Lines wrapped around the building… customers anxiously trying to get in and out quickly… carts filled to the brim.

It was a scene that’s reserved for the latest iPhone release, or 6 am on the day after Thanksgiving shopping holiday.

But suddenly standing outside a store for hours became the new normal.

Local governments worked and still are working hard to decipher what should be considered essential. Even now, as some states start to reopen businesses are ranked by level of essentialness and ease of spread in that industry.

Big Box is Killing Small Business

While most mom and pop shops had to take a mandatory vacation, big-box retailers stayed open and worked to quickly adapt. These giants were worked to streamline curbside pickup and create procedures to get people in and out quickly 50 or so at a time.

Home Depot (NYSE:HD) put up tents so shoppers had some shade while waiting to enter the store. And Sam’s Club taped Xs on the ground six feet apart…wrapping all the way around to the side of the building.

Now as the first-quarter earnings are being released, we’re just starting to see a glimpse real impact that the Coronavirus and stay at home orders is going to have on the bottom line.

Yes, just a glimpse. The second quarter could be even worse…or even better…depending on how consumer spending progresses.

Home Depot was one of the retailers that remained open the whole time. You would have been glad it was if you sprung a leaky roof, sink or, toilet.

With many Americans sitting at home, it was the perfect time to get around to the long list of projects that get pushed to the side. Plus, with grocery store shelves not being stocked as fast, many people decided to take up the hobby of urban gardening.

This led to the orange box giant to see an increase in sales of 7.1% when compared to the same period of 2019. Good news, right?

After taking into consideration $850 million in costs linked to the coronavirus, this quarter was the first time Home Depot missed on earnings guidance in six years.

What’s weird, is it looks like the market barely noticed.

Why? Shareholders are clearly optimistic about those sales numbers.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

We will have to wait and see if additional costs keep racking up as the economy begins to reopen.

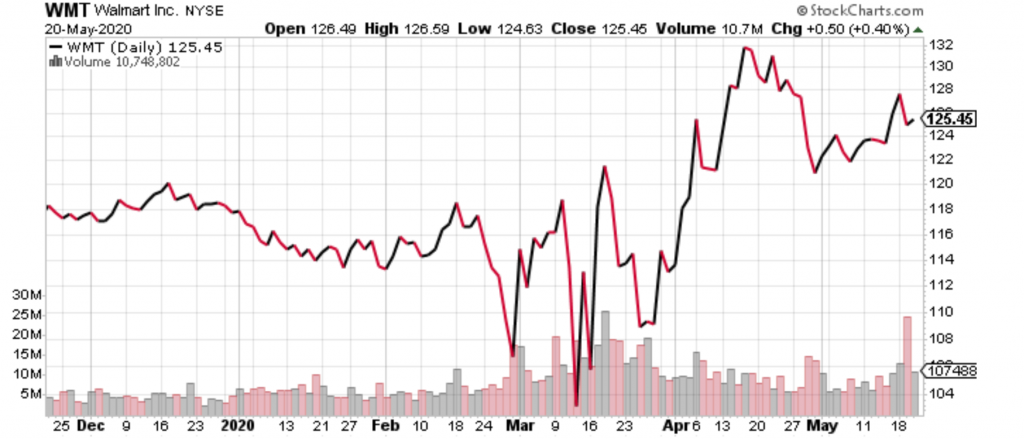

Walmart (NYSE: WMT) also announced earnings this week…and it was clearly going to be a winner.

Back in March, shoppers rushed to get carts full of toilet paper, bleach and, hand sanitizer. And when that ran out, they settled for rubbing alcohol to make their own.

The result was the best performance in almost two decades.

Sales for the first quarter grew 10% when compared to the same quarter last year. And eCommerce sales grew 74%. Just like Home Depot, the company saw nearly $900 million in extra costs related to the pandemic.

And again, it seems like the market barely noticed, despite the stellar quarter.

But stockpiling paper goods and Ramen noodles isn’t the whole story here. Americans bought adult bicycles to enjoy outdoor time with the children and sewing machines to make their own masks.

Preppers Finally Get Validation

CEO, Doug McMillion also pointed out during the earnings call that mid-April saw an uptick in discretionary goods. Is it a coincidence that just around the time stimulus checks were hitting accounts that Walmart saw an increase in the sales of TVs, electronics, and gaming equipment?

How many televisions can you have in one house? When will you need to purchase a bicycle again once everyone in the household has one? And really, when will that family of four, run out of the stock of Ramen noodles?

What comes after the hoarding? Is it a phase of penny-pinching?

Do consumers even have the money to keep going out and spending as the economy reopens?

We’ll have to keep following the earnings to find out. Second-quarter will be interesting.

No matter what happens, we’re sure that shares of both Home Depot and Walmart are not going to land you triple-digit gains anytime soon.

They’re big and established, and it’s just too late.

Timing is everything and buying the March plunge is when you've would've wanted to pounce on these stocks.

That's the past and we want to focus on the future.

As the economy opens up, people will tap into their stockpiled goods and feel more at ease.

The looming issue that the talking heads aren't talking about is that a record amount of houses have been pulled off the market.

Many would consider that a good thing, but we've also seen a 6% reduction on homes under $250,000.

I think there's more pain to come.

I foresee more families looking to stay put and rehab, rather than selling lower than they expect.

That bodes well for Home Depot and the horse I would ride into the 4th quarter of 2020.

As I mentioned, timing is everything.

Especially knowing when to lock in your profits.

My subscribers of the Wealthy Tech Investor just locked in 568% gains this month!

What's even more exciting is that I identified my #1 pick for June that will wallop those returns. Click here to learn more.