Home Depot Inc. (NYSE: HD) is moving faster than anyone could have predicted.

Back in March, when the world looked its darkest, access to credit markets was everyone on Wall Street’s chief concern.

If you recall, the market was crashing like it was 2008 all over again. Even well-funded companies were sinking like they were on their last $10 bill.

The Fed ended up stepping in, securing the markets with extra and unprecedented liquidity. And the rest is history, right?

Well, for many it hasn’t been so straightforward. Capital intensive businesses, especially those in retail or service sectors hit the hardest by the coronavirus, have had to remain cautious throughout the rest of 2020.

Some companies that took advantage of the explosion of available Fed-mandated credit were forced to hold on to that cash.

Home Depot is the perfect example. It doubled its short-term credit facility and took out $5 billion in new long-term debt in four tranches, maturing in 2027, 2030, 2040 and 2050 respectively. Clearly, it took advantage of the low rates the Fed had handed the company on a silver platter.

So far, it has held on to that new money tightly, with an unprecedentedly large cash position.

But this week, that is changing.

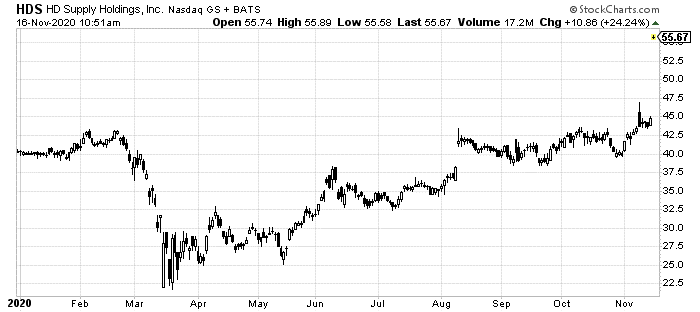

The largest name in home improvement made a splash this morning by announcing a $9.1 billion, all-cash deal to purchase HD Supply Holdings Inc. (NASDAQ: HDS).

That’s the headline, at least. The truth is that Home Depot is using the record low interest rate environment from the Fed credit injection back in March to take its former subsidiary back into the fold.

And it’s a great deal.

HD Supply was officially part of the HD team, as its name suggests. But during the last financial crisis, the two parted.

It’s almost ironic that when the economy hit the skids the first time in 2008 that HD had to sell off HD Supply for cash. Now, because the second economic slide supplied HD with a ton of cheap exposure to cash, it is able to take it back under its wing.

HD Supply is a more focused distributor of “maintenance, repair and operations” (MRO) products. This has a wider segment of customers than it sounds like. The vast majority are homebuilders, property managers and professional contractors.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

It will ultimately lead to a slightly lower percentage of sales coming in from the booming “do-it-yourself” customers. But not by a whole lot. And as I noted just last week, homebuilders aren’t faring so badly themselves right now.

What it does instead is consolidate its industry leading share of the market even further for much cheaper.

With Lowe’s Companies Inc. (NYSE: LOW) gaining some ground during this past year, that’s a boon for HD.

But the math surrounding this deal is what makes it so important… and one you should consider with the company set to report earnings tomorrow morning.

HD Supply is and always has been a very successful business in its own right. Over the last 12 months, it has brought in $2.53 per share in income.

That translates to about 22 times its earnings even after today’s massive 25% post-announcement spike. That’s right on par with where Lowe’s is traded. And it’s actually cheaper than HD itself.

But what is really remarkable is the size of this deal. Since HD timed its original sale of HD Supply perfectly, HD was able to avoid most of the losses from 2008-09 when all homebuilding-related stocks tanked. Those losses fell to original buyers Carlyle Group and Bain Capital.

Instead of taking those losses, HD was able to cash out for $8.5 billion. Here we are more than a decade later, with an even larger and more profitable HD Supply getting scooped up for just a fraction more at $9.1 billion.

Immediately, as soon as the deal closes, HD will see a boost to its bottom line. Early estimates say HD Supply will add about 33 cents per HD share in income. I suspect that could be far higher with the surge in home improvement and homebuilding we’re seeing.

The companies are obviously already well suited for one another. And in this time when the market is on fire for these kinds of plays, HD is getting the best deal it could.

As you can see, HD has lagged Lowe’s this year, despite outpacing the rest of the market. This deal should more than close the gap.

HD is positioned to now surpass Lowe’s in 2021. Tomorrow’s earnings announcement could shake up HD’s stock price. Use that to get in on this profit opportunity before the rest of the market does the math on this deal.