While all eyes were on oil prices over the last few months, another major energy commodity continued its own horrific slide lower.

Natural gas has slid to a new 20-year contract low.

Despite several spikes in the mid-2000s and the remarkable growth of the US shale oil and gas industry, natural gas has been a poor investment for quite some time:

As you can see, natural gas is trading at historic lows. It is no longer economical to even drill at these prices. That’s part of the reason why it was just announced that Chesapeake Energy Corp. (NYSE: CHK) announced it was declaring bankruptcy.

This company was one of the first to benefit from important finds in natural gas and shale oil deposits like Marcellus in Pennsylvania, Powder River Basin in Wyoming and Eagle Ford Shale in Texas.

Now, it is hanging up its hat.

With demand for both oil and gas down significantly in 2020 and the foreseeable future, Chesapeake joins more than 200 North American producers to file for bankruptcy according to Bloomberg.

There are a lot of reasons why natural gas is suffering so badly right now. Demand is obviously at extreme lows as the global economy has been fighting off COVID-19.

But supply has been too high for too long. While stories of Russia and OPEC fighting over oil production filled headlines at the start of the year, it affected natural gas too. Russia is one of the world’s largest gas suppliers.

U.S. production has fueled the rebirth of domestic oil and gas industries. But it has also led to oversupply and record-high volumes right now with no one to sell it to.

What Comes Next?

Unfortunately, it doesn’t look like things are going to swiftly reverse for these companies. But there is a way to play this bankruptcy wave.

You see, natural gas isn’t going away any time soon. In fact, in the long term, demand will inevitably go back up.

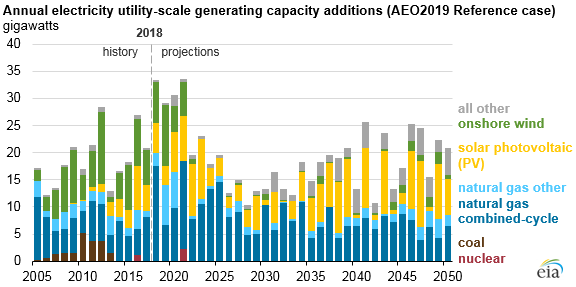

As the U.S. moves on from coal and nuclear power, it is racing into natural gas.

For one, this price tag makes NG plants cost-effective.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Compare to coal, they produce far fewer emissions. And coal plants can more easily be converted into natural gas-fired ones than any other fuel.

And while solar power is coming online in a hurry, natural gas is the perfect supplementary fuel source.

So, now would be a good time to look at getting into this beaten-down commodity. However, with hundreds of producers facing bankruptcy and short-term problems, how do you go about that?

Consolidation Wave on the Horizon

When these gas drillers go belly up, the natural gas doesn’t go away. Neither do their equipment and resources or infrastructure. Instead, that goes on the market. Either through bankruptcy courts or direct acquisitions, someone is going to get in on the ground floor here.

And there’s one company with a track record for exactly this kind of thing.

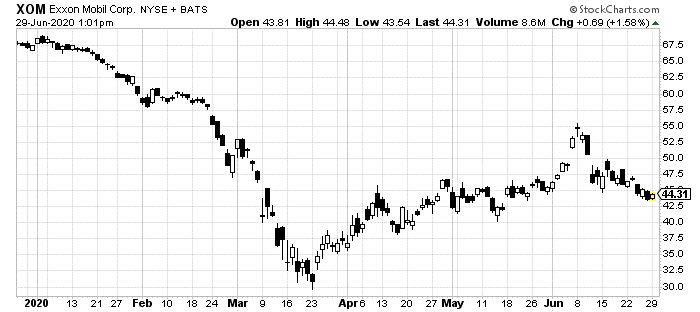

Exxon Mobil Corp. (NYSE: XOM) cut a $41 billion check to buy XTO Energy back in 2009. This single acquisition, which admittedly was a bit expensive, made Exxon the largest natural gas company in the U.S.

Since this deal a decade ago, Exxon has only increased its reach in the gas side of operations. Now, after taking advantage of low-interest rates, the company has built up a tidy war chest to do it again.

The company did just have one of its worst quarters in history, as COVID-19 broke the oil and gas industry. But that’s also why now is a perfect time to get into this real winner from the chaos.

As other giants like Chesapeake crumble, Exxon is positioned to pick up the pieces for next to nothing. Its current troubles only make it cheaper itself to own right now.

Natural gas will recover. And when it does, Exxon will be the biggest winner.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder