"Here’s to alcohol, the cause of, and solution to, all of life’s problems." -The Simpsons

An interesting trend has appeared in nearly every recession in history: people drink more.

It probably doesn’t come as a surprise. But alcohol sales almost always do well, often better, when the economy is in the trash.

It makes sense. Fewer hours devoted to work opens up more hours for socializing.

That’s what makes this particular crisis so different. We can’t socialize.

Even though stay-at-home orders have started easing in some places, no one expects so-called "on-premise" sales will do well. Meaning, people can’t and aren’t going to bars, weddings, parties and so on. But they haven’t stopped drinking.

In a few years, we’re going to look back and find that the 2020 recession proved once and for all how recession-resistant the alcohol industry is.

In past recessions, beer, low- and medium-priced liquors boomed. High-end liquor and wine didn’t fare as well.

Today’s recession is possibly breaking that trend.

Flipping the Alcohol Market

All alcohol has boomed, at least during the early days of this crisis.

During the end of March, beers sales jumped 10%. Spirits and wine grew 27%. In many pockets around the country and world, those numbers were even higher.

Now, to be perfectly fair, those numbers are obviously skewed. That was when the world over was stockpiling for quarantine.

But what they were buying then still shows a break from previous recessions. Spirits are growing at nearly triple the pace.

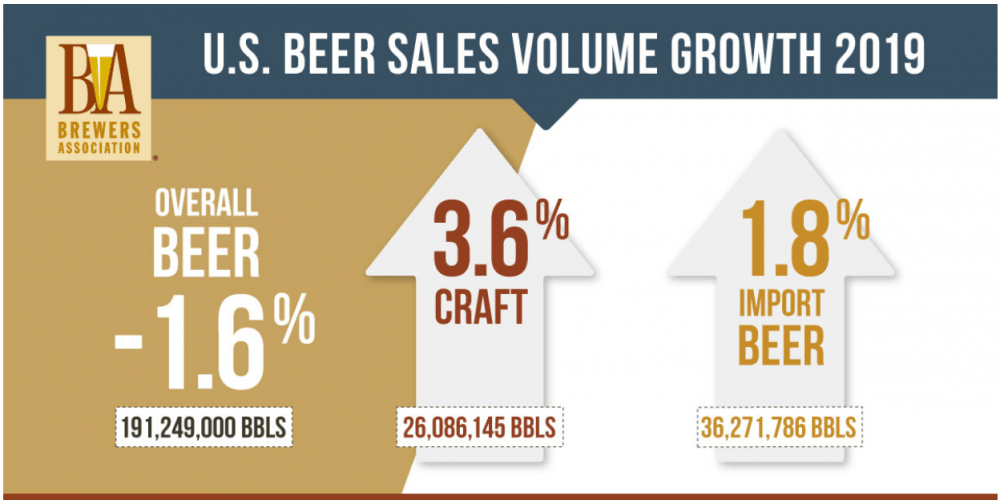

Beer has been dying a slow death for years now. Last year, for instance, overall beer sales dropped 1.6% or 191 million barrels from the previous year. That was even worse in 2018 with a full 2% decline. You can go back more than a decade and see similar results.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Craft and import beer have done better, as you might expect. But they still make up a tiny percentage of the overall U.S. market.

The opposite is true for the rest of the alcohol industry. Liquor and wine sales have more than made up for the decline of beer. In 2018, spirits hit their all-time highs. Wine volumes too grew at a modest 1.4%.

This time around, we’re already seeing these trends exaggerated during this recession.

What used to be a period for huge beer sales is now a liquor market.

Fortunately, there’s a great way to play this.

The King of Booze

Diageo plc (NYSE:DEO) is one of the world’s largest alcoholic beverage makers. Its plethora of household brands bring in more than 13 billion GBP each year.

It’s worth noting that it is a UK company. You see, one of the largest disruptors in the U.S. alcohol industry of late has been tariffs. U.S. companies like Jack Daniels saw their international sales drop significantly since the beginning of the trade war. Diageo is able to avoid most of it.

And what of its brands? It owns global staples like Crown Royal, Windsor, Johnnie Walker, Don Julio, Captain Morgan, Tanqueray, and its big one, Smirnoff. As you can see, it covers the entire range of the liquor market, from discount to super-premium.

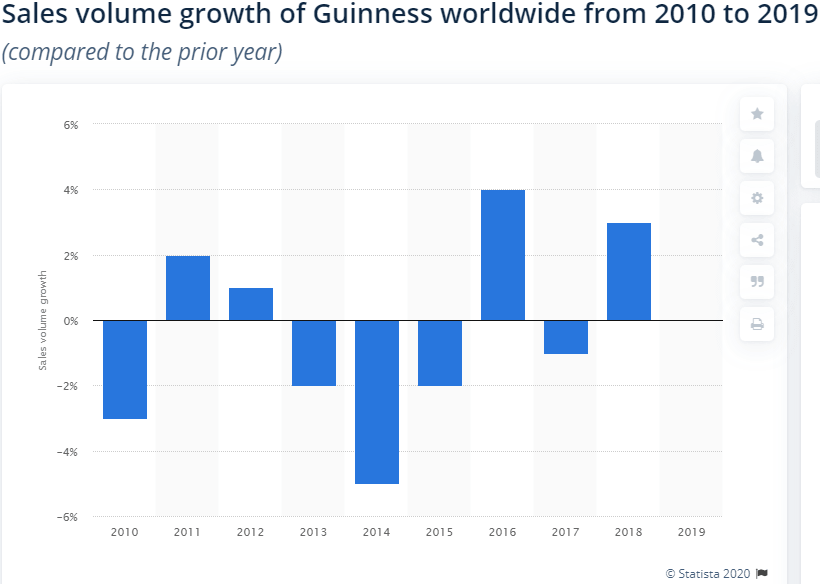

Now, it does have another brand that needs to be mentioned. It owns Guinness. Beer sales have slowed around the world. But Guinness is sometimes the exception. It has had a rocky decade:

Diageo doesn’t report each quarter, as it falls under UK reporting rules. This makes for an interesting play. The company will reveal its first 2020 recession figures at the end of July.

The culmination of these long-term trends, combined with huge stockpiling and panic buying could make that one event worth watching.