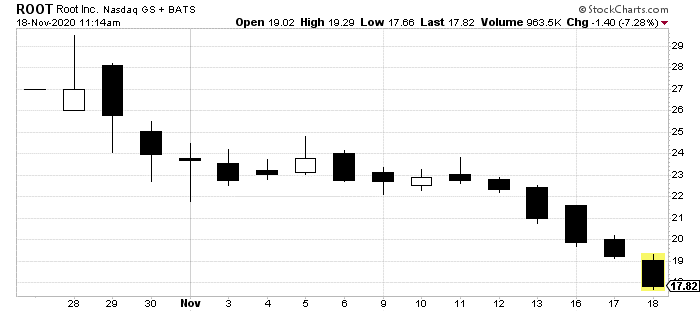

For early investors, the highly-anticipated IPO of Root Inc. (NASDAQ: ROOT) was a bit of a flop.

Shares only briefly traded above its IPO on the first day it hit the market. Since then, including today, shares have dropped in a hurry.

As I noted yesterday, even over-hyped IPOs can fall apart when you look at the facts. But that’s not really what’s happened here.

Investors have obviously been testing ROOT out, seeing where it can find a baseline. And the news hasn’t, on the surface, helped in doing so.

Just today, General Motors Co. (NYSE: GM) announced its own “Root-killer” insurance idea.

This plan, which makes a lot of sense for GM, is to automatically utilize its own vehicles’ technology to offer insurance.

GM’s OnStar tech is built into each vehicle it sells. OnStar collects all kinds of data for the company, including how many miles a person drives, how often they slam their brakes and how fast they go on highways.

If you recall from last month, when I first wrote about Root, that’s exactly what that new insurance company does through its mobile app. It’s the whole premise of its insurance plans. Take that data, and then see how safe each driver is. Offer insurance rates based on that information.

GM is launching its own competing insurance plan that does the same thing. Using the data the company collects from OnStar, it is going to begin offering auto insurance to customers.

This isn’t the company’s first foray into auto insurance. But it is the first since it was forced to liquidate that business back when the company fell apart in 2008-09.

This seems like a problem for the much smaller Root, right?

Well, investors dropping Root’s stock 9% today might be missing the whole story.

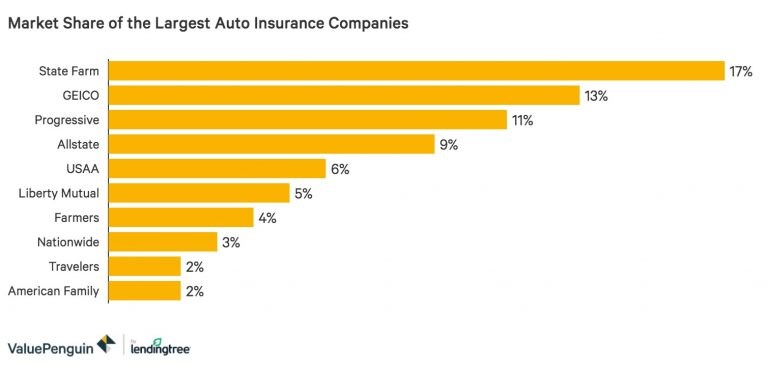

In October, when I first recommended watching this exciting IPO for a potential future play, I noted just how incredibly fragmented the auto insurance game was.

No company has more than 17% of the entire market. Adding competition from GM wouldn’t necessarily change much for Root.

But if that wasn’t enough, let’s go down the rabbit hole further.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

GM’s insurance plan can only work for GM customers. Meaning, if you own a Ford, you can’t get your insurance through GM, since your vehicle doesn’t have OnStar.

So, how much of the auto market even uses GM?

The answer is less than 17%. And that’s dropping. The company’s market share fell nearly 9% just last year.

To put this all together, Root shares are falling 9% today because, at most, 17% of the auto market will have a new insurance option. Far less than that will actually use GM’s plans.

And even if all 17% of the market does someone make the switch, it still leaves the overall auto insurance market exactly where it is today: fractured with no company controlling more than 17% of it.

For Root, and upstart disruptors like it, that’s a win-win. One of the biggest hurdles with insurance is that people generally don’t shop around. They stick to what they already have.

With a big name like GM stepping in and disrupting the already fractured market, that just opens up even more opportunities for people to find Root.

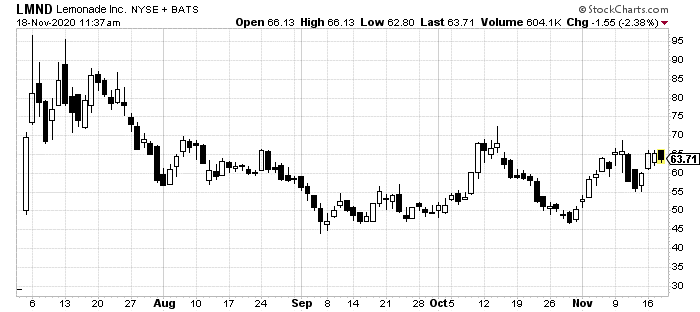

As I noted, this stock could perform like Lemonade Inc. (NYSE: LMND), its spiritual brother from the home and renters insurance industry.

Lemonade surged after its IPO to more than $85 per share. The company is great. But it is not worth $85. Investors realized their mistake and it has fallen ever since.

Those particular shares will look attractive if they get cut in half again from where they are, to around $30.

Root, in its three-week market performance, has been slightly different. It came out of the gate already too hot, with initial trading above its $22-$25 expected range.

ROOT shares have fallen faster. But that just might mean there’s an earlier opportunity to get in than on LMND.

Make no mistake; the insurance game is changing. These two disruptors are messing everything up for the rest of their markets. Adding GM to the mix in Root’s only points more eyes on this fact.

ROOT shares appear to be entering into a perfect entry zone for new investors. Let investors find that baseline they are looking for. But be sure to get in as soon as they find it.