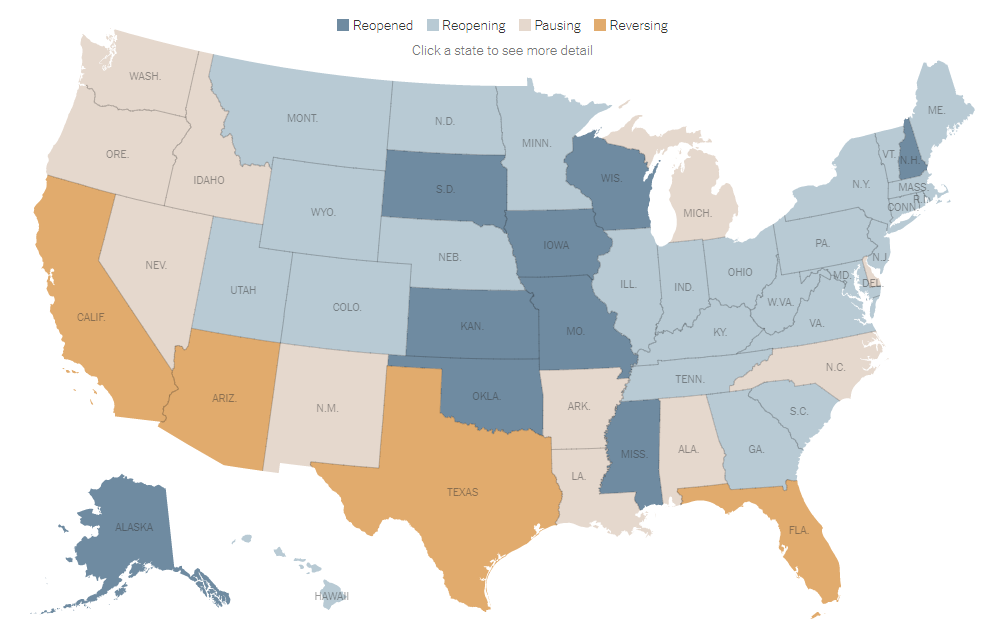

Four huge states have already reversed plans for reopening as new COVID-19 cases spike.

California, Florida, Arizona, and Texas have all entered a second lockdown, of sorts.

Fingers crossed that more will not follow.

Eleven more have paused their reopening. And some of these are likely to reverse as the virus is spreading again.

At the same time, consumer staples stocks continue to outperform the rest of the market. This is obviously no coincidence.

General Mills Inc. (NYSE: GIS) announced its fourth-quarter earnings this week. The company blew away even the high expectations analysts had.

Fourth-quarter earnings per share came in at $1.10 versus the 88 cents estimates.

This is on crazy sales growth: 21% year over year.

Now, this shouldn’t come as a huge surprise. This quarter included all of March and April when lockdowns went into effect in the first place.

Families across the country were hoarding more than just toilet paper back then. They were stockpiling as many foodstuffs as they could. Any pantry essential, they bought double.

For a company like General Mills with big brands such as Annie’s, Pillsbury, Betty Crocker, and Cheerios, that’s going to move the needle.

Now that many largely populated states are reentering quarantine, the question becomes: will these hoarders do it again?

Lockdowns: Part 2

Undoubtedly, some will double down on supplies. But the mad rush over toilet paper and most foodstuffs is probably a one-time thing.

Supply problems have been cleaned up, for the most part. With the surge in meatpacking infections, they aren’t completely fixed. But it is clearly better.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

However, there doesn’t necessarily need to be panic buying for General Mills to repeat its recent quarter’s success.

The company is prosperous. That quarterly growth wasn’t a fluke. It has been growing its top and bottom lines for years, well before the pandemic.

But here’s the thing. Shares are only reflecting the current surge.

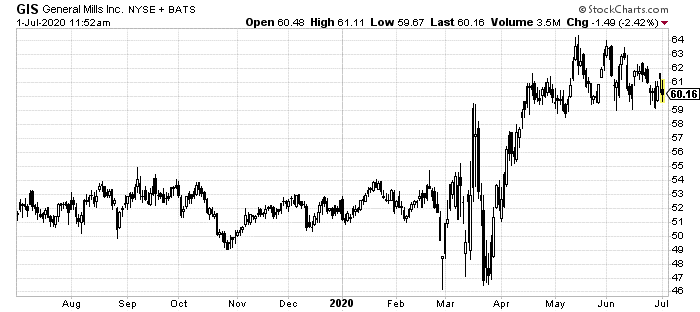

GIS’ one-year chart is impressive. Clearly, no one knew what to make of it when everything was crashing in March. But since then, shares have climbed steadily. They are now trading at about $10 higher than the pre-pandemic.

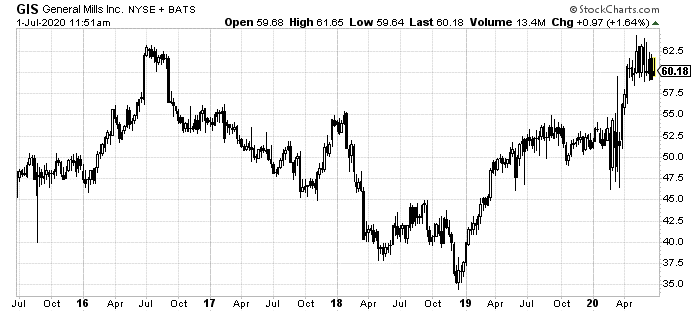

Yet, as I said, this is new. If we take a step back, you can see here that shares are actually only catching up to their 2016 highs right now.

There’s room to run here. But don’t take my word for it. Let the numbers speak for themselves.

The Objective Case For General Mills

Let’s assume that 2020 is just a crazy year for the company. Its numbers mean nothing long term. For that, let’s just skip ahead to its next fiscal year, which will be up this time in 2021.

Analysts expect earnings per share to come in at $3.49. That gives GIS a forward price to earnings of just 17.3.

That’s insanely cheap especially compared to its closest peer, Kellogg Company (NYSE: K)’s 22.1 P/E.

But just looking at this picture isn’t enough. Consider too that analysts have been underestimating GIS for a long time. They missed each of the last several quarters’ worth of earnings numbers. So, basing any valuation on their estimates for next year offers even more buffer room.

Finally, GIS is also sitting on a massive advantage. Right now, Congress and the Treasury are looking to put restrictions on dividends and stock buybacks.

Following recent financial stress tests, restrictions already started going up for large banks for the third quarter.

Others, like airlines and those taking the largest bailouts from the government, won’t be paying dividends at all for even longer.

Meanwhile, interest rates remain low and are set to stay there.

That means income investors are going to seek out companies that can and do pay well. General Mills is one of those companies.

It just announced its latest quarterly dividend yesterday. GIS’s 3.3% dividend yield might not sound like the largest out there. But with the average S&P 500 dividend yield now shrinking back below 2% with further to fall, it is.

General Mills is far from an underground or forgotten play. But with what’s going on in the world, the market’s lowball price for its shares and its dividend, this is a steal for now.

Despite beating analyst's expectations on its' most recent quarter, shares are still trading at where they were last week.

This is a serious buying opportunity.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder