like Profire will be the winners.

But why this one specifically? Well, despite its income statement turning red for the last three quarters, it has maintained a positive gross profit and large cash position. It also carries no debt. And it’s trading at extreme lows.

As we’ve just seen, big players including Baker Hughes’ top dog are willing to pay out money right now for future profits. One way they are likely going to do that is to buy up this kind of technology before the industry itself goes all in.

Profire and other small tech companies working on remote and automated technologies for the oil and gas industry are prime buyout targets.

The biggest profits, as always, come from realizing this ahead of time.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder