Gold is mid collapse. But why?

While most of us were able to take a few days off to celebrate the Thanksgiving holiday, the precious metals market was set ablaze.

Since the Friday before last, gold is off about $100 per ounce, leaving it about $275 below its August highs.

Financial pundits are all beside themselves questioning whether this is just a lull in the bull market for the metal or if it signals a complete reversal from the first half of the year.

There are arguments for both sides. But a simple study of the surrounding facts shows why only one of these opinions can be right.

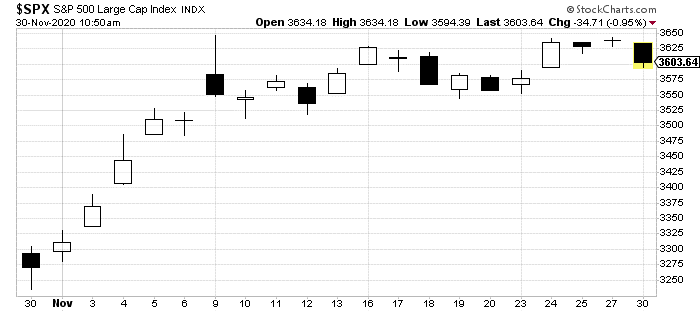

November 2020 is going to go down as an absolutely insane month of trading. With just a few hours left, as I write, it is likely going to remain remarkable despite today’s selloff.

The Dow Jones Industrial Average broke 30,000 for the first time ever. The S&P 500 tacked on more than 300 points itself.

A rather mixed election result and multiple vaccines likely coming to market for COVID-19 paved this path.

Investors seem to like the idea of a muddled and mixed government. They are also over the moon on thoughts that vaccine scientists have come to save the day.

All of this creates a “risk-on” investment landscape. So, it shouldn’t come as a big surprise that they favor stocks over safe havens like gold.

Of course, if investing was so simple, everyone with a brokerage account would be loaded.

There’s a lot more at play with both stocks and gold than meets the eye here.

Gold has been traded forever on the prospect of its safety compared to economic, fiscal and monetary turmoil. Meaning, whenever people struggle to find jobs or a major government spends too much money it doesn’t have investors, pile into the yellow metal.

But isn’t that exactly what we have?

That’s the question all of those current exiting gold are going to ask very soon.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Senate Majority Leader Mitch McConnell is bringing the Senate back into session this week with two goals in mind: somehow pass another stimulus program and avoid another government shutdown.

For gold, both of these pending actions represent bullish catalysts.

Another stimulus program widens the already-record deficit further. And there’s no better reason to hold gold than in times of a shutdown.

Now, I’m not going to speculate on the passage of either piece of legislation. The two parties remain miles apart. But they could indeed find some middle ground in this lame duck session prior to the swearing in of the 117th U.S. Congress in January.

Either way, my previous points about volatility remain in play. Political gridlock forces economic pain. the political agreement, at least in this case, means larger deficits.

Both act as tailwinds for gold.

And there’s one final catalyst on the horizon.

If Joe Biden is sworn in as the 46th President, his Treasury Secretary will be Janet Yellen. Remember her? That former Fed head dove, who never turned down a little stimulus herself?

Though, on this last point, it’s not like Trump is directing his Administration away from stimulus spending either.

Gold may fall a bit from here. It has already broken through a few lines of resistance in the past few weeks. But a return to at least August’s prices are more than on the table.

Bank of America was one catalyst for the recent week’s decline. It abandoned its forecast of $3,000 gold by late 2021.

However, it still thinks the current $1775 is too cheap. It now forecasts gold to hold above $2,000 for all of 2021.

I think even that might be shortsighted. But even if that’s the highest it goes, it still represents a sizable emerging profit opportunity after this past week’s collapse.

Now’s a perfect opportunity to build a position in gold for the coming series of bullish catalysts on the horizons.

Gold’s run isn’t done just yet.

Buy the dip and hold for the long-term.