Yet another facet of society that 2020 stole from millions is the dating scene.

Apocalypsing (/ah-poc-a-lyps-ing) verb: Treating every relationship like it’s your last and getting super serious with someone you just started dating.

Dating in the time of coronavirus has been difficult, to say the least. And that’s after the nature of dating was already going through a complete makeover.

According to Match Group Inc. (NASDAQ: MTCH), 40% of all relationships in the U.S. now start on dating sites and apps. 60% of those start on one of Match’s own properties, like OkCupid, Tinder and the company’s namesake.

All of this was true before the pandemic swept the world. But with vaccines now finally in production and even beginning to be administered, this new way of life for singles is booming.

The above new term “apocalypsing” comes from one of Match’s subsidiaries, Plenty of Fish. It’s among a dozen new terms and realities in the dating world.

Simply swiping right and meeting up for some drinks doesn’t necessarily work in a world with closed-up bars and curfews.

There’s obviously the direct, “come over to my place” schtick. But those practicing safe social distancing dropped that game too.

Now, according to these apps, video first dates are taking off. Tinder is rolling out a new video chat service called Face to Face.

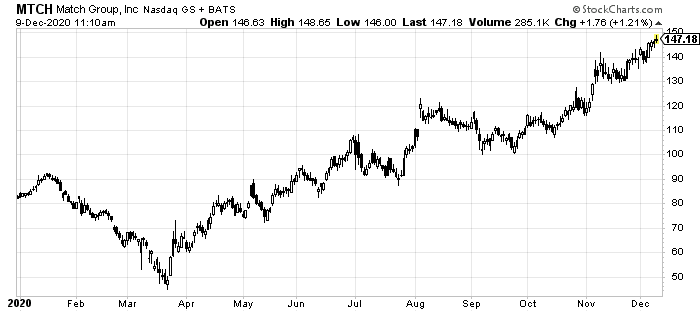

So, it might not come as a complete surprise that Match’s stock took an initial dive back in March, but has recovered in a hurry. In fact, it is one of the best performers of 2020:

So, the question I’m asking is: has COVID made dating apps three times more appealing over the last 10 months?

If so, that justifies the share jump. But if not, these speculators are about to get pummeled.

Clearly, plenty of this run-up has more to do with what the post-pandemic dating world will look like rather than current dark times.

And it is hard to argue that point. Social scenes are likely to be forever changed. With early adopters of video services, features such as Tinder’s Face to Face could very well become mainstays.

And through ads, premium subscriptions, memberships, etc., each minute spent using those features equals dollars in Match’s coffers.

It is also very hard to argue with a 60% market share of mobile dating services. That’s especially true as 40% of couples start through those. Those numbers are still growing too.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

But the most compelling argument not yet being made despite this massive rally is what’s happening in the rest of the world.

Just like the first vaccine finding its way to a person overseas, so is this dating trend.

Match’s numbers, if right, could be the hidden gem to extend this rally even higher.

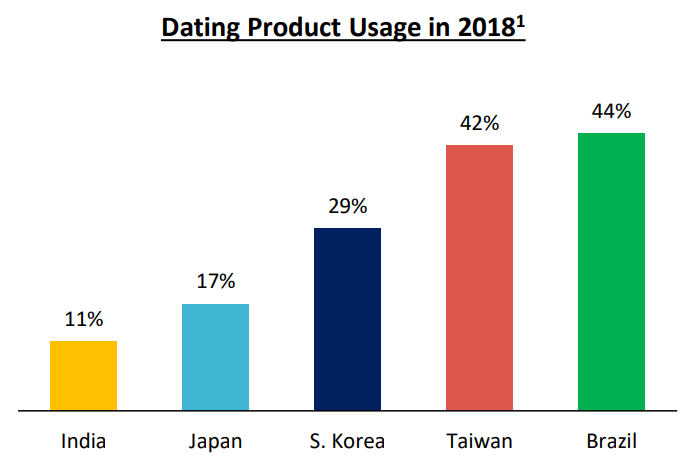

44% of relationships in Brazil and 42% in Taiwan begin on dating apps. That matches with U.S. numbers. But only 11% of Indians use these products, as of 2018. That’s a country with 1.4 billion people.

Match expects the end game to be around 75% of global singles using dating apps at some point in the future. This global pandemic could be the greatest spark to reach anything resembling those numbers.

If even the U.S. alone reaches a 75% or so penetration rate, that’s definitely worth more than just what we’ve seen from MTCH stock in 2020.

There is one word of warning, however. The company, which just recently split from its former parent business, is stuck with a ton of debt. $3.5 billion, compared to just $400 million in cash to be precise.

That’s a pretty bad leverage ratio. But as long as it continues seeing this kind of growth and subscriber increases, it’s manageable. It only has one set of notes coming due in the next two years. The rest is spread out, giving it time to pay it all down.

So, for an emerging profit portfolio, Match Group might just be a good fit.

I can’t say I’d expect a complete repeat of 2020 in the new year for shareholders. But over the next several, there’s plenty of room for this one to run.