We are in the boom times for Space 2.0.

With companies like SpaceX and Virgin Galactic Holdings Inc. (NYSE: SPCE) garnering more than their fair share of attention, both investors and the media are excited about this revival.

With manned missions now competing with satellite launches, all eyes remain focused on these companies. But, in many ways, none of this would be possible without a little outside help.

Aerojet Rocketdyne Holdings Inc. (NYSE: AJRD) might have the most futuristic-sounding name in the history of publicly traded stocks. But it does so for good reason.

This $3.2 billion aerospace and defense product developer counts both SpaceX and the U.S. Department of Defense as customers. And big ones too.

Aerojet was just announced the winner to make both large solid rocket motors, as well as post-boost propulsion systems for the new Northrop Grumman-led Ground-Based Strategic Deterrent (GBSD) program.

That adds to its other contracts, including projects like the National Security Space Launch, NASA’s manned Artemis II mission flying around the moon, and Boeing’s Starliner.

Still, these are only a fraction of what Aerojet does. It is also a major DoD customer for actual weapons.

Late last year, it was named a major subcontractor on the Lockheed Martin Hypersonic Conventional Strike Weapon (HCSW) for the Air Force.

In total, the company has a backlog of projects worth $6.8 billion as of its most recent quarter.

Still, you might be surprised to learn, investors haven’t figured this one out yet.

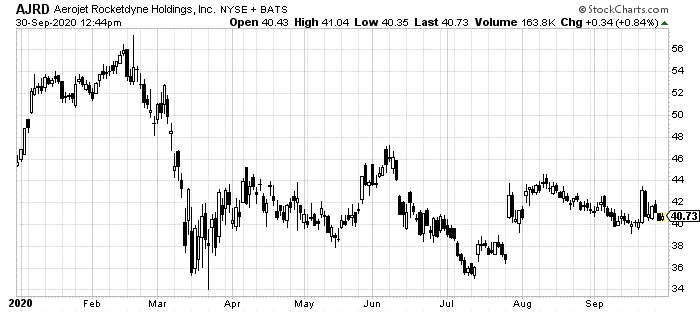

So far in 2020, AJRD shares are not performing so well.

Due to no fault of its own, investors have simply sat out on the rise of Aerojet in this Space 2.0 environment.

The company even reported solid growth of 6% in net sales during its second quarter and a monstrous 202% in free cash flow. Its bottom line did drop by seven cents to $0.47 per share. But that is hardly a game changer.

Over the last five years, the Aerojet has enjoyed EPS growth of 31.1%, which is expected to resume next year.

But what the real number of investors are so clearly missing is its backlog. As noted, the company has $6.8 billion in current contracts from the likes of the U.S. government and hot companies like SpaceX.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

These contracts contain next-gen missile defense programs and lunar orbital missions.

And more importantly, it has the cash and balance sheet to get these jobs done.

As of its second quarter, Aerojet was sitting on more than $1 billion in cash with just $338 million in long-term debt.

For a $3.2 billion subcontractor, this backlog and cash position makes it extremely appealing in this boom time.

While its year-to-date 11% decline in share price might seem like investors are shunning Aerojet, it appears not all have been missing the mark.

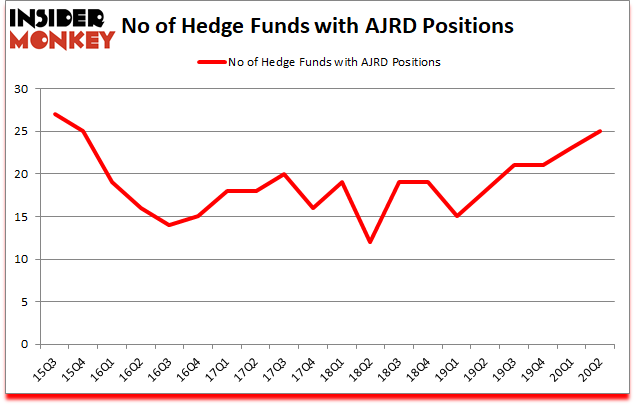

Hedge fund watcher, Insider Monkey, reported this week that there’s been a steep climb in major funds getting into AJRD positions.

Already in 2020, the number of hedge funds jumping in on new Aerojet positions grew by 9% to 25. Over the last two years, this number has doubled.

While all wait to have a chance at SpaceX shares someday, and everyone already knows about Virgin Galactic’s endeavors, powerful money is turning up right now for Aerojet… the company that makes all of this Space 2.0 possible.

This might not be an overnight winner. But for an emerging trend that doesn’t appear to be going anywhere, you can’t beat this backdoor way to play it.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder