As goes January, so goes the year.

That’s an old market adage which suggests that equity returns made in January set the pace for the rest of the year.

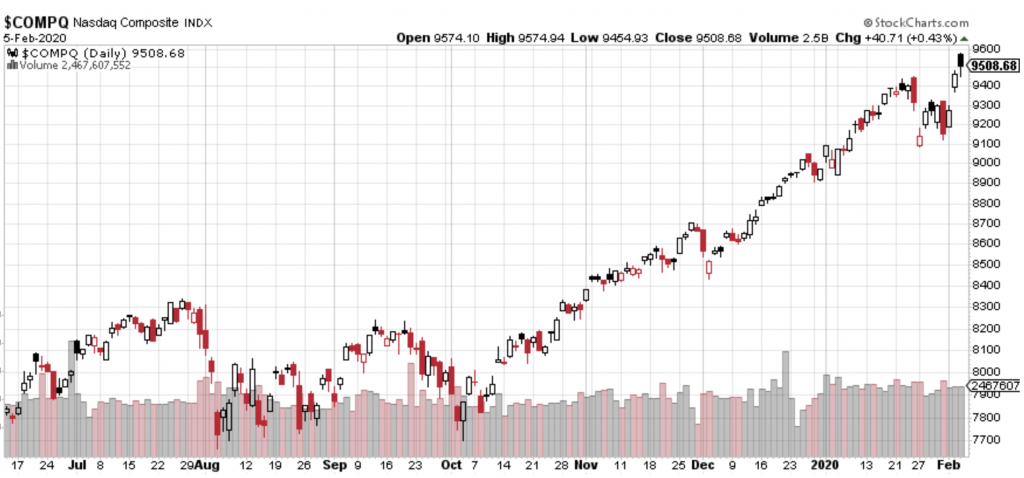

Despite the shallow pullback, the Nasdaq is already up a solid 5% year-to-date, with large-cap technology leading the way.

Goldman Sachs is calling for 10% earnings per share growth for U.S. stocks in 2020… But so far, we’ve seen a mixed bag of optimistic and cautious guidance.

We predicted this scenario in our January letter and this current scenario lends itself perfectly to our trading methodology.

You see…

At Wealthy Tech Investor we don’t just buy and hold - we’re actively managing positions in order to provide strong profits even in cautionary times and choppy markets.

So far over 65% of reporting companies beat consensus expectations. The best sector results have come from financials, consumer staples and healthcare. The weakest results have come from the energy space, materials and consumer discretionary (retail) names.

Now onto our positions.

Zoom Video Communications, Inc. (ZM) - The Biggest Tech Stock for 2020

Our timing in Zoom Video Communications, Inc. (Nasdaq: ZM) couldn’t have been more perfect.

Our position shot up 15% due to the Coronavirus outbreak as more workers request to work from home.

The company reports earnings the first week of March and we have a strong conviction the company will beat expectations, both domestically and overseas.

The traction on their video conferencing software is immense. If the stock pulls back to the $62-$63 levels it tested successfully in December it makes an attractive spot to add to an existing position.

We are excited to open a new position in a high-risk, high-reward stock with a unique perch in the 5G landscape. Here’s the low-down.

It’s easy to provide internet service on land. It’s surprisingly difficult to provide internet access on a plane hurtling 30,000 feet above ground & moving 500 miles per hour!

If you’ve taken a transatlantic flight in the past 10 years, you’ve likely seen this for yourself. If you tried to get on the internet you either didn’t have it available at all or it cut out on you repeatedly.

That’s the problem. Here’s the solution.

Gogo Inc. (Nasdaq: GOGO) is the largest pure play on what’s known as “In-flight Connectivity”, or IFC. Put simply, GOGO makes it possible to have high-speed internet access while flying the friendly skies.

GOGO is eliminating these “dead zones” with their satellite-driven 2ku installations, currently in over 650 planes with another 1,400 in backlog*.

But the space-age difficulties GOGO solves aren’t the only thing that make this company so interesting. It’s also how difficult it’s been for investors to properly evaluate the stock. This confusion is the angle we’re going to exploit.

GOGO is a risky stock, and we’ll get into exactly why in just a minute. It’s only a suitable buy for investors willing to handle a lot of volatility. But the potential for gains of over 200%, 300% or 400% is the payoff.

In the short-term, the biggest stock gains occur when most investors think something is WRONG.

Their wrongness becomes money in the pockets of the people who got it right, traded it right and most importantly saw it FIRST.

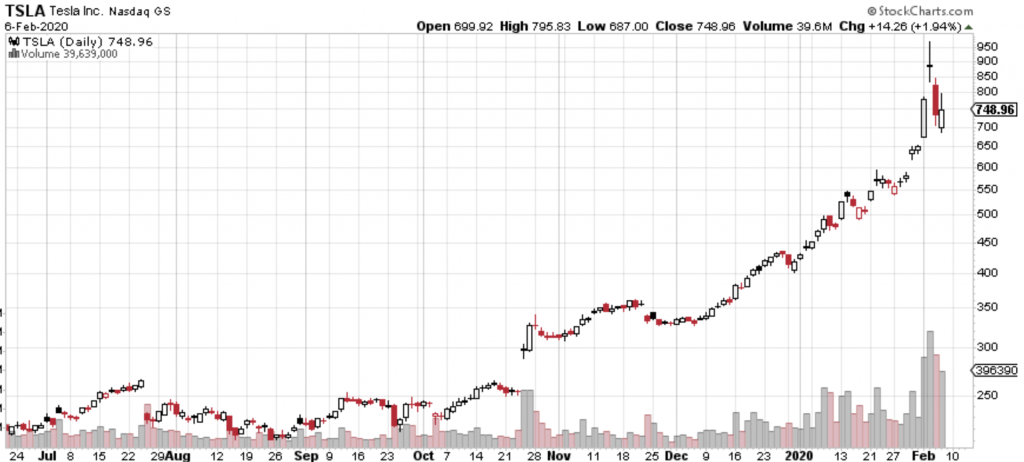

Take a peek at shares of Tesla (NASDAQ: TSLA) since December. That’s what happens when a large group of people are wrong on a short thesis.

TSLA had huge short interest, just like GOGO. Granted, TSLA is a much larger, very different company for sure… but when shorts prove to be wrong the longs who were right make windfall profits.

Make no mistake, there’s a gaggle of investors currently betting against GOGO. Almost 60% of the float (shares available for trade on the open market) is sold short. That number was over 70% last year. These folks are betting 5G isn’t important enough for the airlines to eventually cave and offer free inflight high-speed internet to passengers.

Part of that bet took a big hit earlier this year when Delta – GOGO’s largest customer and the most profitable airline in the country - announced they were going to be offering free Wi-Fi for all passengers “in the near future”. He made this announcement last month at the Consumer Electronics Show (CES) and our ears perked up when we heard the presentation.

Delta CEO Ed Bastain:

Wi-Fi should be free on all flights,” followed by “I’m confident we will reach that goal within the next couple of years at speeds as fast as on the ground.”

Bastian also wants to apply machine learning, robotics, big-data analysis and "binge button" entertainment viewing - all things made possible by 5G.

Doors Opening to China

As we’ve said, GOGO is a complex company - we’re talking satellites and space here!

But people want the internet. They want it everywhere they go. And they want it to be fast. Less than 10% of planes in the global fleet have broadband internet and GOGO is well on their way in solving this problem.

GOGO just signed a deal with APT Mobile Satcom Limited, one of Asia’s largest satellite operators, to provide high-speed internet across multiple Chinese airlines. (The same China that plans to increase their passenger jet purchases by 150% in the next 15 years!)

APT operates both Wide-Beam and High-Throughput satellites and will cover all of China’s airspace by mid-2020. This is a huge growth engine for GOGO and we expect to see more deals struck with Chinese airlines in 2020.

Why the Short Sellers Attacked?

The biggest reason that short sellers of the company decided to go after GOGO was their cash flow and balance sheet. Setting up satellite uplinks in airplanes is expensive, requires leading-edge tech and is very time-consuming. And lest we forget all the necessary FAA approvals needed to retrofit planes in any way. So over the past few years, GOGO had to keep issuing debt. They had to spend money to make money.

But we’re already seeing many signs the tide has turned and this is why we’re not sitting back anymore. We’re buying right here.

GOGO has drastically reduced their cash burn the past few quarters and is running almost cash flow positive. They’ve restructured their debt and they’ve got a huge big pipeline of work.

