I was talking to an acquaintance earlier this week. He owns a private school dedicated to gifted children from early childhood through 8th grade in Florida.

Apparently, the school has already decided that instruction will be flexible in the fall.

This means that parents can decide whether their children will be digital learners or in the classroom. They can also choose to switch it up, a few days here and a few days there. But it will also mean that all the classrooms need to be equipped for the distance students to be a part of the action.

All the classrooms are going to be set up so it’s a seamless transition. He even noted that one family has already moved to Colorado and the child will be able to finish his education without changing schools.

This is just a single school’s plan. Districts around the country are still back and forth as to what the fall will look like for students of all ages.

We’re talking about elementary and middle school-aged children here that may now have to start studying like college students. Teachers are being thrown into the deep end. And so are parents, who may not be equipped to help with content.

This opens up more opportunities in tutoring and supplemental education space. Insert companies like Chegg Inc (NYSE: CHGG).

You might know Chegg as the main disruptor in the college textbook industry. Students could buy used books or rent them for the semester instead of purchasing them from the bookstore.

The company was actually founded on message boards in 2000. It’s a combination of the words chicken and egg. This can be associated with the age-old question of which came first. Just like how college students are unable to find a job without experience while being able to acquire experience without a job.

The company offered scholarship searches, internship matching, and college application advice. In 2007, it suspended all services unrelated to renting and purchasing textbooks but that only lasted for a few years.

The company couldn’t predict the Coronavirus pandemic ten years after the fact, but when it purchased CourseRank, Cramster, and Notehall in 2010, it was setting itself up for the future.

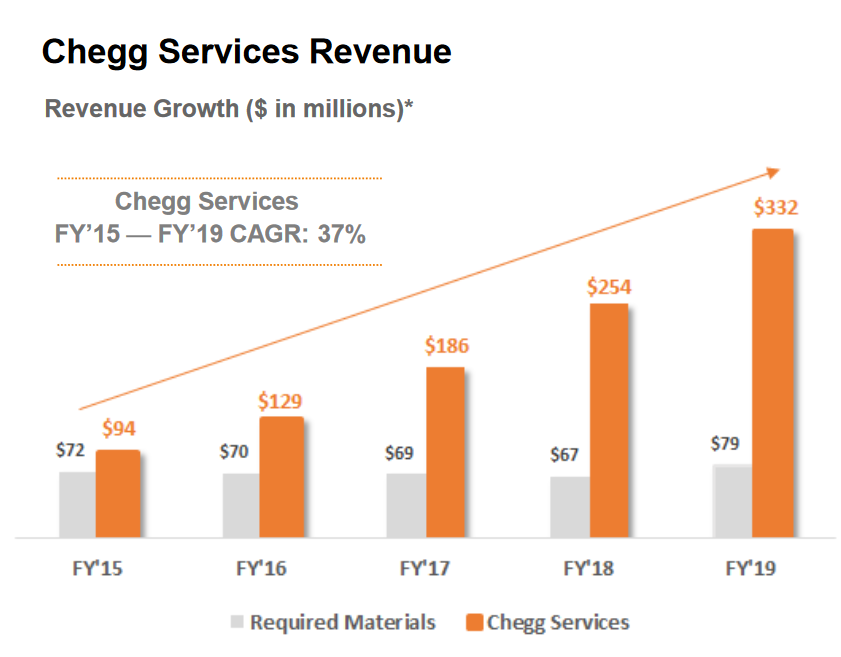

Check out the chart of revenue growth from the company’s most recent earnings presentations.

Textbooks, which most people still associate with Chegg, isn’t the driver. Yes, it’s a solid base, but the real growth is coming from its services.

Chegg Study is its homework help service with a library of expert Q&A and textbook solutions. There’s also Chegg Writing with tools to create bibliographies and check for grammar and plagiarism. The Math Solver is a step by step math problem solver and its Tutors service provides 24/7 help from a community of experts.

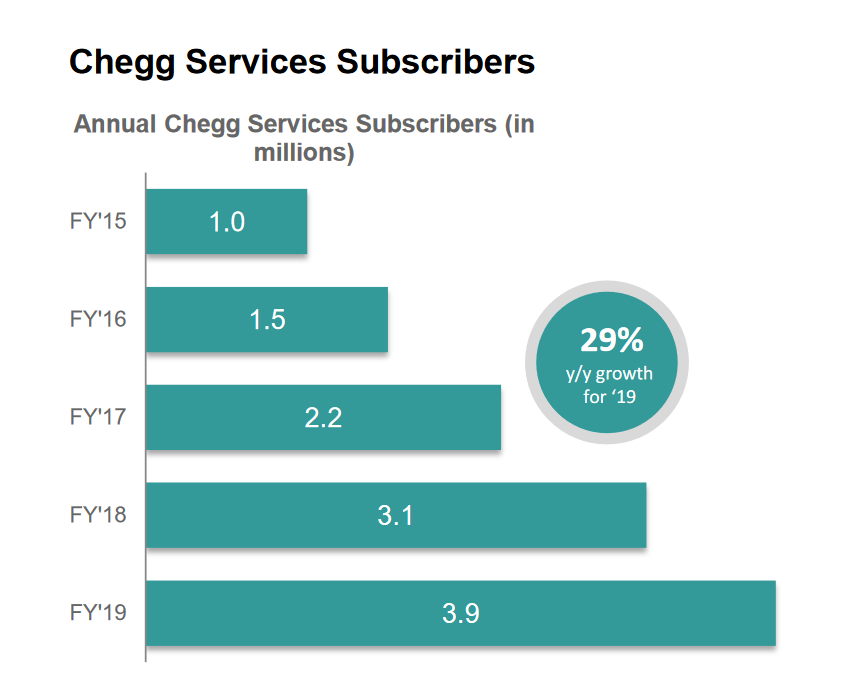

Thirty million visitors visit Chegg’s site per year and they are converting into subscribers.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

That’s 29% growth comparing the full year 2019 to 2018. When looking at the first quarter for 2020, subscribers are up 35% compared to the same quarter last year.

More parents and students are going to be searching for these services to help them through the next school year. And investors are already taking notice.

Shares have almost doubled since this time last year.

These shares still have plenty of room left to increase. This is a trend that will at least last the full school year. But traditional education is already off the well-worn path.

And Chegg is in a prime position to develop with the changing landscape of education.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder