With the fall of Nikola Corp. (NASDAQ: NKLA) and Tesla Inc.’s (NASDAQ: TSLA) rather disappointing “Battery Day,” the electric vehicle (EV) market seems to have lost some momentum of late.

But there’s still a huge amount of money to be made. And not all of it will come from the easiest-to-spot places.

Mainstream headlines about the future of EV seem to only feature two kinds of companies: electric vehicle makers (Tesla, Nikola, Volkswagen, etc.) and battery developers (Tesla again and QuantumScape as recently noted here).

Someday we might see a Tesla in every driveway and autonomous electric big rigs racing down the highway. But there’s a lot of space between now and then.

So, we should back up and look at emerging technologies that will bridge that gap.

Hyliion Holdings Corp. (NYSE: HYLN), which just went public through a SPAC merger last week, might be one of these solutions. It is working on a new technology that can electrify existing fleets of long-haul trucks.

It’s not alone in that goal. And one of its newest competitors is really worth looking into.

Hyliion’s technology involves replacing powertrains in Class 8 trucks, making them essentially hybrids. It could transform the high-carbon-emitting, long-haul trucking industry.

But what about everything else?

Tesla has notably begun work on trucks initially with the rather strange Cybertruck design:

Nikola was supposed to be the solution with its Badger. But we’ve already seen what a mess that whole situation is now.

So, in comes XL Fleet.

XL Fleet is, like Hyliion, a maker of powertrains.

But instead of just Class 8 trucks, XL has plans for hybrid and fully-electric systems for Classes 2-6, which includes everything from Ford F-150 pickups to school busses and garbage trucks.

And this company might really be on to something here.

While Hyliion works on big rigs, XL estimates that the rest of the market for this technology could be worth $1 trillion in the near term.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

That’s a whole lot of money. And unlike Hyllion, XL is already selling its XL hybrid and XL plug-in powertrains.

In other words, unlike the rest of the EV market (besides Tesla), XL’s technology is already out there and selling well.

The company’s list of customers includes some huge names that alone could make this an incredible opportunity. It has deals with the likes of FedEx, Coca-Cola, and cities like New York and Seattle.

But what really makes this a company worth the hype is how it sells its powertrains.

Rather than setting up garages across the country and installing these EV overhauls itself, it has partnered with OEMs like Ford and GM, as well as upfitters like Auto Truck Group and Knapheide. That has given XL access to customers all across the U.S. and Canada.

This North American system allows for absolutely incredible growth.

Just this year, XL expects revenue growth of 192%. Over the next two years, it is shooting for 258% and 273% sales growth respectively.

If it can achieve even a fraction of that, it should be profitable long before Hyliion and others even begin finishing their products.

By 2024, XL estimates that it could control 6% of the entire North American market for this kind of technology.

That might not sound like a lot. But remember this market is estimated to be worth up to $1 trillion.

With the recent bad news in the EV market as a whole of late, it also makes the timing of all of this even better.

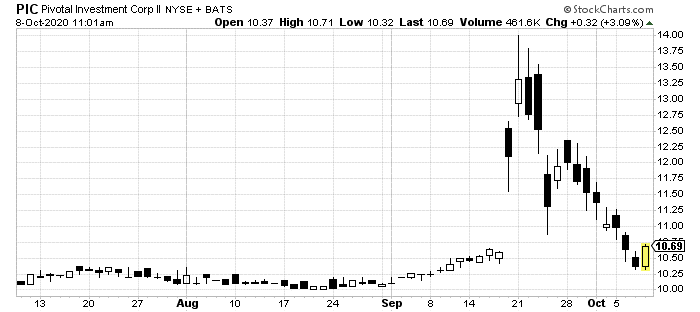

On September 18, XL announced a deal with a SPAC, one of these now-commonplace special purpose acquisition companies: Pivotal Investment Corporation II (NYSE: PIC).

The implied value of XL through this deal gives it a price tag of about $1.1 billion. That’s one-seventh of what Hyliion goes for after its own SPAC merger went through last week.

There’s a huge amount of opportunity here. As you can see, shares did spike in the pre-merger SPAC’s stock when this was announced.

But because of investor worry after the whole Nikola disaster, those shares have come back down. Once those same investors start seeing XL Fleet’s quarterly results post-merger, they should pick up the scent once again.

This is one of those situations where we have a clear emerging profit opportunity. But investors haven’t yet jumped in on it.

You can beat them to this one… and potentially get a piece of a $1 trillion market.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder