As the U.S. closes in on 100,000 COVID-19 deaths this Memorial Day holiday, it might be easy to tune out the rest of the world.

But from nearly no reported deaths just over a month ago, the country with the second-highest number of reported cases should be on investors’ minds.

Just this weekend, President Trump put new travel restrictions on Brazil, the world’s fourth-largest country by population.

It now has more than 363,000 cases, a 42% increase since May 18, just a week ago according to the Washington Post.

Still, investors aren’t always rational. That’s especially true right now.

Sure, many Latin American companies have seen their shares crater. With Chile, Mexico and Peru all joining Brazil in its steep increase in new cases, many industries have been hit.

But one industry, and one company specifically, has been targeted as the exception to the rule.

MercadoLibre Inc. (NASDAQ:MELI) is a massive $42 billion e-commerce giant in South America. It is often touted as Latin America’s version of Amazon, PayPal and Square all in one.

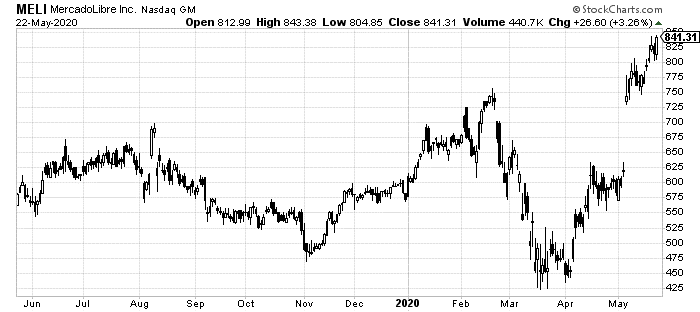

Now, that might make sense to hear that and see this:

Shares of MELI have nearly doubled from their early coronavirus lows. The giant gap up there earlier this month came on better than expected revenues.

So far, so good. But there’s something else that lurks beneath this cheery picture.

No Money Left to Spend

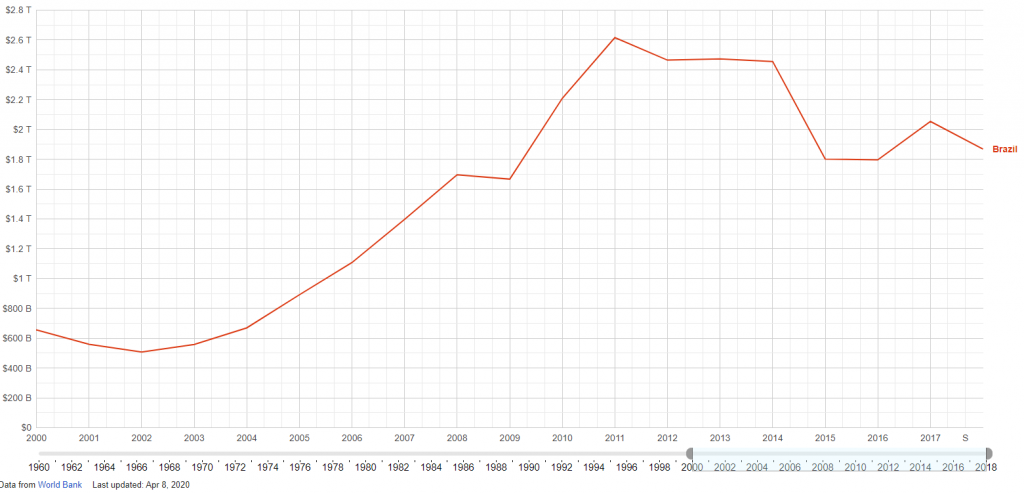

The company’s number one market by far is Brazil. As mentioned above, the country isn’t doing so hot. But its woes didn’t just start this spring.

Brazil’s economy has been in shambles for more than half a decade. After a relatively successful period in the first 15 years of this century, political turmoil and weak oil prices have crushed Brazil’s fledgling growth.

Just since 2014, the country’s GDP dropped from $2.61 trillion to $1.87 trillion. That is substational because nearly one-third of its economy dried up in just six years.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

In that time, the country has impeached a president, jailed a former one and elected a strongman for its third. It’s faced wave after wave of protests and political unrest. It’s lost its precious energy money from falling oil prices. And its export customers have found new suppliers.

Whether Brazilians turn to e-commerce over brick-and-mortar isn’t really the right question. What investors should be asking is whether those customers will spend money in either in the near future.

Sure, long term, a company like MercadoLibre makes a lot of sense. But we’re just not there yet.

That gap-up in share price earlier this month came from a stellar 38% year-over-year growth to $652 million in the first quarter. But, if investors take just one small step back and look at the bigger picture, they’d see operating expenses also grew 51%.

The company is still running in the red. And despite what investors hope, that’s not likely to change.

Mercado’s Current Growth Strategy

The company is a giant in Brazil already. It is actually an Argentinian company. But its future lies farther north.

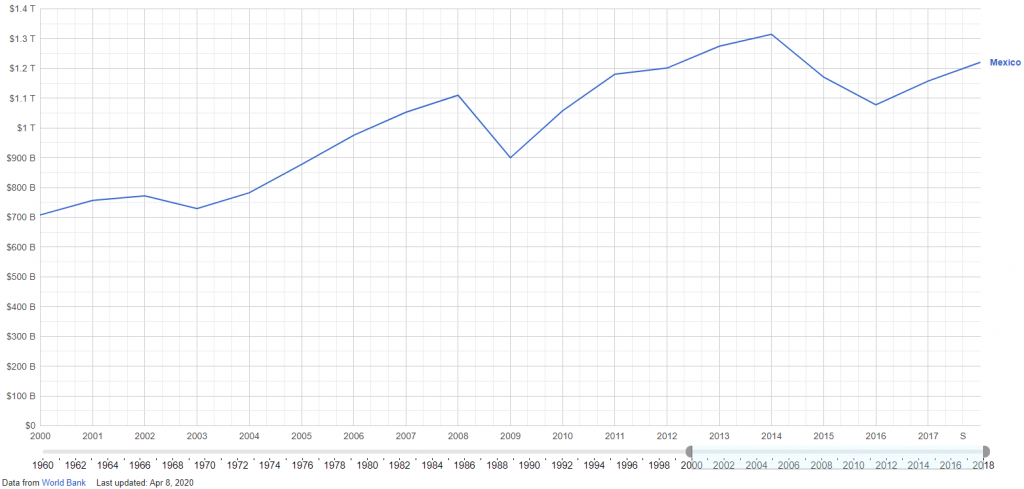

It has already announced that it expects to turn focus to Mexico. Again, on the surface, that doesn’t sound like such a bad thing. But, there’s a catch.

Mexico too hasn’t had a great few years. Though, admittedly, they have been better than Brazil:

While Mexico’s economy fares better than Brazil’s, that doesn’t mean MercadoLibre will be able to penetrate that market the same at all.

You see, Mexico is already the grasp of the very companies Mercado is trying to replicate. Amazon, Wal-Mart, PayPal, Visa, Mastercard all operate there. And with NAFTA, NAFTA 2.0, USMCA or whatever you want to call the current trade agreement situation, they can do so without penalty.

Meaning, MercadoLibre is going up against enormous competition in a sideways market with already-rising costs and no income. And all of that during this global crisis.

If you wait a few years, MELI might be worth buying. But right now, this is one hot stock that should be avoided at all costs.