On many fronts, the hard work done in the past two years is already bearing fruit. 2020 could be a banner year and we give a bulk of the credit to new CEO Okleigh Thorn. Thorn took the reins in 2018 and promptly righted the controls after the previous CEO had a bad habit of overpromising and underdelivering.

Here’s why Thorne is a CEO we want to bank on…

For an insider, he’s got more skin in the game than you’ll likely find anywhere else. He’s the single largest shareholder in the company, owning 30% outright. Thorne sat on the company’s board for many years and when it came time to make a change at the top the guy with the most at stake believed in GOGO’s future enough to take charge.

Buyers here should be focused on the long-term goals:

● Leverage the 5G rollout and insatiable appetite for high-speed internet everywhere, all the time to sign new deals with airlines. Massive untapped global fleet!

● Watch the airlines - Delta’s already tipped their hand - give in to customer demands for free high-speed internet on flights. GOGO will license their tech to airlines directly instead of charging consumers in-flight.

● More airplane installations = more predictable revenue = shorts run away. GOGO can chase prior highs of over $25/share. A potential 400% gain for early believers.

GOGO reports earnings on Thursday, February 20. In this earnings report investors are going to be looking hardest at the cash flow numbers and the operating profit figures.

Strong cash flow will make shorts want to start closing out their positions. And when a bunch of shorts want to get out at the same time, that’s when short squeezes happen and large upside moves can be captured.

For a company with such huge market opportunity, GOGO trades at a market cap of less than $500 million. We feel their access to the entire consumer airline business is being valued at nothing.

Why do we think this?

GOGO’s commercial segment (business/private jets) runs solid operating profits and has a very predictable revenue stream. An extremely conservative valuation on the commercial aviation segment is over $1.5 billion, which is the enterprise value of GOGO today (Market Cap + Debt Load).

We see the whole consumer business as a freebie. A 5G turbocharged lotto ticket. We don’t deny that GOGO has competitors. And they still must execute on their plans, but GOGO is the leader in this new, breakthrough industry and we think they have the right CEO to keep that lead.

A final powerful catalyst is the potential for someone to come in and buy up GOGO outright. Takeouts are an investor’s best friend and almost always come at high premiums to the current stock price.

Intelsat (NYSE: I), who operates many of the satellites GOGO uses in its installations, has been asked about going after the in-flight connectivity companies like GOGO. Here’s what Intelsat’s CEO said on an earlier conference call:

Consolidation in our sector could be a healthy next step so that is always a possibility for synergistic and most importantly for strategic reasons. But it’s always been difficult in our sector as well, so we just have to wait and see…

It could happen, or it could not happen. But the prospect of an M&A around GOGO is enough to keep bullish interest in the shares while we wait for the operating results, new contract wins and 5G rollout to prove the short sellers wrong.

Action to Take Now: Buy GOGO shares up to $6/share.

The largest healthcare conference in the world happened a short time ago in San Francisco. Delegations from all the largest healthcare companies in the world descended on the city to tell investors about their forecasts for 2020, along with their pipelines for new drugs, devices, therapies and services.

In addition to the household names like Pfizer, Johnson & Johnson and GlaxoSmithKline that were pressing the flesh with investors, we heard from hundreds of smaller companies and startups.

All the largest and fastest-growing members of this $3.5 trillion pillar of the U.S. economy were talking. We were listening. Investors want to know if the strong rally to close out 2019 can continue in 2020 thanks to new drugs and therapies.

Digital health - soon to be hyper-charged by the 5G rollout and personalized medicine were the most important themes discussed at the conference.

We also saw the presence of some interesting new attendees - companies like Google, Nvidia, Salesforce and Apple were there. These companies are forming partnerships with leading healthcare companies to combine the power of artificial intelligence, machine learning and 5G technologies to advance critical drug discoveries like never before. The intersection of technology and medicine is more powerful than ever, and we have maximum conviction that there’s explosive gains to come for shareholders in the stocks...

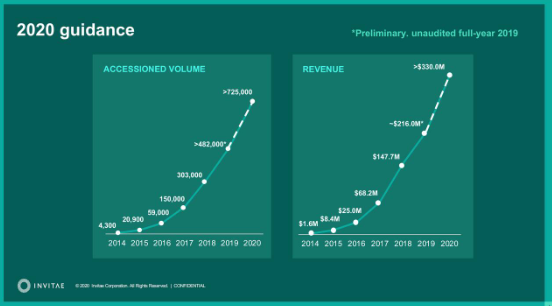

We listened intently to what Wealthy Tech Investor holding Invitae (Nasdaq: NVTA) had to say and the news was impressive. Invitae is forecasting to increase sales to over $330 million in 2020, with the amount of cancer screening tests provided growing to over 725,000, an increase of 50% from 2019*:

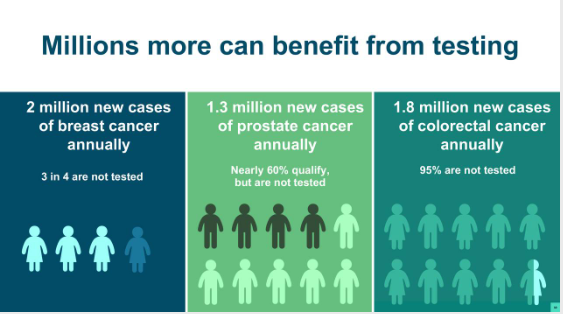

Frankly, 725,000 tests is a drop in the bucket! There are over 35 million people worldwide living with cancer. There are over 2 million new cases of breast cancer each year, and only a tiny fraction receives Invitae’s potentially life-saving screening.

And Invitae has made the genius move to focus intently on prenatal and infant testing. This is not only the most important moment to do genetic screening, but also forms strong customer bonds with new families.

In order to provide their breakthrough testing they utilize artificial intelligence and machine learning to help doctors better identify markers for cancer. AI can find patterns faster than any human ever could and opens up the oncology market.

Genetic-based testing will forever change the way we look at medicine. It’s going to change how doctors diagnose disease and how they treat it. Personalized medicine is the future - a future where instead of cookie-cutter drugs, your therapy is personalized to you based on your own DNA.

And Invitae is breaking down the barriers to personalized medicine, reaching right out to individual patients. We think the company is just getting started - it may be just the 2nd inning of this ballgame.

Invitae reports earnings on Tuesday, February 18 and we see strong company tailwinds that could lead to an increased 2020 forecast for sales, as well as the total number of tests completed for patients. The company is still growing aggressively, plowing any increased cash flow into new equipment to offer new tests and screens.

We added NVTA to the WTI portfolio in January last year when the stock was trading at $11.31 per share. The stock surged over 125% by April, before pulling back to $18.50 where it trades today. Our gain of over 60% crushes the performance of the Nasdaq nearly 2-1 in the past year. We never panicked when the stock pulled back because we have our eyes on the long-term price - personalized medicine for all. We think their growth is inevitable.

Pulse Read on Illumina

Our grip on genetic testing and the intersection of medicine and leading-edge technology doesn’t stop at Invitae. Another Wealthy Tech Investor position is Illumina (NASDAQ: ILMN), the dominant player in gene sequencing. Tens of thousands of healthcare and drug discovery companies license powerful sequencing machines from ILMN to help speed along time to market for gene-based therapies for patients.

ILMN shares lagged the Nasdaq and biotech indexes last year, but we remain bullish.

We also find the covered call trade extremely attractive to earn extra passive income while waiting for the bulls to turn their heads back to Illumina. The February main expiry $347.50 calls can be sold for over $2.50 per share, or $250 per contract (which would be covered by a long holding of 100 ILMN shares).

Items in Focus for Healthcare in 2020

Drug pricing continues to be a hot-button issue in Washington, D.C. - especially in the beginning of the year when pharmaceutical companies raise the prices of older drugs. The level of heat a company like Pfizer takes from both sides of the aisle when they raise prices by just 5% is intense*.

M&A - Big Players Chasing New Drugs and Growth

This is why almost every large healthcare company is openly admitting they’re on the hunt for smaller companies with innovative drugs and therapies in the pipeline. When they’re first approved by the FDA new drugs command premium pricing and generate massive windfalls to their owners.

Pharmaceutical and biotech companies in 2019 alone spent over $340 billion scooping up smaller companies with exciting drugs and products in the pipeline. It was the biggest year for M&A in the sector since 1995*.

No doubt you’ve seen the headlines and when buyouts happen - we’re talking about stocks that can pop 200%, 300% in a single day!