With just 17 days left of 2020, I begin to pick my way through the rubble.

Many companies, including mainstays and perpetual market dominators, have been toppled.

Airlines, restaurants and office buildings have been abandoned for much of this year. And could be a long time recovering.

Unfortunately for many, a complete recovery is likely off the table.

Business travel may never come back to its pre-COVID heights, as millions have accustomed themselves to working from home and digital conferencing.

But for one company in a pandemic-devastated industry, the sky is clearing.

Gym memberships have slid wildly this year, as many were forced to shut in their homes and avoid others.

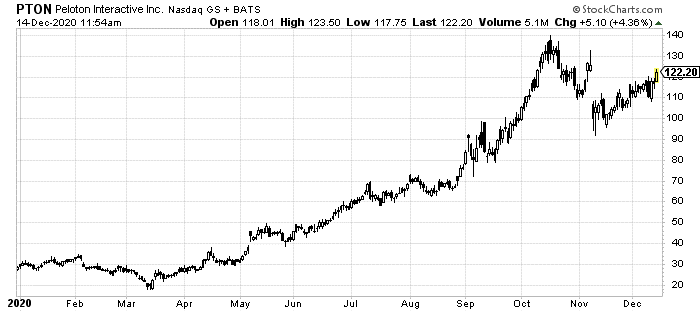

That’s why we’ve seen Peloton Interactive Inc. (NASDAQ: PTON) skyrocket this year.

Its allure makes a lot of sense. Just because people can’t go to their local gym doesn’t mean they don’t want to stay fit.

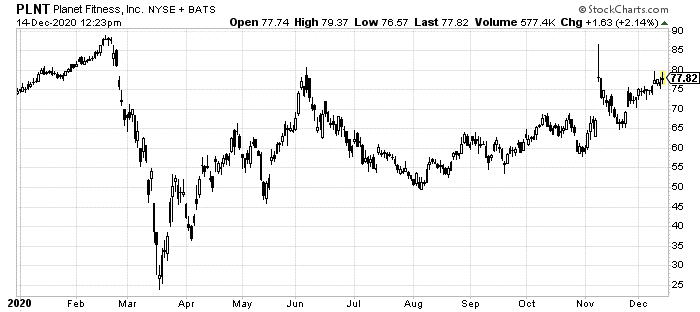

But there’s the flip side of this. Industry leader Planet Fitness Inc. (NYSE: PLNT) has been in the doghouse the whole year.

The company’s stock trades at exactly where it was to start the year, despite the rest of the market hitting all-time highs as recently as this morning.

This too seemingly makes sense. If people can’t go to the gym, how can a gym business make any money?

But there’s a missing piece here. And it’s one that Planet Fitness is going to make good use of going forward.

Building Upon Fallen Enemies

Planet Fitness wasn’t alone in its bad year. All gyms were decimated by lockdown restrictions and social distancing rules.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Therein lies the opportunity.

Going into 2020, the fitness industry was becoming crowded. Smaller “mom and pop” gyms, yoga studios and fitness centers were gaining market share.

The idea of paying large memberships to a mega gym was becoming a bit obsolete. Most people don’t use all the equipment one of these huge Planet Fitness’s has to offer. So, why pay for it all?

Unfortunately, as we all know now, 2020 took a giant hacksaw to small businesses of all kinds. But small studios and workout spaces were hit even harder.

Thousands have been forced to close up business, never to return. But it wasn’t just small-time yoga studios facing the end.

Large fitness businesses like Gold’s Gym and 24-Hour Fitness filed for Chapter 11 this year.

While a bit grim, it has to be noted that Planet Fitness is the winner here. With its better-than-average balance sheet, it has been able to survive and pick through the corpses of its fallen competitors.

This is not the first time such a phoenix-rising moment occurred at this scale.

A Lesson from the Financial Crisis

Remember when just the word “bank” was enough for you to grab at your wallet? In 2008 and 2009, so many banks were failing and going out of business.

It didn’t seem to matter how big they were either. Even those too-big-to-fail like Washington Mutual and Wachovia were forced to sell to competitors.

The entire industry was devastated by the disastrous mortgage instruments that had previously made them rich.

But a few years later, the surviving banks were richer than ever. Income at the likes of Bank of America and Citigroup had doubled from their lows. By simply surviving, they gained market share and millions of customers by default.

Planet Fitness could see much the same as vaccines begin to tamp this current crisis.

It might not be a few weeks or even months. It might be in a year or two before we can look back and see Planet Fitness in the same light as Citigroup post-crisis.

But for two reasons, I am sure that we will.

First, Planet Fitness hasn’t sat in the corner crying this whole time. The company quickly geared down its costs, built up its digital business and reached out to customers. It was able to muddle through a lot better than its competition.

In fact, with just over two weeks left in 2020, it is almost a guarantee that Planet Fitness will end the year with a net profit. Not a large one, for sure. But staying in the black despite its business literally forced to shut down is incredible.

It is a proven survivor. And that status opens it up to an even faster recovery.

The second reason Planet Fitness will be a winner going forward is because it has been able to keep a large cash position on hand throughout 2020. As of its last earnings report, it was sitting on $502 million.

That gives it the leverage to pick up what all of its bankrupt competitors leave behind. Equipment, locations and customers are all there for the taking.

I’m not going to make a call here and say that in two months PLNT shares will double. But I am saying that when the dust clears from 2020, Planet Fitness will be in a much stronger position than it was before 2020.

And with its shares trading at the exact same price now as they were before this industry shift, that is definitely an opportunity for profits.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder